Includes a full 13 page article that is not featured anywhere else.

Quick-View: View the Top 10 Company Gallery

These factors all affect employment across the industry. Overall job gains in the economic recovery mostly have been found in lower-paying positions, often attached to part-time hours. According to The Wall Street Journal, U.S. GDP growth for the first quarter of 2013 was revised downward to 1.8%. Most consumers aren’t earning enough to cover the costs of health care, education, and retirement, let alone discretionary income for consumer goods and services.

Lower-paying jobs with no benefits have replaced well-paying jobs with benefits, doing no good for the health of the economy. These lower-wage jobs and underemployment aren’t stimulating much demand, so companies have little incentive to go out and hire more workers. Many companies also aren’t offering raises to their current personnel, since they know those employees won’t be leaving for other jobs, adding to the lack of spending that’s ultimately hurting the economy.

So, which companies are doing well enough to rise above the stagnant economic tide? We based our list of the Top 50 Employers in Electronic Design on a formula using public financial data with bonus points awarded using the results of our annual Electronic Design Reader Profile Survey.

By The Numbers

According to the Bureau of Labor Statistics, more Americans are working part-time involuntarily. These part-timers now number more than 8.2 million, which is an increase of 322,000 workers from May and almost double the number this time five years ago. Also, a July National Employment Law Project (NELP) study concluded that real median hourly wages declined by 2.8% averaged across all occupations from 2009 to 2012.

This 2.8% decline is astounding, since productivity has increased by 4.5% over the same period. Workers are producing more goods and services per hour but earning less than they were when the recovery began! According to CNN Money, U.S. median income fell to $50,054 in 2011, the most recent full year in which data is available. That’s down 8.1% since 2007, just before the great recession started. Overall, median income has fallen 8.9% from its peak in 1999.

Meanwhile, the middle class is shrinking, as many Americans slide down the economic ladder, according to The Washington Post. During the recovery, job gains have been concentrated in lower-wage occupations, which grew nearly three times as quickly as middle-wage and higher-wage occupations, according to another NELP study. State and federal governments, for example, have cut 835,000 jobs over the past four years—many of them middle-income positions, according to The Huffington Post.

Job growth projections by the Bureau of Labor Statistics show that the healthcare, social assistance, and retail sectors are among the areas expected to add the most jobs by 2020—all industries with jobs that tend to have meager pay and poor working conditions. A lot of these positions will pay the federal minimum wage of $7.25 an hour, the inflation-adjusted value of which has declined by more than 30% since the 1960s.

The official unemployment rate is 7.6%, but the real number is actually about twice that. A statistic known as the U-6 figure includes the unemployed, plus those “marginally attached” to the labor force (they want a job but have largely given up looking), plus those working part-time but who want a full-time job. The U-6 number for June 2013 was a resounding 14.3%, up half a percentage point from May. Fewer working-age Americans are working than at any time in the past 30 years. The employment-to-population ratio is 58.7% according to the Department of Labor, a drop from 63% five years ago, before the recession hit.

However, corporate profits as a percentage of GDP are now at an all-time high, which means that workers’ wages as a percentage of the economy have hit an all-time low. Corporations are now paying employees less than they ever have as a share of GDP. Companies aren’t seeing viable opportunities to use cash for investment, hiring, pay raises, or even rewarding shareholders, so it is accumulating on the balance sheet.

Union wages are a rare commodity as well. In 2012, the median salary of unionized workers was about $49,000, compared to $39,000 for their non-union counterparts, according to PBS Frontline. Fewer workers are earning union salaries, though. Thirty years ago, one in five U.S. workers was a union member. Today, it’s about one in 10.

Education costs are becoming prohibitive too. According to an October 2012 Hamilton Project study, a college education costs 50% morethan it did 30 years ago. Public colleges and universities are cheaper, but not cheap enough. As states cut funding, the cost of attending a four-year public institution has risen by 5.2% each year of the last decade, according to Reuters, and student loan debt in the U.S. now exceeds $1 trillion. Upon graduating, debt-saddled students face youth unemployment of around 16%. Although degrees are extremely expensive, they have become necessary to get a foot in the door for a decent job.

What’s Next?

The IMF’s July 2013 update of its World Economic Outlookcut the forecast for 2013 global growth to slightly above 3%, matching the 2012 forecast. Caterpillar Inc., twelfth on our list, is a bellwether for broader economic growth. Its ties to infrastructure, its global footprint, and its exposure to China give it a strong view as to how global growth will unfold. CAT's recent economic outlook expects U.S. growth of around 2% for all of 2013, which won’t have much impact on unemployment or inflation. As a result, the Fed is likely to keep rates near zero for a fifth straight year.

Housing starts are a rare bright spot. After posting an average annual rate of 915,000 over the first half of the year, the strongest since 2008, starts are set to improve further. Sales of new homes hit their highest rate in five years according to the Census Bureau.

China’s economy will grow around 7.5% this year, with industrial production set to rise by around 9%. That’s slower than the pace seen early in the recovery, but it should still lead to more construction and commodity use. Factory output slowed in China, however. HSBC’s Chinese Manufacturing Purchasing Managers’ Index dropped to 47.7, an 11-month low. It was down from a final result of 48.2 for June, with any reading below 50 indicating a contraction in activity

According to CAT's earnings release, recovery from the financial crisis in 2009 has been very slow by historic standards. Governments and central banks have consistently overestimated inflation problems and underestimated the need for economic growth. The result has been continued high unemployment.

The Eurozone just completed its seventh quarter of recession, resulting in both the lowest construction and highest unemployment in the last 20 years. The Eurozone economy is weak, and CAT believes economic policies are insufficient to support improvements. The risk of a disruptive economic crisis, one that would impact growth in other countries, remains.

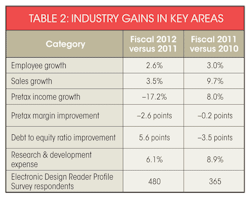

A closer look at the 98 companies we examined to determine our Top 50 reveals some important trends. In almost all of the criteria we used, we saw a decline in performance versus last year’s results. Given the many other challenges in the economy, these companies would do well merely to replicate fiscal 2013’s results.

There are no more major downsizing opportunities. Costs are cut to the bone. Debt continues to be reduced. Sales are growing, but at the expense of margins. And, companies are doing what they can to continue their R&D investments. Until the consumer is in a better position with discretionary income to increase demand once again, global GDP will continue to merely sputter along. Five companies have shown extraordinary success despite these challenges, though, leaping up dozens of places on our list between 2012 and this year.

Includes a full 13 page article that is not featured anywhere else.

Quick-View: View the Top 10 Company Gallery

Ford Races Up 50 Slots

The Ford Motor Company raced up our annual list of the Top 50 Employers in Electronic Design, driving ahead 50 places to park at tenth place in our 2013 edition. Operating in both automotive and financial services, it manufactures or distributes automobiles across six continents. Its brands include Ford and Lincoln, selling approximately 5,668,000 at wholesale worldwide in 2012. Its financial services include holding companies and real estate. The company and its subsidiaries also are engaged in other businesses, including vehicle financing, through the Ford Motor Credit Company.

Q2 2013 was another strong quarter for Ford, and its share price has almost doubled since last summer (+93% in the last 52 weeks). The company posted improved results and increased market share in every region it operates in. Despite contributing $1 billion to its pension funds and spending $500 million on dividends, its gross cash increased from $23.7 billion to $25.7 billion between the second quarter of last year and the second quarter of this year.

Ford continues to work on improving its balance sheet, which has been one of the biggest priorities for current Ford CEO Alan Mulally. In the first half of 2013, Ford generated more cash flow than it did in all of 2012. The company’s goal is to complete funding its pension obligations by 2015. The balance sheet then would be very healthy and cash could be optimized for dividends, share buybacks, and funding growth initiatives.

Recent highlights include second-quarter and first-half records for pre-tax profits in North America. The Asia-Pacific-Africa region delivered its best-ever quarterly profit. Ford Credit delivered solid performance. South America returned to profitability. And, Europe reduced its loss to $348 million versus a $404 million loss in the second quarter of 2012.

In the first half of the year, Ford sold 3.18 million cars, up from 2.80 million in the first half of 2012. Revenue increased from $61 billion to $69 billion in the same period. Ford’s pretax earnings increased from $3.22 billion to $3.74 billion, and its operating margin was up from 5.6% to 5.8%, all healthy numbers on a strong upward trend.

In North America, Ford’s market share rose from 15.6% to 16.5% between the second quarter of 2012 and the second quarter of 2013. This is the third quarter in a row where Ford has posted market share gains. Revenues rose by 13.7% to $22.4 billion while operating income rose by 15.9% to $2.33 billion. The company improved its operating margins from 10.2% to 10.4%. These results are important since North American generates about 90% of Ford’s profits.

In Europe, Ford increased its market share from 7.6% to 8.1%. It sold 391,000 cars, up from 359,000. The company’s operating margin in the continent was –4.6%, which is up from –5.8% in the same quarter last year. Ford also generated revenues of $7.6 billion in Europe, up from $7.1 billion in the second quarter of 2012.

This is the second quarter in a row where Ford posted a market share gain in Europe, which isn’t bad considering the troubled state of the European car market. CFO Bob Shanks said that the company was well on its way to reaching profitability in Europe by 2015. Accelerated depreciation charges on facilities that the company intends to close hurt earnings and somewhat masked the real progress that Ford has made in Europe.

In South America, Ford’s market share jumped from 9.4% to 9.6% as the region saw a meaningful recovery. Total revenues rose by 30% toward $3.0 billion. More importantly, the unit generated pre-tax profits of $151 million, or 5.0% of its total revenues. Last year, the business reported break-even results as the improvements are attributed to higher sales and favorable dealer stock levels despite unfavorable currency fluctuations.

In Asia, Ford’s market share increased from 2.6% to 3.6% as the company generated revenues of $3.0 billion on 317,000 cars in the continent, up from $2.3 billion on 250,000 cars in the same quarter last year. Ford is investing heavily to increase its production capacity as well as dealership network in Asia, particularly in China’s rapidly growing market. Ford’s operating margin was up sharply in the quarter as it jumped from –2.9% to 5.8%. Between the second quarter of 2012 and the second quarter of 2013, Ford Asia went from a loss of $66 million to a profit of $177 million.

Ford Credit posted a net profit of $454 million, up from $438 million last year, which was a result of both increased margin and volume. Its credit loss was improved from $80 million to $71 million. Ford Credit continues to contribute to Ford’s profits. GM and Chrysler lost their credit divisions during the recession.

“Our strong second quarter with improved results in every region around the world is another proof point that our One Ford plan is continuing to deliver and is building momentum. We remain absolutely committed to our plan of serving customers in all markets with a full family of vehicles offering the very best quality, fuel efficiency, safety, smart design, and value,” said Mulally.

While its North American operations are on a roll, Ford still has a lot of upside as South America and Asia are only just starting to pick up, and Europe is beginning to reduce its losses and stabilize. Its U.S. market share increased another 80 basis points to 16.5%. Ford will hire another 3000 workers in Michigan this year to meet the increased demand (see “Ford To Expand Electrification Engineering Team By 50%”.(separate article needed upload, as it’s a sidebar).

The Ford Focus was the best-selling nameplate in the world in 2012, and the Fiesta was the best-selling B-Car in the world based on the latest global data. In the United States, the Ford brand ended 2012 with 2,168,015 vehicles sold, the only brand to top 2 million units in sales. Ford’s U.S. sales also grew across the board in 2012, with cars up 5%, utilities up 7%, and trucks up 2%.

Ford trucks continued to dominate in 2012, with the F-Series earning the title of America’s best-selling pickup for the 36th straight year and 31 years straight as America’s best-selling vehicle. Overall, Ford sold 645,316 F-Series in 2012, a 10% increase over 2011.

Despite a challenging environment in Europe, Ford remained the number two best-selling car brand in its traditional 19 European markets for the fifth consecutive year. Moving forward, Ford’s new vehicles continue to develop strong momentum in the market, with sales of the new B-MAX surpassing 15,000 in 2012. The product line for Europe continues to increase with the introduction of the EcoSport and the full range of Tourneo products designed to address the needs of families across Europe with three derivatives: Custom, Connect, and Courier. The iconic Mustang and popular Edge will come to Europe as well in the near future.

Reasons for optimism in Asia include the 69% increase in Focus deliveries in China, where the company is catching up to General Motors and Volkswagen. Ford China set an annual sales record in 2012, selling 626,616 wholesale vehicles, which is a 21% jump fro 2011. Ford opened two new plants in Asia, with seven additional plants under construction. By 2020, the company is looking to generate one-third of total company sales form the Asia-Pacific-Africa region.

Additionally, Ford is firmly committed to the transformation and success of the Lincoln brand. The 2013 Lincoln MKZ is the first transformational product, with four all-new Lincolns in total launching in the next four years. The global premium industry is projected to grow 39% by 2017. China will play a key role in that since the United States and China will represent 50% of the global premium opportunity. That’s why Lincoln recently announced plans to enter China, the largest car market in the world.

In 2012, Ford introduced six new electrified vehicles in North America, including hybrid, plug-in hybrid, and pure battery electric models. The company sold more hybrids in the fourth quarter of 2012 than in any other quarter in its history, and that strong momentum has continued in 2013. Through June 2013, it has sold more than 46,000 electrified vehicles. According to the company, it now commands nearly 16% of the electrified vehicle market in the United States.

It appears the One Ford plan continues to pay dividends for all.

Includes a full 13 page article that is not featured anywhere else.

Quick-View: View the Top 10 Company Gallery

Ingersoll-Rand Leaps 50 Places

Ingersoll-Rand is number 41 on our list, which is an impressive showing after climbing 50 places since last year’s edition of the Top 50 Employers In Electronic Design. This diversified, global company provides products, services, and solutions to enhance the comfort of air in homes and buildings, transport and protect food and perishables, and secure homes and commercial properties. Its four business segments focus on climate solutions, residential solutions, industrial technologies, and security technologies, with $14.0 billion in revenue in 2012.

The company generates revenue and cash primarily through the design, manufacture, sale, and service of a diverse portfolio of industrial and commercial products. On September 30, 2011, it sold 60% in the Hussmann refrigerated display case business to Clayton Dubilier & Rice LLC. On December 30, 2011, it divested its security installation and service business, which was sold under the Integrated Systems and Services brand in the United States and Canada, to Kratos Public Safety & Security Solutions Inc.

Its climate solutions products include energy-efficient refrigeration and HVAC products and services for the transport and commercial markets including air conditioners, air handlers, exchangers, furnaces, building management systems, diesel-powered refrigeration systems, and vehicle-powered truck and trailer refrigeration systems along with related repair and service. Its brands include Thermo King and Trane. Its 2012 revenues totaled $7.4 billion.

The residential solutions segment markets products designed to provide safety, comfort, and efficiency to homeowners throughout North America and in parts of South America. These products cover a range of mechanical and electric locks, energy-efficient HVAC systems, indoor air quality solutions, advanced controls, portable security systems, and remote home management solutions.

With $2.1 billion in 2012 revenues, the segment’s brands include American Standard, Schlage, and Trane. Products include air cleaners, conditioners, exchangers, handlers, door locks/locksets and latches, electronic access control systems, thermostats, furnaces, and unitary systems, which combine heating, cooling, and fan sections all in one or a few assemblies.

The industrial technologies segment provides products and solutions designed to improve productivity, energy efficiency, safety, and operations. Its products include compressed air systems, power tools, hoists, filters, pumps, material handling, and golf, utility, and rough terrain vehicles, as well as related service and maintenance contracts. Its brands include Ingersoll-Rand, Club Car, and ARO. In 2012, it saw $2.9 billion in revenues.

The security technologies segment provides products and services for safety and security, including electronic and biometric access control systems, locks/locksets, door closers, exit devices, steel doors and frames, and time, attendance, and personnel scheduling systems. With $1.6 billion in revenues in 2012, its brands include CISA, LCN, Schlage, and VonDuprin.

Since 2010, the company management’s main focus has been on increasing efficiency, reducing plant footprints, and squeezing as much value as possible through identifying redundancies and streamlining processes that are shared between segments. This has produced revenue growth even though the construction market has been soft and has yet to experience a significant recovery. The company’s debt to equity ratio is 0.3, as of the most recent quarter, which is substantially lower than the industry average of 1.1.

2012 was marked with new products designed to meet customer needs and market demand. Thermo King launched the Precedent platform to address new regulations for engine emissions. Precedent set an industry standard in both fuel efficiency and emission reduction by delivering double-digit fuel savings, best-in-class performance, and lower life-cycle costs. IR also launched the Ameristar home HVAC system, making headway into the entry-level, lower-price-point market segment.

Ingersoll-Rand also is planning to spin off its security technologies segment into a separate company called Allegion by the end of 2013. This plan is designed to produce value for shareholders by spinning off a separate company with margins close to 18% and substantial revenue of around $2 billion a year. This segment accounted for 11.6% of total revenues for 2012, so it will leave IR a smaller revenue base.

Allegion is an Irish public limited company with its North American office in Carmel, Ind. It will employ about 7600 people in 35 countries, including 20 production and distribution facilities around the world. Allegion’s portfolio includes strategic brands such as Schlage, Von Duprin, LCN, CISA, and Interflex.

Leaner manufacturing, smarter sourcing, a refreshed product lineup, and solid pricing all seem to be leading to improved results for IR. The key issue is still the construction recovery in the U.S., though, and construction spending appears to be beginning to firm up some. After posting an average annual rate of 915,000 over the first half of the year, the strongest since 2008, housing starts are set to improve further. Sales of new homes hit their highest rate in five years, according to the Census Bureau. The median sales price of new homes also is up, and the existing home inventory is now down to around the three-month range.

Ingersoll-Rand doesn’t have all that much exposure to Europe, and improving sales in emerging markets like China can help offset that. In addition, U.S. manufacturing activity also expanded further than expected in July. In the second quarter of 2013, IR’s revenue rose 3% led by its residential business (up about 7%), while the much larger climate business improved about 5%. Industrial and security both were weak, though, down about 3% from last year.

Margins were even better, with gross margin improving more than a full point and adjusted operating income rising 8%, which is good for a 140-point improvement in operating margin. Every unit had double-digit margin increases, with only the industrial category showing a year-on-year profit decline.

It looks like there are reasons to be positive for the first time in a long time on the residential and commercial HVAC and building controls markets that Ingersoll-Rand serves, with solid improvements in the residential business and some growth in the U.S. commercial market. Several companies in HVAC distribution have commented that the past few years have seen significantly above average levels of repair activity versus replacement, and that may be hinting at a sizable potential backlog of business that will be above and beyond any demand tied to new construction.

USB Securities believes we are in the early stages of a multi-year, non-residential construction recovery. If that’s true, then IR has a substantial upside for future sales and margin growth.

Includes a full 13 page article that is not featured anywhere else.

Quick-View: View the Top 10 Company Gallery

Seagate Rises 53 Places

Seagate Technology PLC dramatically rose 53 places in our annual Top 50 Employers in Electronic Design study to tie for second place. As a provider of electronic data storage products, its principal products are hard-disk drives (HDDs) for enterprise applications such as servers, mainframes, and workstations; client compute applications such as desktop and notebook computers; and client non-compute applications including end-user devices such as digital video recorders, personal data backup systems, portable external storage systems, and digital media systems.

Additionally, Seagate provides data storage services for small and medium-size businesses including online backup, data protection, and recovery solutions. It primarily sells its disk drives to original equipment manufacturers, distributors, and retailers. On December 19, 2011, it acquired Samsung’s HDD business. And on August 3, 2012, it acquired 64.5% of LaCie S.A.

As the world becomes more connected, the rising demand for data storage continues to grow at a rapid pace. For a traditional HDD manufacturer such as Seagate, the growing transition to cloud storage remains a huge opportunity. Large interconnected networks require large servers and their backups to store significant quantities of data.

The mobile lifestyle is becoming increasingly visible today through consumer purchases of content consumption devices, which come in many forms. While all of these configurations are important, the one with the most influence on storage is the smart phone. Analysts expect annual smart-phone shipments to surpass the entire installed base of mobile PCs sometime in 2013, according to Cisco’s Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2012-2017, February 2013. They also believe many new users, particularly in emerging countries, will skip the PC and go straight to the smart phone as these countries realize wireless is a more affordable infrastructure investment.

The good news is that tablets and smart phones are content consumption devices that stream data. Cisco reported that global mobile data traffic grew by 70% in 2012 and will exceed 11 exabytes (1 exabyte = 1 billion Gbytes) per month by 2017, which is a 13-fold increase over 2012. Further, smart phones will account for 68% of traffic by 2017. The average smart phone will generate 2.7 Gbytes of traffic per month, and aggregate smart-phone traffic will be 19 times greater than it is today.

Gartner estimates that smart phones and tablets will grow at a 20% compound annual growth rate (CAGR) while mobile Internet protocol (IP) traffic will grow at more than three times the rate at a 67% CAGR from 2013 to 2016. In other words, for every 1% growth in mobile devices, the network experiences 3% growth in mobile IP traffic. This isn’t a surprise, given that consumers will make up more than 90% of all IP traffic in 2016, with 70% of the traffic being video content, Garner says.

Video content will drive gigabyte consumption and demand at two ends of the spectrum: where the data initially resides or is hosted, and where it is ultimately stored. Initially, content is hosted on data servers (bulk storage), and this will continue to grow both in public and private clouds. Ultimately, this data may have various destinations, including centralized home data devices such as NAS boxes, gaming consoles, or DVRs.

Demand for data storage continues to increase as more information is stored remotely and video and graphics become increasingly accessed across multiple platforms, not just by desktop PCs. This type of remote storage typically requires multiple backups of all stored data, usually three times over, which takes serious storage that can only be provided by large hard drives. Solid-state drives increasingly will become a legitimate option for tablets and laptops as their capacity increases. But for mass storage of data, multiple large hard-disk drives offer the optimal solution.

The major consolidation of the HDD industry has resulted in a duopoly comprising Seagate and Western Digital. Intevac is the world’s leading supplier of magnetic media processing systems, and it is the primary capital equipment manufacturer that likely supplies both companies. Its primary manufactured system processes approximately 60% of all the magnetic disk media produced worldwide.

“One major drive company reported 35% year-over-year increase in gigabytes per drive. We also believe this validates that in the ongoing race between total data stored and aerial density improvements, total data storage is winning,” said Intevac president and CEO Wendell Blonigan. “What this means is that as time goes on, more and more disks will be required to meet the market needs. Some estimate that nearly 6000 exabytes of storage will be shipped per year by 2020, more than 10 times the current level. With aerial density growing at around 20% per year, this means around twice as many disks will be required by then.”

These comments suggest that the need for data storage is increasing faster than technology’s ability to micro-size it. This means a need for more disks and more drives. As a result, with the solid-state drive (SSD) market continually lagging the HDD market in terms of growing storage capacity, the long-term future of HDD demand is likely to remain high. This bodes well for both Seagate and Western Digital, whose long-term outlooks have been questioned in light of improving SSD technology.

Seagate’s Q2 2013 results were very positive. The company achieved annual sales of $14.4 billion, which is only the second time in its history that it has surpassed $14 billion. Its balance sheet appears to be in a strong position after restructuring its debt to achieve an annual $40 million interest expense savings and ending up with $2.3 billion in cash.

In May, Seagate unveiled the storage industry’s broadest product portfolio, launching its first client SSD and next-generation enterprise SSDs. The 600 SSD, 600 Pro SSD, and 1200 SSD are engineered to deliver ultra-fast speed and high data integrity. Seagate also announced its X8 Accelerator, a storage-class memory PCI Express card powered by Virdent’s Flash Max II.

Also in May, Seagate launched the first 3.5-in., 4-Tbyte drive engineered for use in video applications such as digital video recorders. Purpose-built for video solutions, the Video 3.5 HDD can store up to 480 hours of high-definition content. In June, the company launched a cutting-edge drive custom-built for always-on NAS HDD. Featuring up to 4 Tbytes of storage, it enables NAS systems such as those used in homes and small to mid-size businesses to provide up to 20 Tbytes of data in a five-bay NAS array.

Seagate also recently announced its Terascale HDD, a 4-Tbyte enterprise-class SATA HDD optimized for emerging cloud infrastructures and large-scale data centers. Its power savings help to minimize data-center operating costs. And, the company claims that its recent Enterprise Turbo SSHD not only is the world’s first enterprise solid-state hard drive, it’s also the world’s fastest hard drive (see “Seagate Launches World’s Fastest Enterprise Hard Drive”.

These new product offerings, along with the Samsung and LaCie HDD business acquisitions, will position Seagate to take advantage of the opportunities presented by data growth driven by advancements in cloud, mobile, and open-source technologies.

Includes a full 13 page article that is not featured anywhere else.

Quick-View: View the Top 10 Company Gallery

Teradyne Soars 76 Slots

Teradyne leaped 76 slots from last year’s list to land at 12 on this year’s edition. It designs, develops, manufactures, and sells automatic test systems and solutions used to test semiconductors, wireless products, hard-disk drives, and circuit boards in the consumer electronics, wireless, automotive, industrial, computing, communications, and aerospace and defense industries.

Its customer base includes integrated device manufacturers (IDMs), outsourced semiconductor assembly and test providers (OSATs), wafer foundries, fabless companies that design but contract with others for the manufacture of ICs, developers of wireless devices and consumer electronics, manufacturers of circuit boards, automotive suppliers, wireless product manufacturers, storage device manufacturers, and aerospace and military contractors.

Teradyne’s first-quarter 2013 financial results were better than expected, with revenue and earnings coming in above guidance and consensus estimates. The company delivered 47% sequential order growth, driven by a 42% increase in semiconductor test and 322% increase in wireless test. Bookings in the first quarter of 2013 were $400, of which $259 million were in semiconductor test, $109 million in wireless test, and $32 million in systems test. Teradyne also raised its outlook for the second quarter of 2013.

“Design wins in LTE cellular test and 3.5-in. hard-disk drive test along with broader demand for semiconductor test systems drove nearly a 50% uptick in company orders in the first quarter,” said CEO Mike Bradley. “As expected, the test equipment market is on a steady recovery path driven by wireless and applications processor, power management, and microcontroller demand. With the substantial growth in orders, we've raised our second quarter revenue plan to meet the expanding capacity needs of our customers.”

In October 2011, Teradyne acquired privately held LitePoint, a test equipment maker for wireless products, for around $580 million in cash, to expand its product portfolio of test equipment in the wireless test sector. LitePoint designs, develops, and supports advanced wireless test solutions for developing and manufacturing wireless devices, including smart phones, tablets, notebooks, laptops, personal computer peripherals, and other Wi-Fi and cellular enabled devices.

LitePoint became Teradyne’s Wireless Test segment. There are strong growth prospects for wireless test equipment due to the increasing penetration of mobile devices. LitePoint’s product offerings and exposure to the higher-growth wireless arenas will allow this segment to substantially outgrow the overall test equipment market in the coming years. First-quarter 2013 LitePoint bookings performance suggests that Teradyne could exceed its target of cellular test share gains. Wireless test new orders in the first quarter of 2013 were 27% of Teradyne’s total new orders, while they represented only 9% of the new orders in the fourth quarter of 2012.

Teradyne’s decision to acquire LitePoint appears to have been a smart strategic move that already has produced strong results, and it can expand Teradyne’s total available market by more than $1 billion. The world is moving toward mobile, wireless, and simple-to-use product platforms. According to IDC,worldwide shipments of smart connected devices grew 29.1% year over year in 2012, and the entire market pushed past 1 billion units shipped, with a total market value of $576.9 billion. Tablet sales grew 78.4% year over year in 2012 and are expected to pass desktop sales in 2013 and portable PCs in 2014.

According to SEMI.ORG, the North American semiconductor equipment industry posted a book-to-bill ratio of 1.08 in April. The North American book-to-bill ratio was below one in the second half of 2012, but since January 2013, it is above one. This is a sign of recovery in the semiconductor equipment industry. Last quarter, Teradyne’s book-to-bill ratio of 1.43 was significantly higher than the semiconductor equipment industry’s average book-to-bill ratio.

Semiconductor and semiconductor equipment manufacturers have historically been highly cyclical, with periods of strong growth and high margins, which have caused companies to raise capital investment, and in effect causing excess supply followed by periods of weakness. The economic data and companies’ comments all say essentially the same thing, which is that the semiconductor equipment industry has already passed through the bottom of the current cycle.

The presentations by Apple CEO Tim Cook on May 28 and by Google executives at that company’s developer conference on May 14 suggest that new Web applications will extend the computing environment to everyday devices like smart television, wearable computing, cars, light bulbs, and more. This development will increase the demand for semiconductor test equipment.

Q2 Results Shine

Teradyne continued its strong performance in the second quarter of 2013, reporting a 53% sequential growth in sales. The company also delivered its 16th consecutive quarter of profitable operations with strong growth in their semiconductor and wireless test businesses, despite the rollercoaster of demand that characterizes most of their markets.

Bradley added that the seasonal pattern in the semiconductor test cycle gets some of the credit for the uplift so far this year, but the company also had good market share momentum in semiconductor test, both system-on-chip (SoC) and memory, as well as a strong first half showing from LitePoint.Semiconductor test orders grew 40% in the quarter driven by the mobile, power management, microcontroller, and memory test sectors. Wireless and systems test orders declined in the quarter as customers adjusted their capacity to market demand.

“Our momentum in SoC test is very good as we've registered back-to-back increases of nearly 40% in bookings through the first two quarters of the year,” Bradley said. “Wireless and power management continue as bright spots, coupled with a very strong surge in microcontroller and digital probe applications.”

Teradyne introduced the new model of its J750 test system with higher frequency and pin count this year. It helped post the best J750 order rate in three years and the second highest quarterly total in more than eight years, with 4400 sold to date. The company has taken the system pin count up to over 2000, doubled the operating frequency, and added more features to shorten the time it takes customers to bring new chips to volume production. These new instruments and software features can be plugged into existing J750s so customers get the maximum leverage from their installed base.

Memory test has been another bright spot, with the six-month order total exceeding the 2012 yearly total. As performance requirements in NAND and DRAM increase, Teradyne is well positioned with the Magnum and the UltraFLEX M systems, and they should outgrow the market by a good bit this year.

In semiconductor test, Teradyne reached a notable milestone as it was awarded first place in the VLSI Research Supplier survey, ranked first in the “Large Suppliers of Chip Making Equipment” category. While the company has been a top performer in the test sector in the past, this year it reached the top.

As for LitePoint, orders for the first half were just under $200 million, which is down from the $230 million it saw last year. But keep in mind that sales more than doubled from 2011 to 2012 driven by record connectivity buying. There is a temporary lull in connectivity demand after the record year in 2012, as the market digests the large capacity adds. However, Teradyne now has an expanded addressable market going forward.

The wireless test market presents huge growth opportunities due to increasing product complexity, driving test times up, new standards obsoleting the installed base, and unit growth driving tester demand somewhat offset by the increasing productivity of new testers and more efficient test operations at their customers.

In 2012, dual-band WiFi drove the market higher. This year, digestion of last year’s spending and improved efficiencies have reduced the market size. For next year and beyond, 802.11ac, multiple-input multiple-output (MIMO), LTE, and future standards will be more widely deployed and wireless unit growth will continue. LitePoint, with its production-optimized test solutions, should be a long-term winner in the growing wireless test market.

LitePoint has been a long-standing innovator, being the first to offer a one-box conductivity tester, the first with non-signaling, and the first with four-device testing. LitePoint traditionally has led by working very closely with the leading chipset companies and brands, offering a solution set-level approach for high-volume production tests.

With new product rollouts, a strong R&D pipeline, and solid market share, Teradyne should continue to deliver positive results in the third quarter of 2013 and beyond.

Includes a full 13 page article that is not featured anywhere else.

Quick-View: View the Top 10 Company Gallery

Whirlpool Rises 47 Slots

Whirlpool Corp. surged 47 places since last year’s edition to climb to 28 on this year’s list of the Top 50 Employers in Electronic Design. As a manufacturer and marketer of home appliances, it operates in North America, Latin America, the Europe, Middle East, and Africa (EMEA), and Asia. Its principal products include laundry appliances, refrigerators and freezers, cooking appliances, dishwashers, mixers, and other portable household appliances. It also produces hermetic compressors for refrigeration systems.

The company produces its home appliances in North America and Latin America, with 65 manufacturing and technology research centers around the world. Its brands include Whirlpool, Maytag, Kitchen Aid, Amana, Jenn-Air, Bauknecht, Brastemp, and Consul. With one of the strongest global brand portfolios in the consumer appliance industry, it has been improving since 2008 following the financial crisis and entered 2013 with strong momentum in sales and profits and a share price that has more than doubled in just two years.

The major appliance industry is one of the most competitive of all. It is volatile with demand driven by new home construction and consumer sentiment. It’s sensitive to rising interest rates since refrigerator or range replacements can be deferred readily in economic slowdowns. Today, many tailwinds exist for Whirlpool. Housing starts are rising, but remain below the rate of family formation, suggesting they will continue to rise.

Consumer confidence is slowly increasing. So is employment. Interest rates are low, and while most observers think they eventually will rise, they also see no imminent risk of any drastic rise when the Federal Reserve has been clear that the low interest rate environment will persist for a while. Commodity prices for inputs like copper, aluminum, steel, plastic, and electronic components are relatively low and benefit the company’s margins.

Earlier this year, the U.S. International Trade Commission ruled in favor of Whirlpool against Korean and Mexican appliance exporters, Samsung, LG, Daewoo, and Electrolux were imposed duties anywhere from 11% to 151%, easing the competitive pricing pressure on Whirlpool. According to IBISWorld, revenues of appliance manufacturers have fallen by an average annual rate of around 5.2% since the housing decline began, while Whirlpool’s sales have dropped from $19.4 billion to $18.1 billion in that time period, or an average annual decrease of just 1.3%.

However, Whirlpool did place first among all major appliance companies for customer satisfaction in the 2012 American Customer Satisfaction Index. The company has led or tied for first place each year since 1996. In the second quarter of 2013, Whirlpool also saw strong unit and revenue growth in every region, strong margin expansion, rising full-year earnings guidance, and strong underlying cash generation.

Net sales grew by 5%, gross margin was up 1.1 points, operating profit was up 69%, and operating margin was up 2.6 points. The operating margin improvement was mostly driven by cost and capacity reductions and somewhat driven by improved price/mix and higher productivity/lower materials costs.

The North American industry demand forecast for 2013 has been significantly adjusted up from 2% to 3% to 6% to 8%, as Whirlpool continues to see very positive trends in U.S. housing as well as a pickup in all segments of the market from a demand perspective. This is very encouraging as the company derives more than half of its sales from North America and about 15% of its sales through the “new install” channel from new housing installers.

In EMEA, the expectation is now flat to –2%, downgraded from flat, as a weak demand environment continues across the Eurozone, although there is some optimism. While southern Europe continues to lag, there are some positive trends in German, the Nordic countries in particular, and the United Kingdom.

For Brazil and other Latin American countries, Whirlpool is forecasting a lower but still positive industry growth for the year. Instead of 3% to 5%, the company is now seeing 1% to 3%. There is plenty of opportunity in Brazil as penetration levels are still low. Finally, Asia is forecast to be flat, down from a previous forecast of 3% to 5%. Given these changes, however, the overall global industry demand assumption has increased for the year.

Whirlpool is a top brand across all of its markets, in terms of unit sales and average sales price per unit. There is little cannibalization between its brands, and its higher-end and lower-end brands serve distinct markets, such as Kitchen Aid and Roper. Its future growth is likely to target higher-end and higher-margin products, moving into markets previously the realm of appliance manufacturers such as Sub-Zero.

The company must continue to aggressively control raw material costs and pass through increases to customers to keep improving margins. The primary raw material inputs are steel, oil, plastics, resins, and other base metals, making up around two-thirds of operating expenses, including their transportation costs.

Since there is continual pressure from competitors such as LG, Samsung, Haier, Kenmore, Electrolux, Siemens, Daewoo, and GE, Whirlpool has to have the best cost structure to win. It has segmented its brands into higher, midrange, and lower-end, with cost structures to match, although the overall average price point is leaning to the higher end.

Whirlpool’s main growth opportunities continue to present themselves in South America, where no compelling domestic brands exist, and in Asia, where there is stiff competition from Korean, Japanese, and Chinese manufacturers. With favorable trends in U.S. housing and growth opportunities in emerging markets and with continuing sales and profit growth, margin expansion, and strong cash generation, it will carry strong momentum into the rest of 2013 and into 2014.

Includes a full 13 page article that is not featured anywhere else.