Electric Drivetrain Conversion Kit Could Change the Economics of E-Trucks

Members can download this article in PDF format.

What you’ll learn:

- A startup seeks to accelerate the transition to electric trucks by retrofitting existing diesel vehicles with electric drivetrains.

- How adapting practices from high-volume truck manufacturers to develop cost-effective retrofit kits can help narrow the cost differential between electric and diesel vehicles.

- The "mass-reproduction" processes used by this startup may prove to be a blueprint for new business models that can be used by other durable goods manufacturers.

The transition to electric vehicles is now almost inevitable, but it's still uncertain how quickly it will happen. This is especially true when it comes to trucks. They account for less than 5% of the vehicles on the road but produce over 20% of the emissions from the transportation sector, which currently accounts for more than one-third of U.S. greenhouse gas emissions.1

This is of concern because the adoption of electric trucks is expected to be slower than passenger vehicles, in part due to their significantly higher cost (2X-3X than an equivalent diesel truck in 2023). And, even though they’re expected to achieve cost parity within a decade,2 trucks tend to have much longer service lives, and they often stay on the road even longer than passenger cars.

But what if there was a way to economically re-power used trucks at a fraction of the cost of a new EV? If the process could be economically done on an industrial scale, could it help electrify the global transport fleet much sooner than expected?

This short video shows how Evolectric changes the economics of electrification by giving old diesel trucks a second life as "upcycled" EVs.

Evolectric’s Intended “Mass Reproduction”

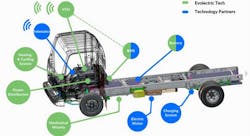

Bill Beverley, Co-CEO & CTO at Evolectric, is in the process of answering that question. While most of today's electric retrofits to date are being done on a one-off semi-custom basis, Beverley and Co-Founder, Jakson Alvarez, are developing the technologies, products, and logistics strategies to support "mass reproduction" of existing commercial vehicles (Fig. 1). Standardized retrofit kits are being used to replace the worn-out diesel drivetrain and running gear with an electric propulsion system in as little as two days.

They’re in the final stages of tooling up a pilot reassembly line where they plan to turn worn-out diesel trucks into like-new vehicles with the same drivability and load capabilities, but dramatically lower operating costs. On the green side of the bottom line, electrifying a single truck can eliminate up to 31 metric tons of emissions per year, plus avoiding roughly 50% of the emissions created during the manufacture of a new truck.

Evolectric's initial focus is on several series of popular mid-sized cab-over-engine trucks that include the Isuzu N-series (payload class 4-6). Such trucks can be upgraded using the same software-configurable e-powertrain kit. The same kit could also be used to convert similar vehicles from Hino and Mitsubishi, which share many common mechanical characteristics.

Once remanufacturing of this first platform is in full swing, the company says it expects to develop a similar solution for vehicles manufactured by American companies like Freightliner, International, and Navistar.

Steps in the Retrofit Process

The retrofit process (Fig. 2) begins with removal of the truck's old motor, cooling system, transmission, and part of the electrical harness. The other controls (including brakes), interior, and cabin systems are left intact but can be refreshed as needed.

Next, the original instrument panel is replaced with a new simplified digital panel that includes EV-relevant instrumentation and controls. At the same time, the truck's original drivetrain forward of the rear axle is replaced with a direct-drive unit that has the same speed range as the diesel it replaces.

The drivetrain includes an ac induction motor made by DANA and a proprietary controller developed by Evolectric. The controller is unique because its model-based software has a modular architecture that can easily accept upgrades or be adapted to support different batteries and vehicle platforms.

Controller that Collects

In addition to its functional flexibility, the controller has been designed to collect operational data from the truck that can improve its reliability and profitability for an individual owner or a large fleet operator. The truck's embedded intelligence will be able to collect operational data for insurance and finance partners and support value-add features such as fleet telematics/intelligence and predictive maintenance, as well as over-the-air software upgrades. Once in full production, Evolectric expects to roll out additional features like ADAS (limited driver assist and computer vision).

The controller's flexible software architecture also enables the company to take a modular approach to batteries. The battery-management software can be easily configured to work with products from several manufacturers and, in the future, different battery chemistries.

Besides reducing the chance of supply-chain problems, the vendor-independent architecture makes possible simple, reliable upgrades as better products become available. At present, Evolectric is using lithium-iron-phosphate (LF) batteries due to their longer life and ability to operate safely under harsh conditions. The company already has signed purchase agreements with two American vendors (located in Michigan and Ohio) and one Chinese vendor (CATL) (Fig. 3).

Calculating the Economics

Given the fact that these ubiquitous diesel cab-over trucks comprise a significant fraction of the 335 million commercial vehicles on the road today, Evolectric has access to a very large and potentially lucrative market—if it can make the economics work. Operators seeking to go electric can send their vehicles in for re-powering and refitting for a cost of roughly $85K. Or they can let Evolectric supply the donor vehicle for $100K—much less than the $150K to $175K it costs to purchase a comparable new electric truck.

While this is still higher than the average cost of a comparable new diesel truck (roughly $65K), Evolectric says the extra expense is more than offset by their vehicles' dramatically lower operating costs. The company estimates that its trucks will save operators $0.50 to $0.75 per mile in fuel costs and thousands in annual maintenance costs.

In many cases, the savings will be so large that the payback period for the conversion can be as low as two years of the truck's 15- to 20-year operational life. And as battery costs continue to drop and the economies of scale begin to kick in, the company anticipates that the cost of an electric conversion should eventually drop to around the cost of a new diesel truck.

References

1. “Medium and Heavy Trucks Account for About a Quarter of Highway Vehicle Fuel Use,” Vehicle Technologies Office, November 2016.

2. The U.S. Department of Energy (DOE) recently released a study showing that by 2030, nearly half of medium- and heavy-duty trucks will be cheaper to buy, operate, and maintain as zero-emissions vehicles than traditional diesel-powered combustion engine vehicles.

About the Author

Lee Goldberg

Contributing Editor

Lee Goldberg is a self-identified “Recovering Engineer,” Maker/Hacker, Green-Tech Maven, Aviator, Gadfly, and Geek Dad. He spent the first 18 years of his career helping design microprocessors, embedded systems, renewable energy applications, and the occasional interplanetary spacecraft. After trading his ‘scope and soldering iron for a keyboard and a second career as a tech journalist, he’s spent the next two decades at several print and online engineering publications.

Lee’s current focus is power electronics, especially the technologies involved with energy efficiency, energy management, and renewable energy. This dovetails with his coverage of sustainable technologies and various environmental and social issues within the engineering community that he began in 1996. Lee also covers 3D printers, open-source hardware, and other Maker/Hacker technologies.

Lee holds a BSEE in Electrical Engineering from Thomas Edison College, and participated in a colloquium on technology, society, and the environment at Goddard College’s Institute for Social Ecology. His book, “Green Electronics/Green Bottom Line - A Commonsense Guide To Environmentally Responsible Engineering and Management,” was published by Newnes Press.

Lee, his wife Catherine, and his daughter Anwyn currently reside in the outskirts of Princeton N.J., where they masquerade as a typical suburban family.

Lee also writes the regular PowerBites series.