As China pursues electric vehicles as one of its seven “strategic emerging industries,” GEM, a major Chinese recycling company, recently announced a deal with Glencore to purchase 50,000 tons of cobalt over the next three years. It represents roughly one-third of Glencore’s estimated production over this time period, and allows China to lock up a large share of the supply of cobalt mined in the Democratic Republic of Congo, which maintains 60% of the world’s supply of cobalt.

Given that China already produces more than 80% of the world’s refined cobalt, this secures its position as the market leader in the manufacturing of electric car batteries. GEM is the main cobalt supplier to Chinese battery maker CAML, the largest battery supplier in the world.

Cobalt is a key ingredient in the manufacture of lithium-ion (Li-ion) batteries, which are used in electronics products ranging from smartphones to electric vehicles. While attempts are made to find substitutes for cobalt in Li-ion batteries, no adequate replacements yet exist and there’s no expectation for a replacement material for decades. With the demand for Li-ion batteries only becoming stronger, it caused the price for cobalt to double in 2017, and has more than tripled in the last 18 months as of February 2018 according to the United States Geological Survey.

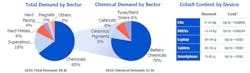

Cobalt trading firm Darton Commodities reports that the demand for cobalt in vehicle battery materials is forecast to grow over 40% in 2018. The figure illustrates how battery chemicals dominate the demand for cobalt and the significant difference in the amount of cobalt used between electric vehicles and other electronics products such as smartphones. The large production volume of smartphones generates strong demand for cobalt even though the relative demand per phone is small compared to electric vehicles.

Demand for cobalt is on the rise, especially in the electric-vehicle space. (Source: The Economist, BNP Paribas, UBS)

Mining companies such as ERG and Glencore are pursuing new cobalt operations that may balance supply and demand in the near term. However, in its report, Darton Commodities stated that production increases of cobalt are expected to level off by around 2022 while demand for electric vehicles will continue to accelerate.

Electric Vehicles vs. Smartphones in Battle for Cobalt Supply

With ambitious plans for electric vehicles, major automotive companies such as BMW and Volkswagen are moving to make deals to procure cobalt directly from the miners in order to secure an adequate supply in the future. In addition, other major players such as Samsung SDI and SK Innovation are also engaging in major cobalt procurement deals. Of course, Tesla continues to be push forward with its own ambitious plans for electric vehicles.

However, a recent announcement by Volkswagen gives an idea of the leap forward planned for electric vehicles. Volkswagen revealed plans to build at least 16 factories to produce electric cars in the U.S., Europe, and China. Its goal is to sell three million electric vehicles by 2025, which would dwarf the sales of 102,807 high-end cars reported by Tesla for 2017.

All of this places automotive companies in direct competition with major handset OEMs like Samsung and Apple for cobalt supplies. There are reports of Apple seeking to establish similar procurement deals with cobalt miners as the automotive companies.

Complicating Factors

The reliability and stability of cobalt supplies is called into question given that the Democratic Republic of Congo has never had a peaceful transition of power, and child labor is still used in parts of the mining industry. With close scrutiny from human rights organizations, companies will need to make sure that appropriate protections are in place with their suppliers of cobalt.