Distribution And Design—What Engineers Really Want

Twenty-five years ago Electronic Design would not have published very much about electronic distribution companies. Our readers always have been predominantly design engineers.

Back then, they would have sourced components from distributors, but that was about as far as the relationship went. Times have changed enormously.

These days, distribution companies are working more closely with design engineers and their projects, though not for purely altruistic reasons. Many distributors recognize that their core business activities are not in themselves sufficient to distinguish themselves and give them a marketing advantage over the rest of the pack. Distributors also realize that providing valuable assistance with their design-in challenges can engender lasting and lucrative relationships with engineers. Design engineers today also face greater time-to-market pressures, and distribution companies can help. Indeed, many distributors now recognize the marketing imperative of design assistance if they want to survive in the business.

What Do Engineers Really Want?

Fundamentally, engineers want continuity of technical support. They also want valuable online information to be available. They want to avoid counterfeit components as well. And, they want to know that distributors have backup strategies to handle unforeseen natural disasters that can seriously disrupt the supply chain. For example, the devastating Kobe earthquake in Japan threatened the supply of materials required in electronics manufacture as well as the transportation of those components. But design engineers aren’t the only people who want continuity of technical support. Component suppliers also expect it of their distribution partners. Suppliers often ask if component manufacturers can increasingly rely on distributors to provide value-added services like design assistance. The answer is not always cut and dried.

Many distributors will claim they can, but can they? Some experts doubt that a distributor offering a huge number of lines can provide personal technical support across every part and technology it supplies. However, this jaundiced opinion is gradually declining. A key element in this shifting view is the way in which distributors have exploited the Internet in their drive to build cooperative relationships with design engineers. In fact, many companies are optimizing their online efforts.

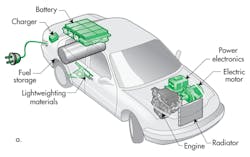

Mouser has coupled the need to offer online design services with the recognition of the growing importance of power electronics and their use in electric vehicle (EV) design. Its Automotive Applications site has new sections devoted to emerging EV and hybrid EV (HEV) designs (Fig. 1).

The site features three new EV/HEV application areas: battery charging, start/stop systems, and HEV main inverters. Users get access to block diagrams, explaining each of the system’s operations. Clicking on a component within the block in the diagram pulls up a Mouser-stocked parts list needed to quickly build that piece of the system.

As HEVs generate more and more consumer interest, they have become increasingly popular design platforms for OEM and aftermarket electronics manufacturers. However, Mouser is not alone in wanting to exploit the power market.

Avnet company Silica has announced a strategy to establish itself as a source of power expertise in European semiconductor distribution. The new approach is being rolled out under the brand Power ’n More (Fig. 2).

“With the continuing trend for energy saving in electronic systems, designers need more and more support to align with the relentless wave of new regulations and directives,” says Karlheinz Weigl, Silica’s regional vice president of sales for central Europe and executive sponsor for Power ’n More.

“To date, engineers have been hampered by a lack of in-depth expertise and know-how across the distribution channel,” she says.

Counterfeit Components

Despite increased awareness of the problems caused by counterfeiting and the advice available from many distributors on how to spot counterfeits and avoid them, bogus parts are still causing major headaches in the supply chain.

Periodic fluctuations in demand characterize the market for electronic components. Counterfeits are primarily a problem in allocation periods when customers urgently require items and procure them from unreliable sources. The transition between scarcity and excess production therefore requires the earliest possible intervention to ensure a reliable, unbroken supply.

The Counterfeit Components Assessment Project of the International Electronics Manufacturing Initiative (iNEMI) recognizes that counterfeit components have become a multimillion-dollar problem, driven by product obsolescence, long life cycles, economic downturns and recovery, and local disruptions in manufacturing due to natural disasters. Counterfeit electronic components affect every segment of the market and lead to increased scrap rates, early field failures, and increased rework rates. The use of counterfeits in high-reliability applications can have far more serious consequences.

The group has developed three easy-to-use risk assessment methodologies that provide a comprehensive view of the counterfeit problem by surveying the possible points of entry in the supply chain and assessing the impact of counterfeit components on the industry at various points of use. These tools cover three areas: the risk of counterfeit use, the risk of untrusted supply sources, and counterfeit loss and total cost estimations.

As mentioned, natural disasters can affect supply chain logistics and contribute to the greater likelihood that engineers will turn to the grey market for supply. So what advice can distributors give engineers facing these shortages?

John Bowman, marketing director of semiconductors at Anglia, believes customers generally source on the grey market because they can’t get supply from their regular “white” market supplier. Often, they end up in this position due to a lack of communication and trust.

Information must be shared in both directions. Distributors need to supply accurate lead-time forecasts and timely warnings of obsolescence. Customers should supply the most accurate sales data they have, as well as timely warnings of design changes.

Rutronik managing director of marketing Markus Krieg maintains that the transition between scarcity and excess production requires the earliest possible intervention to ensure a reliable, unbroken supply. Forward planning enables fast reactions to shortages. One thing is certain. All distributors recognize that supply shortages create openings for grey supplies to seep into the market

Geoff Breed, vice president of European marketing at TTI, says it is very tempting to buy components on the grey market. Yet engineers are risking serious problems that could take the form of early product failure or potentially even a disaster like a fire on the printed-circuit board (PCB) when a component that is not fit for its purpose fails catastrophically.

So 25 years on and distribution companies are going out of their way to engage with design engineers. Design engineers also now recognize that distribution companies are a valued element in the design cycle and not merely the parts shifters of many years ago.

About the Author

Paul Whytock Blog

European Editor

Paul Whytock is European Editor for Penton Media's Electronics Division. From his base in London, England, he covers press conferences and industry events throughout the EU for Penton publications and its Engineering TV and Radio services Qualified to HNC Full Technological Certificate standard, Whytock trained as an automotive design engineer with Ford Motor Company prior to entering technical journalism.