Back in December 2013, Electronic Design Europe took a long, hard look at industry analysts’ and assorted pundits’ predictions for the global semiconductor market in 2014. Basically, they were trying to decide whether it would go boom or bust, or be flat as a pancake. Electronic Design Europe did the math on a whole raft of stats, and concluded that chipmakers financial dreams would come true in 2014.

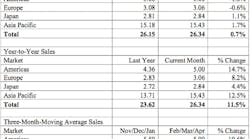

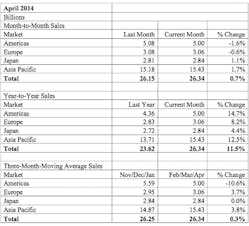

So how's the global market for semiconductors shaping up? Analysis just released by the Semiconductor Industry Association (SIA) indicates “pretty well.” Global sales in April were up 11.5% over the previous year, with worldwide sales of semiconductors reaching $26.34 billion for the month.

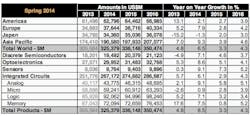

These statistics are actually compiled by the World Semiconductor Trade Statistics (WSTS) organization. A recent WSTS study presented some particularly bullish sales predictions: Revenues in 2014 are expected to grow 6.5% over 2013, with total revenues hitting the US$325 billion mark.

Driving these optimistic predictions is the continued voracious demand coming from the smartphone, tablet, wireless, and automotive sectors. The only strange exception—according to analysts, the weakest market link will be the microprocessor business, with growth showing a slight decline.

Automotive electronics certainly galvanizes this rosy outlook. It’s now recognized that half the value of next-generation cars will be associated with the electronic components, systems, and software that will continue to enhance car safety and management systems, as well as fuel the adoption of advanced electronics in more sophisticated engine and safety controls, electric/hybrid electric drives, navigation, audio systems, and LED lighting.

Wireless-Related Sales

When it comes to chip sales in the wireless arena, market analyst IHS Technology reckons that mobile PCs and smartphones will represent the top revenue opportunities for high-speed wireless integrated circuit suppliers by 2018. Projections show that these portable devices will be the highest-volume applications in this market over the next five years.

Between 2013 and 2018, more than 400 million high-speed wireless ICs are projected to ship cumulatively into the mobile PC market, generating global revenue of $2.5 billion. IHS also calculates that during the same period, more than 80 million high-speed wireless ICs will find their way into the smartphone market, with worldwide revenue forecast to exceed $260 million in 2018.

RF Switch Double-Digit Growth

A further endorsement of the smartphone market’s strength came this week from German chipmaker Infineon, when it announced the shipments of more than one billion RF switches for smartphones and tablet use. The company believes the demand for RF switches will show double-digit growth over the next few years, driven primarily by the increased number of LTE bands integrated into next-generation smartphones and tablets.

Other electronic technologies demonstrating robust market sales include analog components and systems (9.1%) and sensors (9.1%).

Will The Boom Bubble Burst?

Analysts are starting to agree that this buoyant semiconductor market situation could prove to be durable. One potentially negative caveat, though, is the possibility that global economies go into reverse and shrink, with subsequent erosion of consumer spending confidence.

Nonetheless, the global semiconductor market is forecast to be US$336 billion in 2015 and US$350 billion for 2016. By region, Asia-Pacific represents the fastest growing region with expected revenues of US$207 billion in 2016—a near 60% share of the total semiconductor market.

Strange then, given all of these positive indicators for the semiconductor industry now and in the immediate future, that SIA CEO Brian Toohey says the US semiconductor industry is suffering from an “innovation deficit.”

Innovation Deficit: A Potential Warning Shot?

“One threat to the semiconductor market’s continued growth and America’s overall economic strength is the innovation deficit—the gap between needed and actual federal investments in research and higher education,” believes Toohey. “Policymakers should act swiftly to close the innovation deficit by committing to robust and sustained investments in basic scientific research and higher education.”

This statement seems all the more incongruous to me given that the US is one of the most successful markets for semiconductors. Such a worthy position goes hand-in-glove with an innovative and progressive ethos amongst that country’s chip makers and OEM companies.

On a more positive note, in an effort sustain the market’s buoyancy, attendees the 18th annual meeting of the World Semiconductor Council (WSC) agreed on a series of policy proposals to strengthen the industry through international cooperation. The WSC is a worldwide body of semiconductor industry executives.

Recommendations from this year’s meeting included the expansion of the Information Technology Agreement (ITA), which the WSC believes could be one of the most valuable agreements to hit the global technology industry in over a decade. The ITA provides for duty-free treatment of certain information-technology products, including semiconductors. An expanded ITA would generate an estimated total of $1.4 trillion in annual world trade, says the WSC.

Industry leaders also managed to agree on a number of important issues relating to the chip market. Among them was the urgent requirement to develop actions to combat semiconductor counterfeiting; the strengthening of intellectual-property (IP) rights and protections via work and analysis of issues related to patents; patent quality; abusive patent litigation; and trade secrets. Maintaining progress toward reducing the industry’s PFC emissions and ensuring proper attention to other environmental and supply-chain matters also were positioned as imperative concerns.

In addition to these worthy objectives, the WSC wants to encourage countries with semiconductor interests to become involved in furthering the adoption of far-reaching initiatives that would impact the global electronics industry.

The reality of that grandiose statement is it wants governments to forge ahead on implementing encryption standards and regulations to eliminate what the WSC coyly refers to as “problematic practices.” Most of us refer to these practices as hacking and cyber crime.

Environmental initiatives are another priority. Maintaining progress toward reducing the industry’s PFC emissions and ensuring proper attention to other environmental and supply-chain matters should be facilitated via government action.

Now, it’s up to WSC industry leaders to lobby governments to make these recommendations a reality. It will be worth watching this massive undertaking unfold, just as it will be worth noting whether the analysts’ optimistic market conditions remain a sustainable reality.