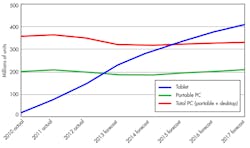

Taking a midyear look at how the global electronics industry is trading throws up a mixed bag of figures with some real surprises. For example, laptops have been one of the mainstay purchasers of semiconductor products for years. But this year, the laptop market recorded its worst trading figures of the past decade.

It’s all because of tablets, and it’s only going to get worse. IDC predicts 230 million tablets sold this year, which is 60% more than last year. Laptops specifically recorded an alarming 11.2% contraction compared to the same six-month period a year ago.

Meanwhile, IHS says global PC shipments in the second quarter of 2013 shrank by 6.9%, representing the first time the segment experienced a sequential decline since the second quarter of 2002. That’s quite a fall since three years ago, when PC shipments surged by 41.7%.

But if the semiconductor market is bemoaning its loss of component sales to PC makers, it must feel financially jubilant about the success of the tablet market, which is expected to increase production this year by 38.5% to 207.1 million units.

Add to that the gains being shown in automotive, communications, medical, and renewable energy systems and it’s not surprising that worldwide semiconductor revenue is projected to total $311 billion in 2013, a 4.5% increase from 2012 revenue, according to analysts Gartner.

However, Gartner also suggests that this year won’t be smooth sailing for all of the chipmakers. The DRAM market’s failure to climb out of the doldrums in 2012 means that its recovery in 2013 will be slow, but it will happen largely due to the effect of undersupply, which will in turn create demand.

Driving Forward

The automotive electronics sector continues to accelerate. Overall, the global market for automotive electronics will rise to $240 billion in 2020, up more than 50% from $157 billion in 2010. Half the value of next-generation cars will be associated with their electronic components, systems, and software.

These advances will continue to enable the car safety and management systems we are already familiar with and will fuel the adoption of advanced electronics in ever more sophisticated engine and safety controls, electric/hybrid electric drives, navigation, audio systems, and LED lighting.

Smart vehicles will be a major frontier for app developers over the next five years, according to Juniper Research. The market for in-vehicle apps will be worth just short of $1.2 billion (U.S.) by 2017. Advances in automotive connectivity standards such as Mirrorlink and higher smart-phone ownership will create foundations allowing automotive connected systems to flourish, particularly in North America and Western Europe.

In the United Kingdom, Jaguar Land Rover will lead a five-year research program with the Engineering & Physical Sciences Research Council and four leading U.K. universities. This project aims to give the U.K. the chance to take a global lead in virtual simulation technology. The £10 million collaboration is the first phase of a 20-year strategic project.

Telecoms Hits A Trillion

Mobile phone production growth in 2012 and 2013 will decline slightly in the short term as tough economic conditions reduce consumer demand. But the market forecast for utility/basic smart phones has increased, largely at the expense of traditional phones.

The adoption of Android-based entry-level smart phones in emerging regions continues to accelerate and is expected be a key growth driver. Worldwide smart-phone unit production growth in 2013 is forecast to be 33%, and Prismark analysts say that smart-phone sales currently exceed 1 billion units annually.

A recent report from Global industry Analysts (GIA) suggests that the global telecom services industry will reach $1.8 trillion in three years. This total encompasses a broad spectrum of telecoms including Internet services, wireless communications, cable TV systems, satellite communications, and fiber-optic networks.

Healthy Optimism

The World Health Organization (WHO) and the Organization for Economic Co-operation and Development now consider the application of medical electronics essential in meeting international health needs at reasonable costs.

Both organizations say the barriers to adopting more electronic-based medical systems have been overcome in terms of the devices (i.e., cost, size, power/battery life, and standards for RF and data transfer) and their acceptance by patients, technicians, doctors, and hospitals. The momentum has, they say, turned from restrained growth to the rapid adoption of medical electronics.

Specifically, there are four main technical challenges relative to medical electronics: power management, smaller system/device size coupled with increased features/capabilities, reduced costs, and RF signal improvements and data encryption standards. The WHO says these challenges have been met, opening up greater market opportunities.

Stable power supplies are essential to electronic-enabled medical systems. The medical power supply market totaled $642.0 million in 2012 and is poised to grow at a compound annual growth rate (CAGR) of 6.2% from 2012 to 2017 to reach $866.8 million by 2017.

PV Sales Rise in The East

Hot on the heels of the first solar capacity decline in Europe in 2012, Asia is poised this year to emerge as the world’s largest region for solar installations. Led by China, Asia will become the main driver for growth in the photovoltaic (PV) market as demand in the region nearly triples from 2012 to 2017, according to IHS.

Asia experienced 65% growth in 2012 to reach 9.2 GW of PV installations. For the first time, 2013 will see Asia with an installed PV capacity of 15.1 GW, followed by four more years of growth until it reaches 25.7 GW in 2017.

Installations in Europe, the Middle East, and Africa (EMEA) declined for the first time ever in 2012 to 18.0 GW, though, down from 19.3 GW in 2011. IHS forecasts an additional, steeper contraction this year for EMEA to 13.9 GW before returning to growth in 2014.

Japan’s solar installations surged by an enormous 270% in the first quarter of 2013, meaning Japan will surpass Germany to become the world’s largest PV market in terms of revenue this year.

New Techs On the Block

Critically important to the long-term market growth of electronics are the financial contributions being made by burgeoning technologies. Analysts M&M have highlighted two industry innovations: gallium nitride (GaN) and graphene.

The GaN power semiconductors market is expected to reach $12.6 million by the end of 2012. The phenomenal growth rate of approximately 60% to 80% year-on-year is expected to continue with forecasted revenue for GaN power semiconductors of $1.75 billion by the end of 2022.

The market for graphene-enabled electronics is expected to grow at a healthy CAGR of 56% from 2013 to 2023. It will be interesting to see how that translates into actual financial performance. According to RnR Research, the European Union is making a substantial commitment to graphene by funding a 10-year, €1.35 billion development program, and South Korea is spending $350 million on graphene commercialization projects.

About the Author

Paul Whytock Blog

European Editor

Paul Whytock is European Editor for Penton Media's Electronics Division. From his base in London, England, he covers press conferences and industry events throughout the EU for Penton publications and its Engineering TV and Radio services Qualified to HNC Full Technological Certificate standard, Whytock trained as an automotive design engineer with Ford Motor Company prior to entering technical journalism.