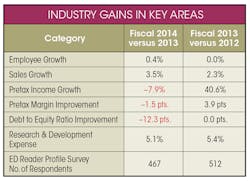

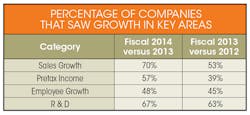

In 2014-15, both sales growth and employment grew ever so slightly higher than the previous year-to-year comparison but for the first time in a number of years, pretax income growth declined—and significantly enough to cause a collective 1.5-point pretax margin decline. Companies had done a great job maintaining margins and leveraging profitability since the economic crisis hit in 2008. With profits slowing down reducing what can be added to equity and companies increasing their debt load to fund future growth, collective debt-to-equity ratios deteriorated significantly.

The good news here is that our collective pool of 92 companies is continuing to invest in R&D at about the same growth rate as last year, and as a matter of fact, at a higher rate than any other indicator. In addition, the hope is that companies use the increase in debt for productive reasons such as increasing investment.

The Top 50 list is based on a formula using public financial data from a "pool" of the 92 public companies, with bonus points awarded using the results of our annual Electronic Design Reader Profile Study. Check out the full methodology here.

What’s In Store?

According to Census Bureau Data for durable goods, business spending should grow by 4% this year vs. 5% in 2014, even though May and April showed about a 1.5% decrease in durable goods orders. Most of the weakness had to do with low demand for commercial aircraft, although that seems to be improving with Boeing now maintaining a significant order backlog. Orders for core capital goods increased by 0.4% in May after decreasing in April, which is a good sign for later in the year, as it relates to increased company spending on equipment and software.

Since its peak in 2008, real non-residential investment is up 8% and up by 35% since its low point in 2009. While investment fell in the first quarter of 2015, if you exclude the oil industry, it actually grew at a 1% annual rate.

Joblessness has fallen consistently since 2010. U.S. labor markets are tightening with reported unemployment predicted to fall to 5.1% by year-end, according to Department of Labor employment data. This means stronger income growth and higher spending by consumers. Good job growth of 223,000 in June (mainly in health care, retail, foodservice, and business services) keeps boding well for future growth. Hourly pay rose at an annual rate of 3.3% in the first quarter.

This file type includes high resolution graphics and schematics when applicable.

The number of workers leaving jobs has increased as a result of more workers quitting. Stronger hiring data suggests these workers are moving on to better jobs.

Sales of new vehicles have held up well, and automobile makers are either maintaining or increasing capacity and modernizing plants. Census Bureau construction activity data also points to the housing sector rebounding, meaning increased demand for a range of industrial manufactured goods.

Department of Commerce GDP data suggest a 3.5% to 4% growth rate in the second half of 2015, resulting in a 2.5% annual growth rate. This was the same pattern that occurred last year, with weather being a major factor. First-quarter 2015 GDP showed a 0.7% decline. Since economic growth began once again in 2010, it has never beaten a 2.5% annual growth rate. It’s a problem that spans beyond the United States, with Brazil and Russia facing deep recessions and China slowing down.

Department of Energy price statistics show that prices at the pump appear to be holding steady and are about 90 cents less than last year. Crude-oil prices are also holding steady and are predicted to stay in the $60-$65 per-barrel range. Although more electric utilities are burning natural gas rather than coal, there appears to be plenty of supply to meet demand.

Long-term interest rates should stay fairly stable as long as inflation stays under control, given improved U.S. and European economic growth. While the Fed is expected to raise short-term rates by a quarter point in September, a further increase will be slow to come as the Fed is aware of the dangers of raising rates too quickly, especially before increases in wages gain enough momentum.

U.S. consumer debt has declined as the ratio of mortgage debt to GDP has fallen below 80%, back to its 2002 level, according to Societe Generale. Total household debt is at 107% of disposable income, the lowest amount since at least 1980. Household net worth is at a record high in real terms and close to the pre-crisis peak as a share of GDP.

Credit markets are strong as companies have issued $609 billion in debt so far in 2015, up by $40 billion from a year ago, according to Dealogic. Bank business lending is up by 12% as of April 2015, according to the Fed. While our company pool debt-to-equity ratio showed a significant deterioration, we expect that some of this debt will be used to fund new plants and equipment and software.

In summary, 2015 appears to be somewhat similar to 2014, but there is good news here. It also just seems to “feel” better than 2014. The key to continuing improvement will be for the Fed to keep interest rates low. This will continue to help households in the hardest-hit regions and ensure that the wage increases we are seeing contribute to higher spending.

There are also some exciting new technologies such as 3D NAND, FinFET, and the drive to single-digit nanometer nodes, and their continuing impact on making us more mobile and interconnected.

Following is a closer look at the top three companies in our 2015 report.

Micron Makes Moves

Our top-ranked company, Micron Inc., is one of the largest memory-chip makers in the world. It makes DRAM (Dynamic Random Access Memory), NAND Flash, NOR Flash memory, and other memory technologies. The company sells to customers in networking and storage, consumer electronics, solid-state drives, and mobile telecommunications, but its largest concentration (nearly a third of sales) is the computer market. Micron’s products are offered under the Micron, Lexar, Crucial, SpecTek, and Elpida brands, as well as private labels. The company generates about 85% of sales outside the U.S.

This file type includes high resolution graphics and schematics when applicable.

(At press time, China's state-backed Tsinghua Unigroup Ltd was preparing a $23-billion bid for the company, in what would be the biggest Chinese takeover of a U.S. business. Whether that transaction goes through or not—Credit Suisse said the deal was “highly unlikely to get past U.S. regulators who are increasingly viewing semiconductors as a strategic industry”—it points to a growing tech war between China and the U.S.)

Micron currently operates through four segments: Computer and Networking Business Unit (CNBU); Mobile Business Unit (MBU); Storage Business Unit (SBU); and Embedded Business Unit (EBU). The CNBU segment includes DRAM and NOR Flash products sold to the computing, networking, graphics, and cloud-server markets. The MBU segment includes DRAM, NAND Flash, and NOR Flash products sold to the smartphone, feature-phone, and tablet/mobile-device market. The SBU segment includes NAND Flash components and SSDs sold into enterprise and client-storage, cloud, and removable-storage markets. SBU also includes NAND Flash products sold to Intel through its IMFT joint venture. The EBU includes DRAM, NAND Flash, and NOR Flash products sold into automotive and industrial applications, as well as the connected home and consumer electronics markets.

Micron Technology was founded in October 1978 and is headquartered in Boise, Idaho.

For fiscal Q3 2015, Micron posted total revenue of $3.9 billion, within its revenue guidance of $3.8 billion to $4.05 billion. Revenue was sequentially lower as expected in fiscal Q3, driven primarily by weakness in the PC sector.

The company expects DRAM industry supply to grow in the low to mid 20% range or so in both calendar 2015 and 2016. Demand in 2015 appears to be at or exceeding supply.

NAND industry supply bit growth is expected to be in the mid to high 30% range for both calendar 2015 and 2016. Demand and supply appear to be equal this year, with demand outstripping supply in future years based on current capacity. Micron will start volume production of its differentiated high-capacity 3D NAND later this year.

The company has remained focused on three initiatives: ramping up its 25 nm DRAM technology; driving scale output of its 20 nm DRAM technology; and the launching of its 3D NAND technology.

In DRAM, while PCs might be soft at the moment, mobile DRAM consumption is expected to surge with the next round of smartphone offerings later this year. New, 3- to 4-gigabyte phones announced at the Mobile World Congress in March are beginning to hit the market. Low- to mid-priced phones targeted at emerging markets are being built with significant memory content, including DRAM specs at 1 gb or above.

Next-generation 4G LTE chipset designs are doubling the memory content of both DRAM (from 2 to 4 gb) and NAND (from 8/16 gb to 16/32 gb). Also, the rapid adaptation of eMCPs (a combination of DRAM and NAND on the same silicon chip) in the mid-range phone market creates a significant opportunity for Micron, as they will drive increases in both low-power DRAM and NAND.

A PC recovery could very well be based on the rollout of Windows 10 and Intel’s Skylake processors. By year-end, the company could be producing 50% more DRAM bits at a 30% lower cost per bit than today, if all goes well. However, the real growth story appears to be 3D NAND. Although it won’t have a huge revenue impact this year, the improved endurance and data retention of this technology may make it the must-have NAND for the next three to five years, especially with the SSD market expected to reach around $65 billion—all based on high-performance NAND memory. Future strategy is to move as much DRAM production to 3D NAND as possible, and Micron moved 40,000 wafer starts per month of DRAM capacity in Singapore to NAND production in 2014.

3D NAND is a type of flash memory that stacks memory die on top of each other within a single package using specialized interconnects. The vertical stacking allows for a significantly higher density of memory cells and improves performance and reliability. 3D NAND is a breakthrough in overcoming the density limit currently facing the planar (2D) NAND architecture and floating gates used in conventional flash memory, as well as yielding speed and endurance improvements.

3D NAND has a denser chip with twice the write performance and 10 times the reliability of planar NAND. 3D NAND cell architecture enables significant performance and cost improvement relative to planar technology.

TrendForce currently projects 3D NAND will account for only 3% of the NAND Flash industry’s overall supply, since the majority of the manufacturers are still in the testing and sample delivery phase. However, the market intelligence provider expects the 3D NAND market share to reach 20% by 2015. According to IHS research, 3D NAND technology will account for the majority of total flash shipments, equivalent to 65.7% by 2017.

Micron also has a joint venture with Intel to develop 3D NAND (Intel Micron Flash Technology). They currently own a joint facility in Utah producing planar NAND. The company has long-term supply agreements with Intel to supply planar NAND, and they anticipate building 3D NAND for Intel out of Singapore as well. While Samsung is already a step ahead, an early entry can help Micron increase share versus competitors such as Sandisk, Toshiba, and SK Hynix.

According to Forbes, Samsung, which accounts for 27.9% of the NAND Flash market, launched its 3D V-NAND storage technology in August 2013 and has already started mass production of the technology. SanDisk (18.2% market share) and partner Toshiba (21.9 %market share) won’t have a 3D NAND offering until 2017. SK Hynix (11.4% market share) has yet to reveal specific 3D roadmaps, methodology, and timing. While Samsung clearly has the first-mover advantage, Micron can also benefit from early entry into 3D NAND technology. By the time SanDisk, Toshiba, and SK Hynix come up with a 3D NAND offering, both Samsung and Micron will be several generations ahead and will have solved the growing pains of controller design and other architectural issues.

Semiconductors Supplied by Applied

Our second-ranked company, Applied Materials, dominates the market for semiconductor manufacturing equipment. With the acquisition of Applied Films, Applied Materials moved into the market for equipment used in making solar-power cells. AMAT vies for supremacy in many segments of the chip-making process, including deposition (layering film on wafers), etching (removing portions of chip material to allow precise construction of circuits), and semiconductor metrology and inspection equipment. The company dropped its proposed merger with Tokyo Electron, the second-biggest equipment maker, due to antitrust concern from U.S. regulators.

This file type includes high resolution graphics and schematics when applicable.

Applied Materials provides manufacturing equipment, services, and software to the global semiconductor, flat-panel display, solar photovoltaic (PV), and related industries. The company operates through four business segments: Silicon Systems Group; Applied Global Services; Display; and Energy and Environmental Solutions.

The Silicon Systems Group segment develops, manufactures, and sells equipment used to fabricate semiconductor chips, also referred to as integrated circuits. The Applied Global Services segment encompasses services, products, and integrated solutions to optimize equipment and fab performance and productivity. The display segment provides manufacturing of liquid crystal displays, organic light-emitting diodes, and other display technologies for televisions, PCs, tablets, smartphones, and other consumer-oriented devices. The Energy and Environmental Solutions segment includes systems for manufacturing wafer-based crystalline silicon (c-Si) cells and modules. These systems are designed to increase the conversion efficiency and yields of solar PV devices in order to help reduce the cost per watt of solar-generated electricity.

Applied Materials was founded in 1967 and is headquartered in Santa Clara, Calif.

The company reported better-than-expected financial results for fiscal Q2 2015. Revenues were $2.44 billion, slightly above analyst expectations of $2.4 billion, with net income at $364 million, a significant year-over-year increase from $262 million. The company continues to lead the nano manufacturing industry. For example, in the semiconductor manufacturing equipment industry, the company’s etch (a critical wafer manufacturing process), conductor etch, and wafer fab equipment segments grew by approximately 7, 12, and 1.5 points in market share over the past two years. In 2014, Applied also added 2 points of market share to its PVD (photovoltaic solar panels) and Epi (epitaxy is the only affordable method of high-quality crystal growth for many semiconductor materials and makes faster chips) segments.

The company is investing to gain market share in emerging technologies such as 3D NAND and FinFet, which are critical in moving the industry forward as single-digit nanometer nodes are reached (7 nm and beyond). With Moore’s law starting to experience a slowdown, newer technologies like 3D NAND and FinFET offer a way forward.

An important goal of NAND flash development has been to reduce the cost per bit and increase maximum chip capacity, so that flash memory can compete with magnetic storage devices like hard disks. NAND flash has found a market in devices to which large files are frequently uploaded and replaced. MP3 players, digital cameras, and USB drives use NAND flash. New developments in NAND flash memory technology are making the chips smaller, increasing the maximum read-write cycles, and lowering voltage demands.

The newest innovation, 3D NAND flash with stackable memory cells, has several benefits: it provides a higher capacity/volume ratio in a smaller physical space and improves electrical performance by shortening the interconnect length between cells (which also reduces power consumption).

FinFET technology is becoming more widespread as feature sizes within integrated circuits fall and there is a growing need to provide much higher levels of integration with less power consumption within integrated circuits. The main characteristic of the FinFET is that it has a conducting channel wrapped by a thin silicon “fin” from which it gains its name. The thickness of the fin determines the effective channel length of the device. Among the advantages are much lower power consumption, ability to pass through the 20 nm barrier, significantly reduced static leakage current, and operating speed in excess of 30% faster than non FinFET versions.

Around 40% of the company’s 2015 NAND investments are expected to be in 3D NAND and they are experiencing 30% to 40% growth in the 3D NAND and DRAM segments. With foundry leaders like Intel and Taiwan Semiconductor competing for market dominance on the FinFET and 3D NAND front, Applied Materials should experience strong demand in these segments.

With skyrocketing global smartphone sales and the general growing usage of other semiconductor-based technologies (e.g., automotive electronics, computerized watches, etc.), there is little reason to believe that semiconductor demand will slow down. In addition, exponentially increasing percentages of global populations are now able to afford such technologies, with the growing Chinese and Indian middle classes serving as a prime example. Gartner Inc. stated worldwide semiconductor sales were expected to reach $354 billion in 2015, a 4% increase from 2014, and could go higher.

Applied Materials should experience increasing demand for its products as chip-based technology use is expected to grow dramatically. Applied Materials is squarely at the forefront of the nano manufacturing arena, apparent in its very strong focus on the 3D NAND and FinFET segments, and their long-term demand trend looks stronger than ever.

Inside Intel

Our third-ranked company, Intel, has followed Moore’s law to the top spot in manufacturing and selling semiconductors. Company co-founder Gordon Moore determined in 1965—making 2015 the 50th anniversary of his law—that microprocessors would regularly get more powerful, smaller, and less expensive. Intel has followed that formula to grab about 80% of the market share for microprocessors that go into desktop and notebook computers, smartphones, tablets, and computer servers. The company also makes embedded semiconductors for the industrial, medical, and in-vehicle infotainment markets. Intel’s technology roadmap calls for releasing a new Core processor and a Xeon processor every two years. Most computer makers use Intel processors. In June 2015, Intel agreed to buy chipmaker Altera for $16.7 billion.

This file type includes high resolution graphics and schematics when applicable.

The company operates its business through the following groups: PC Client; Data Center; Internet of Things; Mobile and Communications; Software & Services; and All Other.

The PC Client Group includes platforms designed for the notebook, desktop, and certain tablet market segments, as well as wireless and wired connectivity products. The Data Center Group offers products designed to provide leading energy-efficient performance for all server, network, and storage platforms. The Internet of Things (IoT) Group offers platforms for customers to design products for the retail, transportation, industrial, and buildings and home market segments. The Mobile and Communications Group offers products that incorporate hardware, software, and connectivity for tablets, smartphones, and other mobile devices. The Software & Services Operating segment includes software products for endpoint security, network and content security, risk and compliance, and consumer and mobile security from its McAfee business; software-optimized products for the embedded and mobile market segments; and software products and services that promote Intel architecture as the platform of choice for software development.

The company was founded in 1968 and is headquartered in Santa Clara, Calif.

Intel’s fiscal first quarter 2015 was a challenging one. The PC segment was impacted by slowing desktop sales, particularly in small to medium-sized businesses, but the good news is that year-over-year revenue was flat due to double-digit growth in its Data Center, Internet of Things, and NAND segments. While the desktop segment slowed, notebook volume grew year over year for the fifth consecutive quarter. The company exceeded expectations, given its competitive advantage produced by its latest 14 nm processors (5th-generation Core and Core M).

In addition to launching the high-volume, 5th-Gen Core products at CES, the CCG Group also reached some important product milestones—including launching its newest Broadwell-based vPro notebook SKUs that feature aspects of the Company’s No Wires vision (technologies to remove the clutter of power cords, display connectors and peripheral cables). Intel also expanded their mobile product portfolio to adjust a range of price points and form factors, including the Intel Atom X5 and X7 for mainstream and premium tablets, formerly called Cherry Trail, which is powering the new Microsoft Surface 3. They also started shipping the Atom X3, formerly SoFIA 3G, the company’s first single-chip integrated baseband and apps processor, designed for entry in value-smartphones and tablets. This product was not even on their roadmap a year and a half ago, but is now launched in the market, demonstrating the renewed speed to market of the company.

In the Data Center, Intel’s manufacturing and architectural leadership combined with opportunities driven by the values of cloud-computing continued to yield impressive results. Revenue grew 19% year-over-year and the Xeon E5 Version 3 product line, formerly known as the Grantley platform, now represents more than 50% of its two-socket volume. (A CPU socket or CPU slot is a mechanical component that provides mechanical and electrical connections between a microprocessor and a printed circuit board, or PCB. This allows the CPU to be placed and replaced without soldering). New products like Grantley and their increased support of custom versions of the product helped achieve record cloud revenue.

Intel also introduced its first Xeon-based SoC processor, optimized for micro servers, storage, network, and IoT devices. Growth in the Data Center also benefited their NAND business, which grew 14% year-over-year.

Intel and Micron formally announced a jointly developed 3D NAND technology. Intel 3D NAND will be available in the second half of 2015, and offers roughly three times the stated capacity of computing technologies, which aren’t expected until 2016. 3D NAND, for example, can provide greater than 10 terabytes of storage in a 2.5-inch solid-state drive and is the first 3D NAND solution to be architected to be lower cost than 2D NAND. The company’s Internet of Things Group grew 11% over the first quarter of last year, based on strength in the retail and digital security market segments.

For the balance of 2015, the company expects the PC market to remain challenging, leading to a mid-single-digit decline in the overall full-year PC segment forecast. That said, Intel is launching its 14-nanometer Skylake microprocessors and is excited about the capability that this product family will enable on a variety of operating systems. In particular, Intel is very optimistic about the release of Windows 10 later this month, especially when combined with Skylake.

Intel’s purchase of smaller chipmaker Altera will help improve the performance of its chips. The acquisition brings Altera’s programmable gate array (PGA) into Intel, which can accelerate performance considerably, up to 200% improvement, as a result of the combination of the products For the big cloud providers, that performance improvement provides them not only with a competitive advantage but a cost advantage as well. With Moore’s law showing signs of slowdown and nanometer nodes approaching single digits, Altera’s technology could be the key to better performance at lower costs.

Intel has been looking for growth beyond the struggling PC market, which has been declining since its peak in 2011. Altera chips are used in a variety of markets, ranging from communications to consumer electronics. Altera’s devices can have their function updated, even after they’ve been installed in end devices. While they’re sold in relatively small volumes, programmable logic usually requires the latest in production technology because they are some of the largest chips in the industry.

Acquiring Altera may help Intel defend and extend its dominance in its most profitable business: supplying server chips used in data centers. While sales of semiconductors for PCs are declining as more consumers rely on tablets and smartphones to get online, the data centers needed to churn out information and services for those mobile devices are driving orders for higher-end Intel processors and shoring up profitability. Cloud companies such as Google, Amazon, and Facebook are still building out their server operations. As a part of Intel, Altera will continue to support designs that couple its chips with others designed on ARM Holdings Plc technology.