This file type includes high resolution graphics and schematics when applicable.

The display industry, especially in the rear-projection television (RPTV) segment, has witnessed the rise and the fall of the microdisplay market. Philips shut down its microdisplay business in 2004, while Mitsubishi was the last holdout, finally shutting down its RPTV segment in 2012. Needless to say, it seriously impacted the microdisplays market.

However, ultra-small displays were still in demand. The introduction of wearable devices, head-up displays (HUDs), smart glasses, and head-mounted displays (HMDs) paved a new path of growth for the microdisplay market. Novel applications of the technology in areas such as military, aerospace, defense, medical, and industrial has further boosted the market for microdisplays.

Microdisplays are microminiaturized displays with a screen size of less than 25 mm when measured diagonally. These high-density, high-resolution screens are used in magnified display systems. They first arrived around two decades ago, and have evolved over that time in terms of technology and applications.

Twenty-plus years ago, digital-light-processing (DLP) technology was invented by a U.S. company that used to cater to the CRT display market. Since then, many technologies, such as liquid crystal display (LCD), have been developed to overcome the drawbacks of digital micromirror device (DMD) technology.

LCD technology arrived in the early 1990s, and witnessed rapid market growth. It’s widely used in aircraft cockpit displays, signage, clocks, and computers thanks to attributes such as image sharpness, geometric distortion, brightness, and screen shape features. It’s still in the growth phase.

Liquid-crystal-on-silicon (LCoS) technology, launched in the early 2000s, is believed to have overcome the limitations of LCD and DMD. Furthermore, it’s much less expensive to manufacture compared to the other two. LCoS is used extensively in the growing near-to-eye segment and other applications such as optical pulse shaping.

Organic light-emitting-diode (OLED) technology came into existence a few years back and is still in the R&D stage. Due to their superior performance and technical stability, OLED is a promising technology in the field of displays, and may even outpace the best that LCD and plasma displays have to offer. The only limitation of OLED, which was observed while conducting interviews with experts, is that it’s yet to be fully tested in the market. That’s because it’s expected to be five times more expensive than competing technologies such as LCoS, DLP, MEMS, and others.

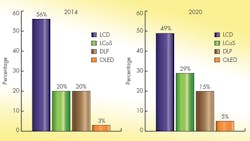

Pros and Cons of OLED

Figure 1 shows some of the significant advantages OLEDs hold over other display technologies—as well as its limitations (Fig. 1). After extensive research and development, OLED displays found their way into mobiles and tablets for the first time in 2010. However, they were only 4- and 5-in. displays. This was followed by the launch of OLED microdisplays, which measure less than 25 mm diagonally, by U.S. display manufacturer eMagin Corp.

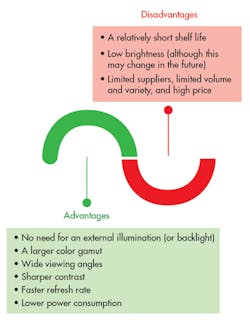

Figure 2 shows the first OLED microdisplay structure created by leading players in the display industry. Most of the companies involved in developing OLED microdisplays understand the importance and advantages of using silicon in OLEDs, namely minimized power consumption and dissipation and less likelihood of failure.

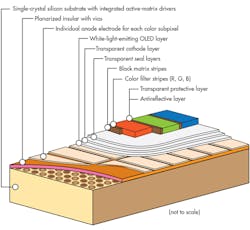

Over the last 25 years, DLP technology has been a catalyst for the development of compact and highly portable digital projectors. Both OLED and DLP are better alternatives than LCoS—except for the price parameter. Due to that fact, LCoS has gained a considerable market share, and huge volumes of LCoS microdisplays are expected to ship by 2020.

Another observation gleaned from doing primary and secondary research was that the global shipment of LCDs crossed 1.5 million units by the end of 2014, which surpasses all of the other technologies. DLP and LCoS were nearly equal in terms of shipments, and OLED ranked last. Once again, this was primarily a result of the huge price gap between OLED and the other technologies. The average price of OLED is approximately $500, whereas for LCoS and DLP technologies cost around $100. Despite that chasm in price, manufacturers prefer OLED because of its outstanding performance, flexibility, and robustness.

Figure 3 represents the market share of the LCD, LCoS, OLED, and DLP technologies for the years 2014 and 2020. The LCoS market projects to continue the same growth trend, while OLED becomes the fastest growing market by 2020 (Fig. 3).

During the study, it was observed that companies, rather than use various technologies in their microdisplay products, are focusing on a single technology to develop their expertise to bolster microdisplay performance. For instance, one leading U.S. microdisplay manufacturer is only concentrating on OLED microdisplays for various applications ranging from thermal imaging and situational awareness to simulation and training in military, defense, and aerospace verticals. Another company headquartered in Texas has a patented a DLP technology that’s expected to be the fastest growing technology for microdisplays in the projection market.

Increased Use of Microdisplays in Various Verticals

Microdisplays find application in several verticals, such as commercial, military, aerospace, industrial, medical, law enforcement and rescue, and automotive. The most widely used microdisplay products in the military and aerospace are HMDs and HUDs. HMDs with microdisplays enable hands-free operation and increase situational awareness with enough resolution for usage in sunlight as well as during nighttime.

The first company to develop microdisplay products for the aerospace and defense industry was MicroOLED. The company demonstrated two prototypes—5.4M-dot, 0.61-in.-diagonal OLED microdisplays in bi-color and tri-color—at SPIE DSS (held in Baltimore, Md.). These microdisplays are designed to enhance the image resolution and lower the power consumption of digital image fusion used in defense, security, and medical applications. This development was considered as a breakthrough innovation in the display industry and led to the development of similar solutions by other companies. For instance, the Kopin Corp. now provides HUDs and HMDs for the U.S Navy and Army.

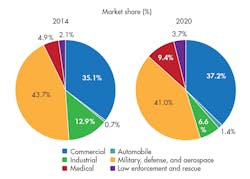

Figure 4 depicts the current market shares of different verticals, and estimations to 2020. The trend witnessed by different verticals this year will likely to continue until 2020, wherein the military and aerospace sectors would be dominate the market, followed by the commercial segment.

The presence of numerous players has created a highly competitive atmosphere within the microdisplays market. They have adopted different strategies to expand their global presence and increase their revenue, including new product developments and partnerships, agreements, contracts, and joint ventures.

A wide range of topics are covered in market-research firm MarketsandMarkets’ report, which includes the market analysis, overview, industry analysis, market dynamics, market classification, and market landscape, as well as company profiles and key players. For more information, check out Microdisplays Market - Forecast to 2020.

Swapnil Nanir is a research analyst and Ravi Rajiv is a research associate for MarketsandMarkets.

References:

http://www.marketsandmarkets.com/PressReleases/microdisplay.asp

http://www.displaymate.com/shootout.html

http://www.displaymate.com/OLED_Galaxy_S123_ShootOut_1.htm

http://www.marketsandmarkets.com/Market-Reports/reality-applications-market-458.html