The latest Chinese industrial policy, Made in China 2025, came out two years ago with an emphasis on semiconductors, fanning the nation's ambition to become a global superpower in microchips.

But semiconductor experts at the Design Automation Conference in Austin last week wanted to dispel misconceptions about how China wields a $150 billion investment fund – called the “Big Fund" inside China – to assist chip suppliers in competing with foreign rivals and manufacturing memory and computer chips locally.

Shaogun Wei, a professor of electrical engineering at Tshinghua University, trotted out statistics in a presentation to ground China's fast-growing industry. He wanted filter out the "noise" surrounding China, which has been accused of propping up the industry, requiring companies to buy local chips, and stealing intellectual property.

Last year, Chinese manufacturers consumed 27% of the world’s chips but exported two-thirds of those inside smartphones, televisions, and other gadgets. The nation's chip makers only account for 7.3% of the $338 billion global market, while China’s largest fab SMIC is two process nodes behind rival foundries like TSMC.

“China is on the lower end of the value chain,” Wei said.

A panel of four executives from China also aimed to clarify the state of the industry, which is feeling growing pains. In the panel, “Growing IC Design and Ecosystem in China,” they said that most venture funding comes from private equity firms and provincial governments, which sometimes only send part of the money that companies are promised.

New companies have been piling up. There are around 1,300 fabless suppliers in China, up from 500 in 2011, according to the Chinese Semiconductor Industry Association. The industry is top-heavy, with 90% employing fewer than a hundred people and half earning less than 10 million RMB – around $1.5 million – per year.

The surge in start-ups could also be related to China’s engineering culture, the panelists said. “Every Chinese engineer wants to become a C.E.O. in China,” said Xianing Qi, the chief executive of Hangzhou's C-Sky Microsystems, whose CPU cores have been shipped in over 500 million chips.

Last year, only around 13% of China’s fabless suppliers accounted for 81% of the entire fabless industry, which generated 164.4 billion RMB or around $24.1 billion in revenue. Last year, the fabless industry grew 24.1% in China, Wei said.

The smaller firms often lack the technological chops to take full advantage of the Big Fund and handle the intense scrutiny that comes with it. “We need to build up our muscles before we can use the money in the right way,” said Steve Yang, chief executive of Huada Empyrean, an electronic design automation firm.

“You have to make a return on the money from the Big Fund,” said Chen Nanjing, the executive vice chairman of CR Microelectronics. “That money is not free,” he said, adjusting his gavel-like microphone stand after a question about the government fund, which he said is tougher to court than U.S. venture capital firms.

The government may not be giving out money lightly, but the multibillion dollar fund has rattled both the Obama and Trump administrations. Last year, Penny Pritzker, the former U.S. commerce secretary, said that China's war chest would corrupt prices and hurt competition in the same way that China's tactics doused markets for steel and solar panels.

Around a third of China's fund will support fabless companies, but the Chinese government plans to spend almost twice as much on expanding its manufacturing industry, which grew 25.1% last year. The remaining funds will pay for raw semiconductor materials, Wei said.

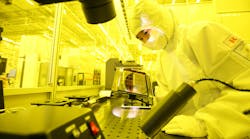

Tsinghua Unigroup — the international face of Beijing’s semiconductor plot — recently announced that it would build a $30 billion memory factory in the city of Chengdu. There are 25 more 300mm fabs, often supported by major multinationals, under construction in China. When finished, the fabs will increase China’s capacity to 1.11 million wafers per month, Wei said.

“Such spending momentum will drive China to the top-tier bracket for fab equipment and is paving the way to establish China’s position on the global semiconductor stage,” according to a January report from SEMI, a global semiconductor industry organization, which tracks fabs being built in China.

Increasingly intertwined with Beijing's funds are major foreign chip makers. In February, GlobalFoundries announced a $10 billion project with the support of the Chengdu government. Intel is pouring $5.5 billion to update a memory factory in Dalian, while Taiwan’s UMC is partnering with two local Chinese suppliers on separate fabs.

These partnerships – and the "noise" – come out of fear and anxiety on both sides, Wei said. While major multinationals fear that China will stop buying their chips, while China worries that foreign companies with advanced chips will abandon its vast electronics industry, he said.