An Objective Analysis of the Industry Outlook for 2016

This file type includes high-resolution graphics and schematics when applicable.

The electronics industry in 2015 was marked with continued effort to assemble the infrastructure, platforms, and things of the Internet of Things (IoT); consolidation of semiconductor and technology companies; steadying of the smartphone and PC markets; and the evolution of products with more consumer than industrial focus.

From an external standpoint, the financial markets in the second half of 2015 became very volatile, somewhat reflecting greater economic concerns. This year will likely continue seeing wild swings in market dynamics, on both the financial and the product and services side. Objective Analysis holds an optimistic outlook for 2016, with growth forecast to jump from 10% to 14% over 2015. However, expect volatility during the year and across markets.

Year Good, Maybe Toppy

Most pundits were surprised when 2015 went out with lower-than-expected economic growth, financial markets experiencing wild swings and closing the year near the levels at which they started, and suspected stalling of the markets and industry of China. Yet the United States' central bank, the Federal Reserve, felt confident enough in the U.S. economy to raise the prime interest rate from near-zero for the first time in over seven years. Some of those high-tech consolidations may have taken place at just the right time. After a long run up, the price of oil dropped to lows not seen for decades.

In electronics as well as the greater economy, 2016 will likely continue as a transitional year. The IoT may be transformational, but it’s really an evolutionary movement and will take more time to hit full stride. Meantime, not all products and services proposed for the IoT will succeed. Smart watches quickly turned lackluster and the connected home has not moved much past government-subsidized smart meters, although those markets continue to show high activity and visibility—and are growing.

Tesla is creating an exciting new category of automobile, and Uber and Lyft are shaking up the taxicab business like bad shocks on an urban shortcut. But the shameful scandal where Volkswagen deliberately sidestepped emissions standards has pushed the lofty reputation of engineers—German ones at that—off a cliff. Still, car production is up and electronic content therein continues to expand. The auto industry may soon get a further boost as people shift back to more powerful engines, which always seems to be the case when gasoline prices are low.

The IoT: A Driving Force but a Long Haul

It will still take 5 to 10 years for the Internet of Things (IoT) to be widely implemented and robust with the kinks worked out. The IoT is not being driven by the evolution of a singular application, like the cellphone. Instead, the Internet offers numerous ways for a multitude of applications to connect sensing or actuating things utilizing distant data, processing, and control facilities. The possibilities of the IoT will inspire and enable widespread technological innovation over the next many years, providing the drive that will keep electronics and the semiconductors at their heart as very vibrant industries.

However, most of the issues on the IoT discussed a year ago (see “Is 2015 the Year for IoT, ADAS, 4K UHD, or Surround Cameras”) are still unsettled. Interoperability is the greatest hindrance to the explosion of connected products and services promised by the IoT. Today, fulfilling the vision of IoT still seems a few years off.

Industry Consolidation: Take Advantage of Finances

Semiconductor companies in 2015 had an unusually busy year of high-profile mergers and acquisitions (M&A). This is an industry where high production volume is a requirement for success; the sophistication and complexity of the electronic chips is extreme; and the cost to design the hardware, develop the software and ecosystems, and market such circuits to win customers is very expensive.

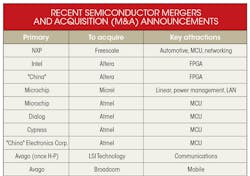

Consolidation in the semiconductor and electronics industries at this time is spurred by difficulties faced by many companies after the recession that started in 2007; the historically low interest rates on borrowed money; and healthy companies making the best use of their cache of cash, picking up gain systems expertise, resources (including people), intellectual property (IP) rights, and software. It has been a good time to invest in some resources that were previously in other companies. The table lists some of the recent semiconductor M&A announcements.

Most of the last year's acquisitions add missing parts to the buying company's portfolio. By buying Altera,Intel can put the high-priced, high-margin FPGAs often sitting near Intel CPUs on customer boards (see “Intel Really Set to Buy Altera FPGAs”) into its own accounting books. But some of those FPGAs contain ARM processor cores—surely an aggravation to Intel's processor zealots.

Microchip Technology carefully spends its capital buying companies with products that complement its own, to obtain better coverage for new applications and markets. Microchip's purchase of Micrel in 2015 fits this pattern, picking up analog, linear, and networking resources. Previous acquisitions included Supertex (high voltage), ISSC (wireless), Roving Networks (wireless), Standard Microsystems (SMC) (mixed-signal), and the flash resources of SST (see “Microchip takes SST in a Flash of Cash”). As far back as 2008, Microchip tried to buy MCU competitor Atmel, but was shunned and in recent months has again wrestled to buy the company. Atmel would bring ARM MCUs into Microhttp://sourceesb.com/microchiptechnology/distributors-and-vendorschip, which has fought them with a vengeance in the past.

Various organizations and companies in China have made offers on high-tech companies in the U.S., Europe, and Japan. Closing such deals can be more difficult and time-consuming due to governments of foreign countries scrutinizing the technology that would be turned over, since China's political and military position is still being established. Compared to others, companies in China may have more to gain from the acquisition of established companies. IP and patent rights are very valuable to newer companies, let alone access to the expanded customer base.

NXP buying Freescale has the more typical overlapping-products scenario with reaches into the automotive market and general-purpose MCU markets (see “Q&A: Tom Starnes Examines the NXP-Freescale Union”). Watch for products to be pared down where overlap exists, even if more automotive applications can be served by the ultimate NXP portfolio.

Nearly all M&As involve cutting of projects and people as cost savings. Wall Street unilaterally likes these actions, but employees and even customers can be severely impacted by such cutback measures, in addition to adjusting to the new corporate culture.

Impact of consolidation: If joining two chip companies results in greater total sales ( 1 + 1 > 2 ), then real manufacturing costs can be reduced, which can spur additional sales in more cost-sensitive markets and improve quality and performance of the chips, benefiting all users of the company's products (Fig. 1). Fortunately, the electronics industry has always valued the improved performance and new features of more advanced chip designs, furthering sales in the original markets.

Changing Currency Coddling Commerce

The last year or two has seen changes in the means of paying for goods and services, involving a lot more software if not electronic hardware. Apple, Samsung (Fig. 2), Android, and retailers from Walmart to Neiman Marcus (Fig. 3) promote their own "mobile payment" systems that allow customer-users to pay for goods and services utilizing their smartphone rather than with cash, check, or the ubiquitous credit card.

Many of these ride on the Apple Pay or Android Pay structure that’s designed to let users tap or pass their smartphone to make a purchase. They may use contactless near-field communications (NFC), fingerprint verification, and assorted encryption techniques to provide security for the transmission of personal information to the infrastructure. Traditional credit-card systems ultimately sort out the actual financial transaction. Visa, MasterCard, American Express, and Discover, and banks associated with them, are likely to be directly entering the mobile pay space soon, too, to more firmly hold onto their 2.7% fees.

In another corner of the market, thousands of small businesses have been able to take credit-card payments in a new way. By adding a tiny reader device (Fig. 4) from Square Inc. to their iPhones and Android devices, the local vendor can swipe credit cards just like the big stores. Besides eliminating the need for an expensive card reader, Square's availability and fees are attractive to low-price or low-volume mom-and-pop businesses, making credit- and debit-card sales practical.

Upwardly Mobile?

New electronic means of paying for goods and services have been proposed for some time now (see “Payment Applications Make E-Commerce Mobile” - Neal Leavitt Computer, IEEE Computing Society, December, 2010). They have struggled to gain acceptance for numerous typical reasons, including the chicken-and-egg paradox: Which phones or tags offer it, which retailers or Web sites accept it, where does the invoice appear, is "credit" necessary, do users trust it, and where does fraud liability rest?

The popularity of iPhones and Android phones give some hope for success of transactions associated with those devices (Fig. 3, again). However, only the latest devices are adequately equipped. At the retailer end, changes, upgrades, and rollout of software and hardware will have to take place and be managed. What is the benefit to the retailer; wouldn't the customer pay one way or another, anyway?

In the U.S., only in the last few months have credit card terminals in retail stores been upgraded beyond magnetic stripe "swiping" to read smart card credit cards. Retailers may not be too keen to turn around so quickly to shell out for yet another terminal that will handle NFC-enabled financial transactions, let alone the back-end software, to allow the new tap-and-go mobile payments.

Like many new ideas the uptake of a mobile payment service will be a true test of the value it offers versus its cost. The value may be "convenience", but how hard is it really to fish a credit card or cash out of a leather wallet. It's not like a person would be able to leave their real wallet behind, because 80% of the merchants around town probably cannot take the specific electronic payment.

On the other hand, the cost of using mobile payments, assuming a person bought the iPhone 6 for other reasons, may just be the time and effort put into setting it all up and keeping the information up-to-date. Some e-wallets may be yet another bank account to keep topped up and balanced. It’s perhaps telling that Amazon, the massive company whose entire existence is the epitome of e-commerce, closed its Amazon Wallet less than a year after opening the program.

Impact of mobile pay: Mobile pay-by-phone schemes need security hardware/software, some processing power, a support system of NFC receivers, and the connectivity to the existing backbone of financial transaction systems to operate. But one assumes that cost will quickly be the dominating factor in these systems, so mobile pay will not be a top-25 revenue generator for the electronics industry.

Not Your Father's 8-mm Film Camera

Few consumers currently buy cameras as standalone products like a few years ago, as they’re satisfied with the reasonable quality camera built into their always-at-the-ready smartphone. This marks the demise of yet another once-prolific consumer-electronics product category.

However, image sensors, photographs, and video are not going away; they're becoming an ever-more present part of our lives. Safety, security, remote sensing (almost one category, really), and specialization are now the driving forces for image sensors, in addition to the processors and software massaging the pictures, with displays trying to keep pace.

The GoPro has been a standout specialty camera, giving action junkies a pricey way to capture and share their exciting if dangerous activities. However, as anticipated (see “Is 2015 the Year for IoT, ADAS, 4K UHD, or Surround Cameras”), the GoPro itself may have hit a wall in 2015, possibly saturating the bulk of its market while fighting competing products from lower-cost upstarts. But 4K may start some churn in the action camera business, where the higher resolution allows better post-production zooming or capturing of a bigger field-of-view.

Though 3D cameras have largely faded away, more startups keep trying to make them work—and there are some possibilities. Cameras on drones are certainly growing in interest, but the market is very fragmented and the aviation authority and public's tolerance for intrusive drones and privacy have yet to be fully resolved. The place for surround/720°/3-axis—perhaps best called "spherical"—camera systems has yet to work itself out, but may end up as a subset of the GoPro market, possibly tied in with VR goggles, or a version for automotive or security applications.

Bright for Imagery

Perhaps the richest opportunities for digital photography and videos are in expanding markets in automotive and safety, security, and remote viewing. Demands include a camera with the quality for fitment in the automotive environment (rugged, long-lasting, vast dynamic range), the horsepower for real-time processing of streaming images, and algorithms that detect and categorize features accurately—all for the tens of millions of vehicles being produced annually.

No doubt, it creates a rich market for the winning components in automotive imaging applications, many associated with advanced driver assistance systems (ADAS). Sensors for radar and imaging beyond the visible light spectrum also help determine proximity, temperature, density, distances, and speeds, thus further multiplying opportunities for design activity.

With each passing year, image-processing algorithms improve the ability to identify key characteristics about what is in the field of view—without the assistance of a human. The amount of research, development, implementation, and productization of image- and vision-related sensing, processing, and classification has never been higher. Coupled with network access to cheap sensors and cameras in smartphones as well as to growing databases of use-cases, the possibilities become almost scary.

Worldwide terroristic threats and outspoken concern for interactions between criminals and law enforcement in the U.S. has "first responders" being asked to wear video cameras on their person ("body-cams") to supplement those that may be mounted in their vehicles. Even cheap consumer-grade "dash-cams" are starting to capture road-rage incidents and accidents-in-progress.

Impact of imaging: Numerous electronic design opportunities surround cameras specifically and sensors generally, even if they’re in non-traditional forms. Many of these prospects will be high-value products, much in real-time as well as post-processing software, and may require large quantities of storage.

Concerns: Bubbles in the Air

In the late 1990s, too many companies were attaching themselves to commerce on the Internet. However, the "dot-com" bubble burst just about the time people were sidetracked with a non-issue known as "Y2K."

Today everybody is chasing the Internet of Things. There’s still much to work out as a business model that encompasses all of the IoT’s individual parts, while producing products and services that consumers and businesses feel are worth the price. Add connectivity to a $20 thermostat and somehow this device keeping your nest warm costs $200. Let the cable guy into the house with a set-top box (STB) and soon there's a $200/month bill that includes security footage and the refrigerator ordering milk for delivery.

Numerous IoT products will not survive in this nascent unproven marketplace, and the companies that make them will suffer as a result. Caution should be exercised when evaluating IoT-rooted systems and the companies promoting them.

Concerns: The China Syndrome

China has been a cheap manufacturing engine for the developed world for nearly a decade while becoming a significant, billion-person market of its own, coming into the modern world. Yet the country's rapid growth and seemingly endless money supply may be starting to falter. A breakdown in China's economy could have disastrous effects on the rest of the world.

China is still a communist country, with a strong central government, now playing heavily in the capitalistic external market. The government controls the country's currency, banks, stock market, and the companies operating within its borders in its own way—just like other countries. However, the motivations for, and transparency into, the way China operates is often difficult to understand from the outside. Whether the country is on solid ground economically is hard to ascertain, and there are rising concerns that the market and businesses in China are slowing down and in worse shape than previously believed.

Today's electronics industry is one of many that depends on China, both for production as well as being a new market for consumption of finished goods. At this point, if China stumbles as a supplier, a financier, or a consumer of electronics would surely upset the careful balance of many advanced nations’ economies.

Impact of IoT overcrowding and China: It’s time to consider the risk of so many products and companies counting on the IoT and China for their growth as well as their sustenance, and the ramifications of delays or stumbling of such big growth drivers in today's intertwined markets. Analyze carefully how those products and companies stack up against their competitors. Then evaluate what would happen when many of the products designed around the IoT fail to draw customers, or the markets go soft in China or production becomes expensive or unreliable.

Demand Drivers for 2016

Semiconductor revenues trailed off in the second half of 2015, and 2016 is likely to continue to be soft, with worldwide economic conditions an aggravating factor. Many applications, such as automotive and imaging, should keep electronics a vibrant market. However, an eye should be kept on unsustainable overcrowding in the IoT markets while trying to understand what’s really happening in China as an economy, a market, and a producer.

Further elaboration of the topics in this article can be found in an extended paper found on Objective Analysis’ website.

About the Author

Tom Starnes

Analyst

Tom Starnes is arguably the best-known embedded processor analyst in the semiconductor industry. Covering a range of products, Starnes' insight, coupled with his no-nonsense approach to processor and end-use analysis has led to his becoming one of the most sought-after consultants in the world of processors. It is through his hard-hitting insights that many key players in this industry have found their focus and refined their product strategies.