Almost a year after a Chinese semiconductor company tried to buy Micron Technology, the memory chipmaker is still riding stormy waters. Facing a prolonged downturn in revenue, the Idaho-based company said during its third quarter earnings call that it would be cutting jobs as part of a larger cost-cutting plan.

The job cuts are intended to counteract the falling prices of its short-term memory chips in computers and long-term storage for mobile devices and data centers. Trimming its workforce, shifting employees to new projects, and cutting spending will save Micron an estimated $300 million in 2017, according to chief financial officer Ernie Maddock.

Micron will cut about 7.5% of its workforce, Micron spokesman Daniel Francisco said in an email. Of the company’s roughly 32,000 employees, that translates to around 2,400 jobs. About a third of the cuts will involve eliminating open positions, according to Francisco.

Mark Durcan, Micron’s chief executive, said that the job cuts were not made lightly. “The decision to implement cost reduction initiatives is always difficult and is never made without thoughtful consideration about the short-term and long-term impacts,” he said in a conference call with financial analysts.

The cuts are the largest since 2008, when Micron said that it would reduce its workforce by around 15% as part of a larger restructuring of its memory operations. In 2013, smaller cuts were announced when Micron said it would trim its headcount nearly 5% to rein in costs.

The latest changes were announced with Micron’s third quarter financial results, which underlined the steady decline of the chipmaker’s fortunes. The company had revenues of $2.90 billion, down 25% from the same time last year. Micron’s losses increased to $79 million, up from $48 million in the previous quarter.

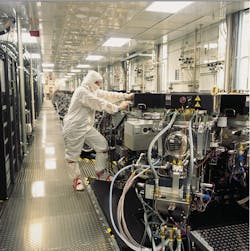

Having forged its reputation supplying chips for personal computers, Micron is the latest chipmaker to flounder at slowing computer sales. While it had established itself as the largest maker of dynamic access memory chips in the United States, Micron has faced stiff competition from Samsung and Hynix in making NAND chips for mobile devices and storage.

Over the last year, that problem has played out at other companies as well. In April, Intel said that it would cut 12,000 jobs – nearly 11% of its workforce – to further its bet on cloud computing and mobile devices. Last year, Hewlett Packard split its business into separate enterprise and personal computer companies, with the latter saying that it would cut 3,000 employees this year.

For Micron, job cuts have come with the territory. One of its persistent problems has been dealing with variable memory prices. Unlike other semiconductors, memory chips are mostly interchangeable, causing prices to change based on supply and demand. When the supply of memory chips has been higher than demand, Micron has occasionally tried to soften its losses with job and spending cuts.

A similar situation is unfolding now. The company is trading on shoestring prices for memory chips. The average price of DRAM and NAND chips fell 11% and 6% respectively over the last quarter. In recent years, Micron has tried to gain more control over the supply chain by buying out competitors – including Taiwan’s Inotera Memories – in an attempt to influence prices. But these efforts are not helping to insulate Micron against slowing markets for computers and smartphones.

“Although we have made good progress in deploying our advanced DRAM and NAND technologies, we continue to face challenging market conditions,” Durcan said in a statement.

To counteract the falling prices, Micron has been investing to boost production of its 20nm DRAM and develop more efficient 3D NAND chips. In addition, it has been striking deals to plug DRAM chips into dashboard displays and automated driving systems, as well as expanding its business for mobile devices.

In the conference call, Durcan underlined data center storage as another key to Micron’s turnaround. But he admitted that success would depend on Micron's switch to 3D NAND chips, which stack layers of cells to create storage with higher capacity than planar chips. Many of Micron's latest chips have been solid-state drives for data centers based on 3D-NAND.

Despite the discouraging losses, recent success in markets like automotive and mobile has kept Micron executives optimistic. “Micron’s strategy is not changing, but the company needs to make adjustments in the business to address the current market environment,” the company spokesman Francisco said.

About the Author

James Morra

Senior Editor

James Morra is the senior editor for Electronic Design, covering the semiconductor industry and new technology trends, with a focus on power electronics and power management. He also reports on the business behind electrical engineering, including the electronics supply chain. He joined Electronic Design in 2015 and is based in Chicago, Illinois.