Electrical Engineers See COVID Pain Turn Into Salary, Bonus Gains

This article is part of the Professional Advancement Series: Annual Salary Survey

As the world collapsed under the strain of coronavirus last year, many companies delayed raises, canceled bonuses, and paused hiring for electrical engineers to reduce costs. Now they are starting to make up for all the belt-tightening.

Employers are raising salaries and boosting hiring for electrical engineers as the economy roars back from the worst of the pandemic, according to the results of the latest annual survey from Electronic Design and Endeavor Business Media's Design Engineering Group. As employers grapple with a skills shortage, many are boosting bonuses or other perks to entice engineers from other jobs or hold on to the ones they have.

Last year, engineers made it through the pandemic better than most. Unlike large swathes of the workforce, most engineers were able to work remotely. While they continued to struggle with balancing tight deadlines, continuous education, and other challenges, they prospered for the most part. For more than 58% of survey respondents, their wages have not been directly affected by the economic turmoil caused by the pandemic.

But electrical engineers were not completely unscathed. The economic uncertainty unleashed by the virus pressured wages for many engineers, reversing some of the gains they enjoyed over the last decade or so. Last year, many engineers polled by Electronic Design said that, while their employers were keeping raises, bonuses, and a wide range of other perks in place, the wages gains were significantly weaker than usual.

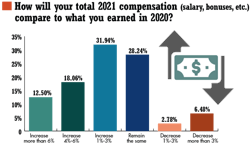

Now companies seem to be picking up from where they left off. Around 60% of respondents say they will see their compensation rise in 2021, a stark improvement from the 42% of engineers who saw raises in 2020.

Around 650 engineers responded to the survey, volunteering to share details about their salaries, bonuses, and other sources of compensation with Electronic Design, Evaluation Engineering, and Microwaves & RF. Engineers said they have gained a stronger hand as jobs are abundant, salaries are rising, and companies compete for talent. A negligible number of engineers say they are losing out on raises or bonuses in 2021.

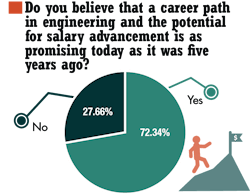

But they remain upbeat about their prospects. Buoyed by demand for highly skilled engineers, around 70% feel the potential for salary advancement in engineering is at least as favorable now as it was pre-pandemic.

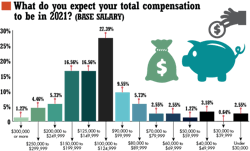

Several factors impact how engineers are compensated, including education, experience, title, seniority, age, location, and the status of the broader economy. But the survey results reveal that electrical and electronics engineers have very high-paying jobs. Engineers say that they will have a median base salary of $100,000 to $124,999 in 2021. Also, 58.5% report a median base salary in the range of $100,000 to $199,999.

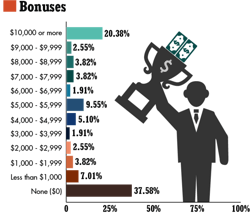

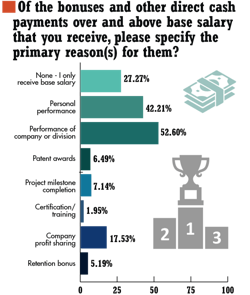

Many employers plan to pay out bonuses, supplementing engineers' salaries with a median bonus of $1,000 to $1,999. Around 35% of respondents say they are in store for $5,000 or more in bonus pay this year.

At the top of the pay scale, engineers in management and executive roles not only have higher salaries, but they also earn thousands of dollars more in stocks and through employer-led share-matching programs. In contrast, rank-and-file engineers only get bonus pay and other perks on top of their base salaries. Only 30% say stocks are part of their compensation package, and around 12% are counting on $10,000-plus in stock awards in 2021.

Around 14.5% said that compensations rates will jump by more than 6% in 2021, about twice the percentage last year, and about 30% of respondents revealed they are seeing an increase of 1% to 3% in compensation. According to the data, about 16% of engineers say they will see compensation boosts of 4% to 6% in 2021, signaling that electronics companies are boosting pay for engineers as the economy continues to rebound.

Only around 10% say they expect a pay reduction in 2021—a significant improvement from the 20% who last year said wages would contract due to delayed bonuses, pay cuts, or other cost-saving measures by their employers.

Around 30% say they are not getting raises or seeing pay cuts this year, whether because of economic pressures, business challenges, or other factors, such as older engineers reaching the top of their pay range. But at a time of rapidly rising inflation, those paychecks may not go as far as they used to.

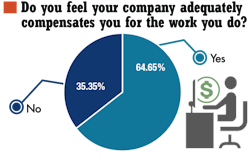

More than 60% of respondents say their employer sufficiently compensates them for their work, and 37% feel that their compensation is as competitive as other firms pay engineers with the same job.

Another 19% report they are probably better compensated than their peers at other employers, while 29% say their wages are “somewhat” less competitive than what others are willing to pay in 2021.

At the same time, given the grind of electrical and electronics engineering, others feel that these wage gains are falling short of what they should be. Many engineers grappling with long hours, tight deadlines, and the challenges of continuing education worry that their salaries are out of step with what they bring to their job. Among engineers who claim to be under-compensated, most feel entitled to a raise of 10% to 25%.

While many engineers feel as though they deserve to be making more money, around 90% say they would recommend engineering as a career with—all things considered—a promising future and competitive pay.

Only 30% of respondents have debated whether to leave engineering permanently or take a detour into another industry. Many workers report feeling burned out by the unrelenting demands of the job and want to pursue a career with a better work-life balance. Others are seeking new challenges to shake up their work situation. Among engineers that have considered leaving, approximately 31% hope to make more money.

As the economy recovers from last year's pandemic-induced slump, employees are quitting their jobs at a record clip this year. The flood of departures is exacerbating a skills shortage in a wide range of industries, forcing companies to pay more to stand out and lure new employees. The mass resignations mark a sharp turn from last year, when workers craved stability as the virus spread, leaving economic turmoil in its wake.

But it is unclear whether the shortages are specifically responsible for making companies in the electronics industry more willing to raise salaries or preventing them from freezing wage growth or delaying bonuses.

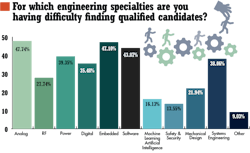

The struggle to find engineering talent predates the pandemic, and it could have to do with the types of jobs engineers are comfortable taking than it does with a worker shortage. Even so, high-end engineering skills continue to be coveted: around 54% of respondents to last year's salary survey said their companies were having hiring troubles. Now? 67% say they are struggling to locate qualified candidates for open positions.

While some industries are churning workers more than others, the number of workers quitting may help explain why so many employers are struggling to plug holes in their engineering departments. More than 70% of respondents feel that there is a shortage of skilled engineers. Nevertheless, companies plan to keep hiring new workers, with 42% saying that they work for companies looking to hire more engineers in 2021.

Engineers are also keeping the door open to changing jobs. Many say that moving to a management role or changing jobs are the only ways to guarantee salary growth in engineering. Around 11% are seeking out a new job, while 31% say that, while they are not actively looking to switch, they would follow up if personally contacted with a job. Another 29% say they would follow up if they heard about a promising opportunity.

Around 29% of engineers are staying put and have no plans to start a new job in the foreseeable future.

The survey signals that while some engineers are walking out the door and others are eyeing open positions, most are staying where they are, possibly in part due to the ongoing uncertainty around the virus and the stability of their current jobs. Only 7% of engineers changed jobs within the last year, and among them, 13% were promoted to a new position with their current employer, while 23% left to pursue another opportunity.

Around 15% of engineers who changed jobs say they landed at a new employer after losing a previous job.

Given the challenges of scouting and hiring engineering talent, many companies are trying to hold on to the ones they already have. More than 60% of respondents say their employers are at least as focused on employee retention this year compared to last year. In the short term, the talent shortages could give engineers more bargaining power to negotiate a raise or promotion, allowing them to avoid changing jobs.

Employers are increasing non-wage compensation and other perks to remain on their engineers' good side. A number are paying for continuing education, as mounting competition for skilled engineers underscores the need to nurture new skills internally. While companies suspended travel because of lockdowns last year, engineers say some are reopening their wallets to pay for travel to industry conferences or training courses.

Covering the cost of healthcare continues to be one of the top priorities for employers, respondents said.

Engineers have long struggled with feeling that employers look at them as interchangeable assets. But the current engineer shortage could help bring about change long-term—and possibly better pay in the process.

Read more articles in the Professional Advancement Series: Annual Salary Survey

About the Author

James Morra

Senior Editor

James Morra is the senior editor for Electronic Design, covering the semiconductor industry and new technology trends, with a focus on power electronics and power management. He also reports on the business behind electrical engineering, including the electronics supply chain. He joined Electronic Design in 2015 and is based in Chicago, Illinois.