Will 2024 Unleash Another Semiconductor Super Cycle?

This article is part of Electronic Design’s 2024 Technology Forecast series.

Members can download this article in PDF format.

What you’ll learn:

- What will be the impact of AI in the data center?

- What world factors will affect AI deployment?

- Are we in line for another Super Cycle?

With 2023 in the rearview mirror, and along with it the big 2022-2023 down cycle, what have we to look forward to in 2024? Glad you asked. 2024 promises to be a year of change.

COVID’s Continuing Impact

The biggest change will be the return from the return to work. In 2022, as workers in most of the world returned to their workplaces, students to their schools, and everyday people to entertainment venues, the demand for internet connectivity dropped, and data centers saw a corresponding drop in online traffic. PC sales declined as well, and this led to an oversupply of computing and communication chips.

Even though the shortage of older-technology linear and power-conditioning chips continued, this wasn’t enough to prevent semiconductor sales from plummeting. It was the result of the return to work.

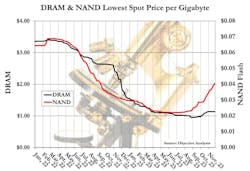

That scenario appears to have fully played out. One indicator of this is DRAM and NAND flash spot market pricing, which has been rising in recent weeks, NAND more so than DRAM for the time being. We can call this the return from the return to work (Fig. 1).

The pre-pandemic market patterns seem to be falling back into place—PC unit shipments are returning to a slow and steady decline, and cell-phone shipments are back to their pre-COVID growth curve. 2024 should return these two markets to pre-COVID spending patterns.

AI in the Data Center

Data-center demand is the only market in question, since AI is being explored as a means of slowing the ballooning rate of server deployment that’s been the data-center norm for the past decade or longer.

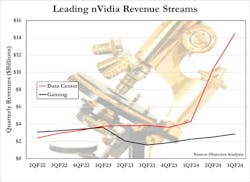

That change is made more than evident if we look at the sales growth of NVIDIA’s two largest revenue centers: data center and gaming. While gaming is NVIDIA’s established market, one that’s showing great stability, sales of GPUs into the data center edged past it in the first quarter of the company’s 2023 fiscal year (approximately the first quarter of calendar 2022), and then took off like a rocket a year later (Fig. 2).

Today, the company’s data-center business accounts for a full 80% of total NVIDIA revenues. And it looks like that share will continue to grow rapidly over the next few quarters as data centers migrate from standard servers to AI servers.

Other semiconductor manufacturers who produce companion chips to AI GPUs look hopefully at these numbers. However, the reality is that data centers can’t be expected to grow their total spending at a rate to support both this kind of growth of AI spending and the continuing purchase of the same number of standard servers as they have purchased in the past. Expect standard server sales to decline to offset AI spending.

The net result of this is that total data-center spending will not grow at the same rate as NVIDIA’s data-center revenues. Rather it will shift from a conventional server-centered model to an AI-plus-server model. It’s too soon to estimate how this will change the complement of semiconductors shipped to the data center. Rest assured, though, that the balance of CPU/GPU to other semiconductor revenues will change, perhaps leaving more money in the pockets of the CPU/GPU makers, or perhaps shifting it in the other direction. Don’t anticipate a sudden AI spending frenzy in 2024.

World Factors

Other factors have also made a significant impact on the semiconductor market. We’ve already discussed the whipsaw effect of the return to work, so let’s explore some of those others. They can be grouped into two categories: Old, which are elements that have been with us for over one year, and New, which have developed in recent months.

The first on the Old list is the U.S./China Trade War. As the shift in U.S. administrations brought a stylistic shift to the way the issue is being managed, little has changed except for the predictability of events.

The U.S. has moved to a position of warning of its responses to various events and then following through. This renders it somewhat unlikely that the industry will see a purchasing surge in 2024 like the one we underwent in 2017-18, when chip purchasers in China built contingency inventories for fear that their supply would be cut off suddenly and unexpectedly. We shouldn’t expect a 2018-style super-cycle in 2024.

After the Trade War comes financial considerations—interest rate hikes and inflation. Inflation was a very natural result of COVID stimulus payments that governments used to prevent the collapse of their economies in the early stages of the pandemic. A big bolt of new money was created and pushed into the economy, which responded as it always does to a supply/demand imbalance: If there’s too much money around, then prices increase.

Some economists liken that effect to a goat being swallowed by a boa constrictor—you can watch the lump travel through the snake as the goat progresses through the snake’s digestive system. The new cash traveled through the economy in a similar way. This process seems to have run its course, and inflation is likely to return to pre-incentive levels. With this, consumer spending should improve in 2024, helping to improve consumer electronics sales.

As for interest rate hikes, this has been triggered in the U.S. largely by attempts from the Federal Reserve Board of Governors (“The Fed”) to cool down an overheated U.S. housing market. The Fed has only one knob to turn to achieve its goals, and so they made a pretty dramatic change. Since credit is bought and sold globally, an interest rate rise in the U.S. required similar interest rises in other nations to prevent all investment from being drained out of those economies and into U.S. debt.

The Fed now seems to be easing back from that stance out of concerns of destabilizing the economy. This should benefit capital spending, which could have a minor positive impact on the 2024 chip market.

The last on the Old list is Russia’s invasion of Ukraine. This conflict appears to have reached a stalemate. Neither side wants to back down, and neither can seem to win. Both sides understand that there are some pretty dire consequences to escalation, possibly resulting in nuclear war. The world seems to have found a way to live with this stalemate, and Europe continues to purchase natural gas from Russia despite its sanctions on other imports, while Russia is coping with the sanctions.

Economies that used to purchase produce from Ukraine now have other sources lined up to cover for any losses. The people of Ukraine continue to suffer. Although there were initial fears that a helium shortage would threaten chip production, those fears were misplaced. This war has had little impact on the global chip market. The world has reached a balance that can be expected to continue through 2024.

Moving to new factors, we’ve already discussed AI, which is today’s hot topic, and the economy. That leaves us with the new war between Israel and Hamas.

This dreadful situation is also one in which escalation could lead to a rather terrible outcome, and it appears that Israel, in a somewhat heavy-handed way, is trying to avoid triggering an all-out Middle East crisis. It appears that Israel will be satisfied and go no further if it can root out Hamas. It appears Hamas intended to trigger a much broader conflict to permanently damage Israel, something that Hamas can’t accomplish alone.

At the situation’s absolute worst, all of Israel’s neighbors could attack the country, which would draw in the nations that support Israel, as well as other nations that support the surrounding nations. Russia is closely tied to Syria, and this, at its worst, could directly pit Russia against the U.S. That level of Middle East conflict would interrupt the flow of petroleum to wreak havoc on the world economy. Hopefully diplomacy will prevent anything of this magnitude from evolving.

For the time being, we’re taking the stance that fighting will not escalate past its current level, and that the lasting effect will be ongoing high-level tension in the Middle East. We don’t incorporate any changes to our 2024 forecast to account for this event.

Outlook for 2024

So where does this lead us?

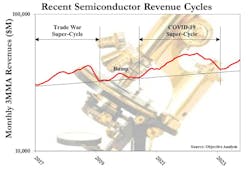

The first question is whether the semiconductor market will continue on the growth trajectory that it’s been following since May. This growth, which is evident at the far right of the chart in Figure 3, is surprisingly similar to the beginning of the two Super Cycles that the industry experienced starting in 2017 and 2020.

The 2017 Super Cycle was triggered by the U.S./China Trade War and partly fueled by the surprise moves made by that period’s U.S. administration. The current administration’s approach, as mentioned before, has been following a more predictable path and is unlikely to trigger panic semiconductor purchases in China.

The second Super Cycle was triggered by the change to work/play/study-from-home, and there’s no reason to expect a similarly abrupt change to occur over the next year or two.

So, if we don’t have a Super Cycle, then how will the market’s recent rise play out? Objective Analysis expects it to follow a path more similar to the bump that the market underwent between these two Super Cycles. This bump is similar to other bumps over the past few decades, even resembling bumps that are superimposed on top of the 2017 and 2020 Super Cycles. We expect a correction to set in relatively soon, with growth falling back into line with the market’s 3.9% long-term revenue growth trend.

This implies that growth will be modest in the wildly swinging memory chip market and in the semiconductor market in general. Our forecast is for 2024 to see a 3% growth in DRAM revenues and 0%-5% growth in the overall semiconductor market. Given that recently announced semiconductor forecasts have been in the 11%-17% range, that’s a very unusual outlook. On the other hand, were anyone to forecast that we would have another Super Cycle this year like that of the 2020-2022 cycle, then the forecast would be for growth of about 27%.

The Objective Analysis forecast calls for end-market growth to fall back to the trends that they were following prior to the pandemic, with PCs on a slow decline, and smartphones growing more moderately than in past years. Meanwhile, the move that hyperscale data centers make toward AI will redirect data-center spending, but not substantially increase it.

Still, the market continues to be susceptible to unpredictable influences stemming from the China/U.S. Trade War, consumer sentiments in light of inflation, and general economic conditions. Although our forecast sees no reason to anticipate another Super Cycle, or a rash of AI spending, we do see a return to pre-COVID growth that will benefit the industry in a smaller way in 2024 than in the following year.

Read more articles in Electronic Design’s 2024 Technology Forecast series.