With more than 1 million annual road fatalities worldwide, safety has become a key focus for the whole automotive industry. In Europe, the New Car Assessment Program (NCAP) is encouraging OEMs to adopt advanced driver-assistance systems (ADAS) in all new cars by implementing stringent safety requirements.

Many applications have emerged to support the zero-accident objective. One of the first was adaptive cruise control (ACC), followed by automatic emergency braking (AEB) at the front of the car, blind-spot detection (BSD) and lane-change assist (LCA) at the rear, and vehicle-exit assist (VEA) and pre-crash warning (PCW) at the side.

As of 2018, AEB will be a requirement in Europe for new cars to reach the maximum rating in order to protect vulnerable road users such as pedestrians and cyclists. The same trend is occurring in the U.S. with 20 OEMs committed to making AEB systems standard equipment in any new car by 2022.

Most OEMs are also looking further ahead with fully autonomous cars that push the limits in terms of the safety pledge. This approach of “mobility as a service,” as an alternative to the traditional automotive business model, is emerging mostly in medium-size cities. Companies such as Google and Uber are already working on fully automated robotic cars that target this market.

Sensor Collective

For all of these applications, sensing technology is of great importance to enable a 360-deg. safety cocoon around the car. Sensors must enable detection and classification of objects in every weather or lighting condition, and inputs have to be ultra-reliable to ensure safety-critical functionality. Consequently, both sensor redundancy and fusion are desirable.

Combined sensor inputs bring more accurate and reliable information on the car surroundings, allowing the control unit to take preventative or corrective actions with, for instance, warning and haptic feedback, or emergency braking and steering, respectively. These sensors include radar, cameras, LiDAR, and ultrasonics. Each brings their particular strengths and limitations to the table.

On the Radar

Millimeter-wave radar has been employed for more than a decade in automotive for high-end cars, though more to ensure comfort, and thus with limited volume. With the recent sharper focus on safety, the market potential for ADAS has been extended to mid-range cars as well. An analysis of current OEMs’ ADAS reveals that millimeter-wave radars are well-considered and employed by many brands—71% for AEB, and 85% for BSD. This points to a total millimeter-wave radar module market of $2.2 billion (U.S.) in 2016.

Following a National Highway Traffic Safety Administration (NHTSA) recommendation in the U.S., Toyota was first to announce last year that it will equip 80% of its cars with an AEB system in 2018. We can expect other OEMs to follow by employing long-range radar for this task.

The other ADAS use cases for rear and side car monitoring, such as BSD, LCA, and PCW, will contribute to short- and mid-range radar market growth. Additional applications like valet-parking assist and the implementation of autonomous vehicle levels 4 and 5 will obviously contribute to this growth. The total millimeter-wave radar module market is forecast to reach $7.5 billion (U.S.) in 2022.

The radar market is supported by a complete supply chain with a large Tier1 offering in Europe, the U.S., Japan, and China, where car growth rate is highest at the moment. Large companies, such as Robert Bosch, Continental, Autoliv, Hella, and Denso, all supply radar modules. Several generations of products have been developed over the years. For example, Continental is in its fifth generation of long-range radar, which will enter production in 2019. Today around 50 active product references are commercially available on the market.

Attuned to the Frequency

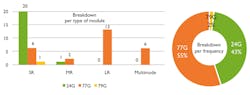

On the technical side, long-range applications are based on the worldwide-adopted 77-GHz frequency. However, for short- and mid-range products, there’s more diversity with modules powered at 24, 77, and even 79 GHz. So far, 24 GHz has been more common for short-range applications, but 79 GHz is gaining traction.

The 79-GHz frequency combines a better form factor with 3X smaller antennas and benefits from a wide frequency band of 4 GHz (77 to 81 GHz). This opens up the opportunity for high-resolution radar, which is critical for autonomous cars. On the contrary, 24-GHz operation in ultra-wideband (21.65 to 26.65 GHz) will be forbidden in Europe as of 2022, restricting the 24-GHz usage to ISM narrowband (24.05 to 24.25 GHz).

High-resolution radar development is currently a hot topic for short-range applications, as is 79-GHz radar. Research centers like IMEC in Belgium have been focusing on it for a few years now, and a significant number of startups created over the last two years have targeted high-resolution radar with the 79-GHz solution. Even large companies such as Continental have offered this solution as an option since the middle of 2017. Furthermore, OEMs have been sampling 79-GHz system prototypes for corner radar; the qualification phase should finish before 2020. We thus anticipate the 79-GHz radar market to reach $2 billion (U.S.) by 2022.

Leveraging Different Materials for Radar Chips

To build these modules, semiconductor companies provide high-performance millimeter-wave chipsets on both 24 GHz and 77 GHz. It’s worth noting that the latest 77-GHz chips can support 79-GHz operations.

Historically, players such as Infineon, NXP, UMS, and STMicroelectronics mainly use silicon-germanium (SiGe) technology for both frequency bands, and a small amount of gallium arsenide (GaAs). Together they share most of the chip market by value, estimated at $165 million (U.S.) in 2016, and expected to grow to $570 million (U.S.) in 2022.

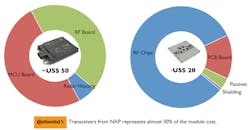

When we look at the material cost breakdown of the latest radar system from Continental, for example, the major cost component—30%—is the RF chipset. This represents a huge market opportunity for semiconductor companies such as NXP.

With intense pressure on the semiconductor industry to integrate more functions on the chip, the technology mix is expected to change. Texas Instruments, which entered this market mid-2017, is likely to change the technology landscape very quickly with a new millimeter-wave sensing portfolio developed on standard in-house RF complementary metal-oxide semiconductor (CMOS) technology. It enables a high level of integration at the chip level from the radar front end to the digital signal processing.

In addition to a better form factor, the technology allows for higher computational capability. It enables more channel scaling with reduced interconnect losses on the board, and at an overall lower power consumption and lower system cost. By cascading up to four of these chips, it’s possible to reach an angular resolution of 1.6°.

This integration trend is paving the way to high-resolution radar. NXP also is prototyping integrated chip solutions both on SiGe and RF CMOS technologies.

Another sign of radar market traction is the positioning of silicon foundries such as GLOBALFOUNDRIES, which is now targeting mass production of radar applications for autonomous cars, with their advanced RF CMOS nodes. However, while it always makes sense to scale down the digital part of the component, it’s not necessarily the case for millimeter-wave passive components, which can’t shrink as much.

In terms of cost, the use of CMOS instead of SiGe makes sense for short-range applications like blind-spot detection. In this case, all-in-one systems could offer a 79-GHz solution that replaces the future forbidden 24-GHz band at a lower cost. But for high ranges, advanced RFCMOS nodes would have difficulty competing with the SiGe technology.

Conclusion

The automotive radar market has never been so dynamic, as we enter an exciting era of technological innovation. New opportunities for radar are still emerging with, for instance, vital-sign driver monitoring systems, chassis-to-ground monitoring, and hands-free trunk opening. The industry is now envisioning radar imaging as a possibility. There’s no doubt this technology will be key in autonomous and robotic cars.

Still, questions linger. What will the technology look like? A channel scaling race? A combination of wide bandwidth with a novel modulation scheme? A synthetic aperture approach? How will radar be integrated with cameras and LiDAR? Which roles and functions will they separately serve? The Yole Group of Companies plans to have these questions on its radar.

Dr. Stéphane Elisabeth and Cédric Malaquin are analysts at Yole Développement.