In the day-to-day operation of a business, you’re always making decisions that affect the success of your product launch. Whether it’s breaking down pricing, prioritizing functions, or analyzing what the competition is doing, these decisions will determine the ultimate success of the product

Through all of your analysis, you are probably pulling in third-party industry analyst reports to understand what’s happening in distribution and pricing trends. But have you thought about pulling in a third-party perspective to analyze a competitive product—either the design, the reliability, or the cost of manufacture? As in other areas, more information leads to better decisions.

If you’re like most companies, you would say “but we already research our competition.” However, how deep does your research go? Do you tear down the competitor’s product and compare implementations and the cost to manufacture? Could that provide information that would influence your tactical or strategic decisions?

Your answer should be a yes to integrating competitive analysis into your decision process and here’s why!

Here’s a real-life example with the names of the participating companies changed (Fig. 1). Company A was confused as to how Company B could sell its competing product for much less than the competing could. After all, it had compared specifications and they were the same. The conclusion was that Company B must have used low-grade components to achieve a lower cost to manufacture. The problem with that conclusion was there didn’t appear to be a difference in the product failure rates.

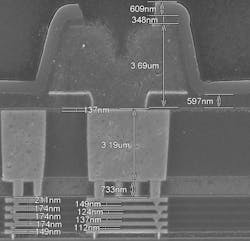

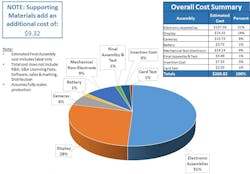

Enter the outside consultant that suggested a product teardown of both devices to compare components, function, and costs. Company A decided it was worth the cost of the product teardowns and analysis to find the answers to their dilemma and decided to proceed with the teardowns.

Three weeks after the acquisition of the devices, the answers to Company A’s questions started to become clear (Fig 2). The findings were:

- The components used in both devices were virtually the same. Especially the high-value parts.

- The cost to manufacture both devices was essentially the same.

After the detailed report was published with a comprehensive set of photographs of the devices and corresponding components, Company A reached a conclusion they really didn’t want to hear. The difference in end-product pricing was really a matter of gross margin. Company B was willing to live with a much lower gross than Company A.

The role of most product teardown consultants is to look at competitive products and provide the client with a deeper insight into the answer they require.

Can a third-party analysis help? What do you think?

Ted Scardamalia is Co-Founder and President of MSW Analytics Inc.