Emerging Memory Market is Finding its Direction

Despite COVID-19, despite Intel’s Optane DIMM delays, despite US-China trade wars, and despite numerous other setbacks, the emerging memory market is on a path to grow significantly over the next decade.

A newly released report by Objective Analysis and Coughlin Associates, “Emerging Memories Find Their Direction,” shows that emerging memories are well on their way to reach $36 billion in combined revenues by 2030. This is driven by two phenomena. The first is the fact that today’s leading embedded-memory technologies, SRAM and NOR flash, are unable to efficiently scale past 28 nm and thus will be replaced by embedded magnetoresistive RAM (MRAM) or another technology. The second is the adoption of Intel’s Optane DIMMs, officially known as the “Optane DC Persistent Memory Module,” which is poised to grab a meaningful share of the server DRAM market.

Foundries, Designers, and Memory Makers Impacted

Foundries and other companies that participate in the memory markets must pay close attention to this transition or they will be left behind. Designers and users of SoCs should be thinking right now about what ramifications nonvolatile memories will have on their designs. The changes that these new memory types will bring to power consumption and system responsiveness will fundamentally alter the way we use and profit from memory technology. Those who understand these changes will have a profound competitive advantage.

Emerging memory technologies have become extremely interesting to designers of all types of systems. Chips for artificial intelligence (AI) and the Internet of Things (IoT) are starting to embrace them as embedded memories. And larger systems are already changing their architectures to adopt emerging memories as a superior alternative to today’s standard memory technologies. This transition will challenge the industry, but it will bring significant advantages.

New Materials Need New Tools

Many of these emerging memory types require new materials and processes, driving changes to the tool complement in standard CMOS logic fabs. Those changes will create opportunities for capital equipment suppliers.

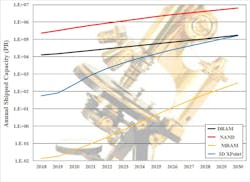

In response to this market change, the report’s forecasts find that emerging memory petabyte shipments will rise faster than other memory technologies (Fig. 1), driving revenues to grow to $36 billion. This will occur largely because these emerging memories will take over a share of established markets for today’s mainstream technologies: NOR flash, SRAM, and DRAM. New memories will replace both discrete memory chips and the embedded memories within SoCs: ASICs, microcontrollers, and even the caches in compute processors.

The report explains how 3D XPoint memory revenues will surge to more than $25 billion by 2030, simply because the technology sells for less than the DRAM it displaces. It also explains why discrete MRAM/STT-RAM chip revenues will grow to more than $10 billion, or nearly 300X 2019’s MRAM revenues. In addition, it projects that resistive RAM (ReRAM) and MRAM will compete to replace the bulk of embedded NOR and SRAM in SoCs, fueling even greater revenue growth.

Capital Spending Must Increase

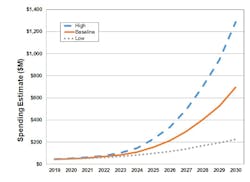

The semiconductor industry’s conversion to emerging memories will require increased capital equipment spending. The report finds that by 2030, the incremental manufacturing equipment spending required by MRAM is most likely to grow 16X its 2019 total of $44 million to almost $700 million, but it could grow as high as $1.3 billion (Fig. 2).

Many Contenders in the Race

It’s not completely clear which memory technology will emerge as the winner in this battle, though. The report investigates phase-change memory (PCM), ReRAM, ferroelectric RAM (FRAM), MRAM, and a number of technologies that aren’t yet as mature as these, and gives each technology’s competitive strengths and weaknesses. Nearly 100 company profiles identify each participant and explain how each plans to address this market shift. These companies include chip makers, technology licensors, foundries, and tool makers, to cover every corner of the semiconductor supply chain.

The 203-page report includes 142 figures and 31 tables, providing detailed forecasts for embedded memory on SoCs, discrete emerging memory chips like MRAM and ReRAM, and 3D XPoint memory. A capital equipment forecast models the demand for new equipment to support the market’s transition from today’s to tomorrow’s memory technologies.

The report can be purchased online for immediate download at either company’s website:

Jim Handy is General Director of Objective Analysis.