EV-lutionary Catalysts: Electronics Accelerates the EV’s Journey to the Mainstream

In the world of automotive events, the 2020 Philadelphia Auto Show is a well-respected, but second-tier affair. With the exception of SSC unveiling its Tuatara, a 1750-hp, 250+ mph hypercar, there was a distinct lack of major product introductions, flashy concept cars, and other market-defining announcements normally found at top-tier events held in the likes of Detroit, Geneva, or Milan. Yet the very ordinariness of the Philly show made it a great place to get a sense of how far along electric vehicles are along the adoption curve, and what, if any, plans manufacturers have to accelerate their entry into the mainstream market.

These questions are important to Electronic Design’s readers because, if EVs succeed, their extensive use of advanced power systems and other electronic technologies will make them a major source of innovation and opportunities for semiconductor makers, EEs, and many other players in the tech sector. Many semiconductor makers and component makers are already betting heavily on an electric future.

Infineon, for example, applied its expertise in silicon-carbide (SiC) technology to roll out a line of improved 650-V power devices primarily aimed at EV motor drives, EV charging, battery formation, and solar-energy systems. Similarly, STMicroelectronics' recently announced battery-management controller provides higher accuracy and advanced features that will enable batteries to deliver longer range and service life, increased safety, and reduced solution costs.

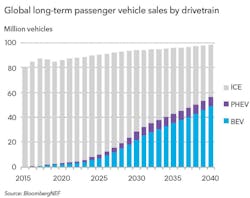

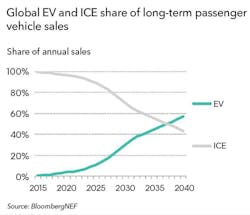

Although EV sales haven’t met expectations so far, there's a growing consensus that the question is not "if," but "when" they will begin to occupy a significant fraction of the market. That answer may be found in Electric Vehicle Outlook 2019, Bloomberg's annual long-term forecast on electric transportation. It predicts that EVs will reach cost parity with conventional combustion-engine vehicles before the end of this decade and overtake them in sales volume by 2038 (Fig. 1). It predicts similar trends for light- and medium-duty commercial vehicles, and much faster adoption for buses.

Clues from the Show Floor

At first glance, the Philadelphia Auto Show's exhibits would lead one to believe that EVs are doomed to continue serving a relatively small niche market. There were only a few more electric models on display than last year, reflecting their modest 2% share of U.S. auto sales and 2.5% of global sales in 2019. But looks can be deceiving. A day's hike around the show floor revealed several subtle, but important, indicators that EVs and plug-in hybrids may be at an inflection point. I'll explain why after a quick recap of what we saw there.

My photographer and I began our trek with visits to several luxury vehicle makers. Although high-end cars constitute a small fraction of the market, Tesla effectively used that segment to create awareness and demand for EVs. Since then, many auto makers have followed suit.

No tour of the show's EVs would be complete without checking out the Porsche Taycan Turbo, designed specifically to compete with Tesla for the title of the world's fastest production EV (Fig. 2). Its 482-hp motor is fed by 93-kWh 800-V(!) battery. The higher voltage was chosen to reduce the size (and weight) of the wiring required to deliver up to 750 hp worth of juice when the Taycan's "overboost" mode is engaged. The beast can hurtle from 0 to 60 in 2.6 seconds, and has a top speed of 160+ mph, but only gets around 200 miles out of its supersized battery—a shortcoming that has caused a bit of controversy in the auto community. This appears to be the only electric on Porsche's horizon, although they will continue to offer plug-in versions of its Panamera and Cayenne models.

Next, we took a look at Audi's new e-tron, which replaces its earlier plug-in hybrid offering that went by the same name (Fig. 3). The luxury crossover vehicle sports a 95.3-kWh battery and a 355-hp motor that can exceed 400 hp in boost mode. Coupled through its all-wheel drivetrain, the e-tron can run a bit more than 200 miles between charges. But you won't have to spend $75,000-$85,000 for an electric Audi much longer. The spokesperson at the booth said that the company is investing heavily in electric technologies and intends to offer an electrified version of every model it offers by 2025.

As we continued our tour, it became apparent that that many other manufacturers have similar strategies.

Electrics for the Rest of Us

While the Porsche, Audi, and other pricey electric asphalt-burners were fun to look at, the important developments were to be found at the less-glamorous exhibits, where the more practical, affordable cars that most of us drive were on display. Chevy, Ford, Nissan, and most of the other majors we visited offered a purpose-built EV or an EV/PHEV option for one or two of its existing models. However, it was clear that they will remain a distinct minority in the herd for 2020.

But appearances can be deceiving…

A closer look at the exhibits revealed several important signs that EVs may be approaching an inflection point, similar to the one solar industry reached in 2008. Back then, the slowly declining price of solar panels got low enough to trigger a demand/price cycle that quickly drove their cost to below $1/W. Steep drops in panel prices also drove down the cost of inverters, racking, and other PV system components, further accelerating their widespread adoption.

While it's tough to say exactly when EVs will hit a similar point on the hockey-stick curve, a few trends and patterns we saw indicate it will happen relatively soon:

- Battery evolution: Better, cheaper batteries and improved drivetrains are enabling existing EV models to enjoy dramatic improvements in range, without raising prices. The best example is Nissan's Leaf, which had an 80-mile range when it was introduced in 2010. Ten years later, its price remains around $30k, but it boasts a much larger interior, much less ugly styling, and a standard range of 150 miles. New for 2020 is an option for a peppier 214-hp motor and a 62-kW battery that will take it up to 226 miles.

- Multi-drivetrain platforms: A growing number of manufacturers are moving away from producing specialized electric cars and focusing on developing multi-drivetrain platforms that can be built with ICE, electric, or plug-in/hybrid drivetrains on the same assembly line. This allows them to spread the development and tooling costs of their electrified vehicles across a much larger production run and enjoy the economics of using 75% or more common components across the model line. Hyundai pioneered this strategy with its Ioniq platform, introduced in 2016. The four-door hatchback is attractive, comfortable, and available as a $22,200 hybrid that delivers 55+ MPG, a $26,500 PHEV with a 29-mile range, or a 124-mile all-electric that starts at $30,315 (Fig. 4).

- Electrifying old favorites: Many companies, including Ford and Kia, are adopting a variant of this strategy for their existing product lines. Ford, for example, used the product refresh cycle of its Ford Escape as an opportunity to develop a much-improved design of the popular crossover's plug-in hybrid version, as well as a soon-to-be introduced all-electric variant (Fig. 5). Kia took a similar approach with its Niro, introduced as a gasoline vehicle in 2017, with a PHEV that rolled out in 2018, and an all-electric in 2019.

- Building consumer confidence: Now that manufacturers have been able to narrow the price gap between hybrids and plug-in hybrids (PHEVs), they may become the "gateway drug" for consumers still too nervous to buy a pure EV. It may explain why Ford, Hyundai, Mercedes, and other mainstream manufacturers are offering PHEV options for a growing number of their products.

Challenges and Opportunities

What we found on the show floor and in the Bloomberg report indicates that, for the short term, the cost of batteries will be the dominant factor in bringing EV prices into line with ICE vehicles, and in turn, how quickly they gain market share. That said, advances in materials, motor technologies, electronics, and manufacturing are also driving EV evolution and will exert a growing influence over the next few years.

During this time, semiconductor manufacturers, and the EEs who use their products, will earn their pay addressing new technical challenges. Discussions with electronics manufacturers, including with STMicroelectronics, Texas Instruments, TE, Pre-Switch, and MagnaChip, provided a sampling of the issues they expect to be dealing with over the next decade:

- Higher operating voltages: While most of today's vehicles run at 400 V, electric trucks and some high-performance cars will turn to 800-, and possibly 1200-V systems to reduce current levels, cabling weight, and resistive losses.

- New battery structures and chemistries: Batteries will evolve over time with new lithium-based types, and alternative chemistries that provide higher energy densities, lower cost, and greater safety. Upstart EV manufacturer Atlis Motors, for example, claims that it has developed a new battery that can power its pickup truck for up to 500 miles and charge in 15 minutes. Battery-management systems, and their associated chargers, must also evolve to support these types of changing requirements.

- Higher charging currents: Today's 400-V dc chargers can already deliver staggering amounts of current, but new designs and technologies such as those used by Atlis may be required to meet consumer demand for even shorter charging times. This will be a challenge for cables, connectors, and other materials that go into charging stations, as well as semiconductors.

- Mining hidden efficiencies: Electric vehicles are already remarkably efficient, but there are still potential gains to be made by attacking the seemingly inevitable losses that continue to lurk within the drivetrain and storage system. Pre-Switch, for example, is taking on the hidden inefficiencies in today's motor-drive electronics by using advanced signal processing and much higher switching frequencies to produce ultra-pure sine waves to drive the EV’s motors. By dramatically reducing switching losses and other power-robbing effects, they expect to add 5%-12% to a vehicle's range.

- Motors that don't depend on rare earths: Shortages of neodymium, cobalt, and other rare-earth elements used to produce the powerful magnets used in EVs' electric motors is sort of a "black swan,” i.e., a situation that's unlikely to occur, but if it does, will have tremendous impact. As Sridhar Nagarajan, Automotive Marketing Manager, Texas Instruments, points out, it's not that rare earths are actually rare, but that 90% of their known reserves are located in China, Russia, or other places where obtaining them could become difficult. Lots of work has been done on high-performance motors that can be built without rare earths, but bringing them and their drive electronics to market could become a major challenge for our industry.

Comments? Questions? Suggestions for topics you'd like to know about? Write me at [email protected]