Electronic Design welcomes Jeff Phillips, Head of Automotive Marketing at National Instruments, as a Contributing Technical Expert, presenting a regularly appearing blog in the field of automotive technology.

The world—it is a-changing. That change is most evident when you look at the transportation industry. The future of not just automobiles, but how the greater “we” get from point A to point B, is painted with excitement and opportunity. The technological revolution of connected systems is inducing change for the electrification of vehicles, autonomous-driving systems, and how vehicles can communicate with each other and the infrastructure around them.

In the future, I’ll delve into these trends and the impact that they’re having on the day-to-day challenge of testing the today’s vehicle designs. But, with so much emphasis being placed on how things WILL change, and to a certain extent rightly so, the market is losing sight of the existing challenges that stand in the way of producing safe and reliable vehicles today: test configuration in the face of compressed timelines, the (re)centralization of the ECU, and the lack of enterprise data-management solutions. For each of these, we’ll look to adjacent industries to understand where the answers will come from.

Test Configuration

French novelist Jean-Baptiste Karr is most widely attributed with the quote that roughly translates to “the more things change, the more they stay the same.” As I’ve visited validation engineers at automotive accounts across the world, both OEMs and Tier 1 suppliers, the topics of the conversations are different, but the substance of those conversations is eerily similar. They are dominated by statements such as, “There’s not enough time to do the test” and “there’s no budget for new equipment.” With many of these systems now directly controlling, or feeding into, safety-critical systems, the challenge of testing these devices to ensure safety and reliability has never been more important.

Paramount to this is the seemingly simple task of “setting up the test.” Automotive components that once were simple—e.g., headlights or car seats—are now complex electromechanical systems that incorporate an ECU, sensors, actuators, and communication to the rest of the vehicle. Validating the behavior of these subsystems now require different testing methodologies.

Formerly, testing of doors, windows, steering columns, lighting, and seats were exclusively physical tests—validating physical performance and life cycle. The tools of the trade for these mechanical test groups were shaker tables, environmental chambers, actuators, and data-acquisition systems. As these components incorporate more sensing, computation, and control, physical components have evolved into vehicle subsystems that require design and test methodologies mirroring the behavior of powertrain design. While design teams adapt to this new reality, modeling, software design, regression testing, hardware-in-the-loop (HIL) test, and system integration are creating test challenges that can’t be addressed by taking longer or spending more money.

The solution to this challenge requires specialized tools for one-off tests that can then transition to programmatic tools for automation, or doing the same test over and over through a variety of variables—length of time, temperature, weather elements, crash forces, etc. This type of specialization can be seen in adjacent industries, such as semiconductors, where tool specialization has reduced the overall cost of test while allowing vendors to get to market faster. This same trend will find its way into the transportation industry. In fact, you can start to see some of this specialization in products like NI FlexLogger, which provides a configuration-based interaction for data logging.

To Centralize or Not to Centralize (the ECU)

As intelligence and edge processing were added to automotive components, the number of ECUs per car grew exponentially. Logically, this meant that the component designs were more modular, having less failure propagation. As we sprint toward Level 5 autonomous cars (Audi has already announced that the 2019 A8 will be the world’s first Level 3 autonomous car), the fusion of the data from various sensor systems will certainly impact the current trend of decentralizing the ECU.

One school of thought is to bring subsystems together under a one centralized ECU, sometimes called a fusion ECU. Centralizing the processors simplifies software updates, data aggregation, data streaming, cost, and critical path testing. This will surface where the OEMs choose to own differentiation, doing the direct development in-house and depending on the Tier 1 suppliers for fully integrated end-to-end sensor systems.

For example, with regard to electric vehicles, many OEMs are looking to isolate their IP—braking, charging, powertrain—into a single ECU and rely on the industry for “commodity” ECUs to again reduce testing burden, drive cost down, and distribute liability. It’s critical for the entire value chain to understand how these systems come together and share standards.

Regardless, the challenge of validating the behavior of the embedded software on the ECU will get harder, and the ability to quickly create and build up HIL testers will become critical. The current de facto standard for HIL systems is to build the entire system end-to-end, which obviously sounds very attractive.

Though that model worked well in the past, two critical developments are changing the landscape. First, the sheer pace of change in the market makes these “black box” testers too costly, as changes require building up a new black box. Second is the evolution of ADAS. As ECUs do more and conglomerate information from various suppliers, the know-how and IP in those is even more important that a single automotive company will own that IP and keep it close, as they need to be able to modify their test systems accordingly—the black box just won’t work.

Consider how Subaru used a flexible, modular platform to alleviate the above concerns and ultimately reduce their test time to one-twentieth of the estimated time:

Historically, this level of “in-house ownership” was in the engine control. However, I contend that the ADAS systems are the new “powertrain” in the sense of being the critical path of innovation and ownership, which means owning the IP here will be just as, if not more, critical. Combine this lack of flexibility for future-proofing with a heavy price markup for the customized service that they provide, and engineers are looking for other solutions. Further, there’s the issue of scale—based on the cost. These "black box" testers won’t be suitable for smaller subsystems; however, even the small systems are still incorporating considerable software logic.

Data-Management Solutions

I’ll spare you the unnecessary reference to how the amount of data being collected is growing exponentially. For the transportation industry, this will only continue to grow as our automobiles move toward Level 5 autonomy. Data from sensors such as radar, LiDAR, and cameras will be combined to understand the world around the car. Data from biometric sensors will help understand the state and health of the driver. Systems such as lane-change assist and adaptive cruise control will be actuated based on this data. To shine a brighter light, the imminent explosion of AI capabilities in this domain is just around the corner.

For test engineers, the data problem is exacerbated because of the sheer volume of data being collected, the extra step of validating the collected data, and the need to analyze those large data sets nearly instantaneously. Just look at the recent Tesla crash for an example of the instantaneous data-processing challenge. The potential impact for making better decisions is infinite.

Consider this scenario: A crash occurs. The data from the sensors on the car are analyzed and an error in an autonomous driving algorithm is identified. If the data that’s used to test these systems is the same data used to monitor and evaluate these systems, then the next steps could be…

Error is fixed and automatically updated to the fleet of cars using it. The same data generates a new test parameter in the validation of the system to ensure the error isn’t repeated.

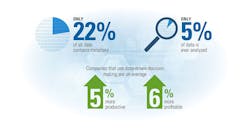

This scenario is in the realm of what we could see in the next decade from autonomous driving algorithms, AI, and the Internet of Things. But, we don’t see this happening yet because although we’re storing loads more data, we aren’t actually analyzing it.

Central to this is an enterprise data-management solution that makes it easy, not just possible, to store, share, find, and analyze measurement data. While this is challenging, I have seen several examples where automotive companies are able to implement a solution that demonstrates impressive results. Toyota demonstrated a 50% reduction in the man-hours needed to analyze data; Deutz demonstrated a 90% reduction in data-analysis times; and Jaguar Land Rover increased the percentage of its test data that gets analyzed from 10% to 95%, with 20X less time required to do so. What was common amongst these? A standardized, enterprise implementation for data management and analysis.

Things are Trending

Change is the new constant for cars, and not just the experience of using them or the technology that defines them. Government regulations and liability insurance coverage have unknown changes coming; car dealerships and rental car companies have disruption bearing down on them. Paramount to these changes are the systems and methodologies that you’re using to validate and test these components—for cost, time-to-market, reliability, and most importantly, safety.

Fortunately, the components that are being used to define these new systems are not novel. We’ve seen the same technologies evolve the testing landscape in semiconductor and aerospace/defense, the latter with many of the same “auto-pilot” type capabilities.

National Instruments has a 40+-year history of excellence in testing, and we’re squarely focused on the automotive industry. As you’ll read in future blog posts, we’ll talk about many of the lessons learned from similar challenges in adjacent industries, highlight many of the evolving trends in automotive and what they mean for test engineers, and ultimately showcase some of the coolest successes across the industry for what “mobility” companies are doing now.