Finding a cost-effective and efficient solid-state battery for electric vehicles could prove equivalent to finding the golden fleece in Greek mythology. According to the legend, anyone who possessed the golden fleece would be considered a true ruler. According to the present technology, anyone who could develop a cost-effective and efficient solid-state battery would rule the EV world.

Developing a practical solid-state battery has generated considerable interest from automotive companies (the lead image shows a potential solid-state battery implementation for the Audi e-tron). For example, Volkswagen recently increased its stake in QuantumScape, a developer of solid-state batteries.

Volkswagen’s Dr. Axel Heinrich notes, “We want to accelerate the commercialization of QuantumScape’s solid-state batteries. And we combined forces to leverage Volkswagen’s experience as a production specialist and QuantumScape technology leadership. Volkswagen is thus taking another step toward a sustainable, zero-emission mobility for our customers in the future.” Volkswagen’s investment in U.S.-based QuantumScape and will be its largest automotive shareholder.

Since 2012, Volkswagen Group Research had already been collaborating closely with QuantumScape, a Stanford University spin-off. Founded in 2010, QuantumScape, headquartered in San Jose, Calif., holds approximately 200 patents and patent applications for solid-state battery technology. Its expertise makes the company a leading pioneer in the development of this form of energy storage.

QuantumScape and Volkswagen will work together within a newly formed joint venture with the goal of enabling an industrial level of production of solid-state batteries. One of the long-term targets is to establish a production line for solid-state batteries by 2025.

Mystery Battery

Unfortunately, the characteristics of a solid-state battery for EV use can’t be described yet, because no one has produced such a battery of the appropriate size and cost for an electric vehicle.

“That is exactly the problem,” says Dr. Milan Rosina, Senior Analyst, Power Electronics & Batteries, within the Power & Wireless division, Yole Développement (Yole). “We can describe different approaches, both on materials and manufacturing level, but we need more data from the testing of the whole battery-cell stack and about the design and components of the battery stack (including thermal management, BMS, etc.).

“However, the development of different technology bricks cannot be done completely in parallel. It means, we first have to develop a cell stack (fix the choice of materials for electrolyte and electrodes) and manufacturing method, and then we can progress further by optimizing battery-pack design and components. Briefly, what we can describe is different approaches, not a single ‘winning’ approach. Depending on the material and process used, the characteristics are different.”

Dr. Rosina also noted that what he learns is the feedback of R&D and industrial players about the different approaches being developed. The winning approach isn’t clear yet and players are still working on different approaches.

“At Yole, the evaluation of technology readiness level is mainly based on feedbacks collected from R&D and industrial players,” says Rosina. “This enables building a picture about the technology development and time-to-market that is much more realistic compared what to we found in the public announcements of some companies.

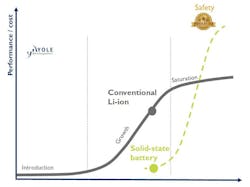

“The cross-check of information from different players (R&D, material suppliers, automotive players) enables Yole to get an objective picture. For the evaluation of the commercialization start for a solid-state battery is also to position well this emerging technology with very well-established conventional Li-ion technology, in terms of safety, performance, and costs. Furthermore, Li-ion has still untapped potential for further performance improvement and cost reduction—a solid-state battery has to be benchmarked with a moving target.”

Figure 1 shows the development of conventional Li-ion batteries and the prediction for solid-state batteries.

1. Solid-state batteries are expected to reach higher energy density than conventional Li-ion cells, with the added value of greater safety. (Courtesy of Yole)

Solid-State Seems Like Most Solid Option

Today, solid-state battery cell technology is seen as the most promising approach for the e-mobility of the future. For example, a solid-state battery would increase the range of a Volkswagen E-Golf to approximately 750 km compared with the present 300 km.

This battery technology has further advantages over the present lithium-ion technology: higher energy density, enhanced safety, better fast charging capability, and—above all—they take up significantly less space. A solid-state battery of the same size as a current battery package can achieve a range comparable to that of conventional vehicles.

But, while the approach has a lot of promise, advances have been difficult to attain and no other battery supplier has been able to achieve automotive performance. Volkswagen successfully tested QuantumScape early-stage solid-state battery sample cells in Germany running at automotive rates of power—an industry first.

Over the last several years, numerous players have made announcements regarding the readiness of prototype cells and expected commercialization starts, only to see these ultimately be cancelled or postponed. And despite decades of development, many technology challenges remain unsolved.

Research in solid-state battery technology dates to the late 1950s. Solid-state battery technology has found applications in the form of microbatteries as a micropower source for sensors, etc. Unfortunately, materials and manufacturing methods used for a microbattery’s fabrication are extremely difficult to translate into bulk-size battery manufacture on a cost-effective basis.

According to Yole’s analysis, the current momentum for growing interest in solid-state batteries is the strong application-pull of game-changing battery industry players—the EV/HEV makers. Currently, hybrid and plug-in electric cars use a variety of battery technologies, including Li-ion, nickel-metal hydride (NiMH), lead-acid, and electric double-layer capacitor (or ultracapacitor), with many car makers adopting Li-ion technology for their EV offerings.

Battery Development Buttressed by EV Industry

Many technology bricks are involved in solid-state battery technology development, including electrolyte material screening, ionic conductivity enhancement, electrolyte/electrode interface stability, lithium metal anode, separator coating, cell and pack manufacturing methods, battery management system (BMS), and battery pack design.

2. Hyundai is working with Ionic Materials on solid-state batteries.

Yole says more than 100 companies and R&D players are involved in solid-state battery development. For an emerging technology, it might be surprising to see that only 14 of 68 industrial companies identified are startup companies (Ionic Materials, NEI Corp., QuantumScape, etc.). These startups are positioned mainly in electrolyte material screening and development (Fig. 2).

R&D activities are rapidly developing within big companies, 54 of which have been identified by Yole Développement. Top firms involved in such R&D include Toyota, BMW, Volkswagen, Renault-Nissan-Mitsubishi Alliance, and Hyundai. Toyota, with a strong solid-state development history and 200+ engineers working on solid-state battery technology, is considered a leader here.

Strong participation from EV/HEV makers is extremely important for solid-state battery commercialization. Besides huge market potential, they bring know-how regarding EV/HEV battery requirements, battery-pack assembly, testing, and qualification. And, in fact, the simplification of battery-pack design and its components will improve the solid-state battery’s cost-competitiveness compared to conventional Li-ion batteries.

Today, much of the development work on solid-state batteries is performed with partnerships (Fig. 3). Among the players are conventional Li-ion battery-cell manufacturers (i.e., Samsung SDI, LG Chem, A123 Systems), battery separator technology solutions suppliers (Asahi Kasei), and materials suppliers (Solvay, Umicore, etc.).

3. The increasing number of R&D partnerships and large consortiums brings strong additional momentum to the development of solid-state batteries. (Courtesy of Yole)

According to Yole Développement’s market forecast, mass production of solid-state batteries will begin by 2022 and represent less than 1% of Li-ion battery demand by 2025. This might explain the relative low interest from equipment suppliers, which might change when large solid-state battery manufacturing capacities start to be built.

About the Author

Sam Davis

Sam Davis was the editor-in-chief of Power Electronics Technology magazine and website that is now part of Electronic Design. He has 18 years experience in electronic engineering design and management, six years in public relations and 25 years as a trade press editor. He holds a BSEE from Case-Western Reserve University, and did graduate work at the same school and UCLA. Sam was the editor for PCIM, the predecessor to Power Electronics Technology, from 1984 to 2004. His engineering experience includes circuit and system design for Litton Systems, Bunker-Ramo, Rocketdyne, and Clevite Corporation.. Design tasks included analog circuits, display systems, power supplies, underwater ordnance systems, and test systems. He also served as a program manager for a Litton Systems Navy program.

Sam is the author of Computer Data Displays, a book published by Prentice-Hall in the U.S. and Japan in 1969. He is also a recipient of the Jesse Neal Award for trade press editorial excellence, and has one patent for naval ship construction that simplifies electronic system integration.

You can also check out his Power Electronics blog.