The Automotive Industry: Radical Change Ahead?

What you’ll learn:

- The market share for battery electric vehicles over the past few years has remained largely stable, rising to 1.3 million vehicles sold last year, which is only about 8% of total sales of new passenger vehicles.

- From all indications, 2025 is shaping up to be one of the most challenging periods the automotive industry has faced in years.

- President Trump’s recent executive orders present a test to automakers that have made a generational investment in EV and EV infrastructure. The President has said he will erase tax credits for electric-vehicle purchases, federal grants for chargers, and subsidies and loans to help rework assembly lines and build battery factories.

Automaking is America's largest manufacturing sector, employing 10 million Americans in all 50 states, building 10.3 million vehicles annually. Altogether, the automotive industry drives an estimated $1 trillion into the economy annually.

In particular, the market share for battery electric vehicles (BEVs) over the past few years has remained largely stable, rising to 1.3 million vehicles sold last year. That’s only about 8% of total sales of new passenger vehicles and less than the 25% to 30% market share forecast several years ago.

But an alarm has been sounded that smoke could be accompanied by fire. From all indications, 2025 is shaping up to be one of the most challenging periods the automotive industry has faced in years.

Ending EV Subsidies

President Trump’s recent executive orders present a test to automakers that have made a generational investment in EV and EV infrastructure. The President has said he will erase tax credits for electric-vehicle purchases, federal grants for chargers, and subsidies and loans to help rework assembly lines and build battery factories.

President Biden’s Inflation Reduction Act provided tax credits of up to $7,500 for buyers of new electric vehicles and $4,000 to buyers of used models. These credits lowered the cost of buying electric cars to that roughly on par with prices for cars with gasoline or diesel engines.

Pres. Trump further rescinded a Biden executive order that called for 50% of new vehicles sold in 2030 to be fully electric, plug-in hybrids, or vehicles that run on hydrogen fuel cells. This executive order puts an immediate pause on billions of dollars in funding allocated for EV charging stations appropriated through the climate law. Biden’s goal had been to create 500,000 EV chargers by 2030.

While Tesla accounts for about half the electric cars sold in the United States, so far there are no signs that Elon Musk—the chief executive of Tesla and head of the Department of Government Efficiency under the Trump administration—is trying to mitigate the impact of Trump’s executive orders on electric vehicles.

With fewer moving parts, in time it can be more profitable to build an EV than a gasoline-powered car, given its complex engine and transmission. Tesla’s profit margin on its cars, for instance, was estimated to be about 16% during the first three quarters of 2024. That’s nearly twice the profit margin said to have been chalked up at General Motors.

Another executive order also seeks to terminate a federal exemption that allows California to phase out the sale of gas-powered cars by 2035. Pres. Trump also has said the administration would seek to revoke California’s authority to establish air-quality standards that are stricter than federal rules.

The federal waiver is important not only to California, but also to other states that follow its standards on vehicle emissions. These states are Massachusetts, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, and Washington. The 1967 Clean Air Act allowed for a waiver to the California Air Resources Board to set their own greenhouse gas (GHG) emissions standards. California's Advanced Clean Car Act II mandates 100% light-duty zero-emission vehicles (ZEVs) by 2035.

Here, given the general expectation that industry will not meet existing federal regulations, the California standard may need to be delayed by the state itself.

Federal support for EVs was part of a 2022 law that may require congressional action to change, although the details of the tax credit were set by the Internal Revenue Service, not Congress. There’s no script for this. It's virgin territory for everyone involved.

What’s more, a climate of uncertainty is created by the President’s promise to impose 25% tariffs on goods from Canada and Mexico, which are major suppliers of cars and car parts to the United States. This is an expedition into the labyrinth of economic possibility. If the tariffs are set at a proposed 25% or higher, it could lead to price increases. It’s also reasonable to expect that tariffs will increase labor rates. Economic analyst firm AEG estimates that it will tack on $4,000 to the price of a new vehicle and possibly lead to layoffs.

Impact on Driver-Assist Technologies

Rules that have been published in the Federal Register, but aren’t yet in effect, include the Automatic Emergency Braking (AEB) Systems for Light Vehicles, personal-AEB (P-AEB) and the Vehicle Safety Transparency, and Evaluation Program. The latter would establish a national program for ADS-equipped vehicles under NHTSA’s oversight with the goal of improving public transparency related to the safety of certain ADS-equipped vehicles. It’s scheduled to take effect in 2029.

AEB is a safety technology developed by automakers to help detect the possibility of collisions with vehicles, pedestrians, and cyclists. AEB systems use sensors to detect when a vehicle is close to crashing into a vehicle or pedestrian in front, provides a warning to a driver, and automatically applies the brakes if the driver hasn’t done so. NHTSA projects that this new standard, FMVSS No. 127, would save at least 360 lives a year and prevent at least 24,000 injuries annually.

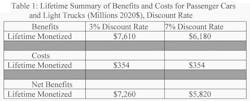

Table 1 summarizes the findings of an NHTSA benefit-cost analysis (Source: Federal Motor Vehicle Safety Standards Automatic-Emergency-Braking-Systems). The lifetime monetized net benefit of this rule is projected to be between $5.82 and $7.26 billion, with a cost per equivalent life saved of between $550,000 and $680,000. That’s far below the Transportation Department's recommended value of a statistical life saved; $11.6 million in 2020 dollars.

According to industry estimates, the auto industry has already invested more than a billion dollars in developing AEB systems.

The Alliance for Automotive Innovation lobbying group recently sued the Department of Transportation for mandating the AEB and P-AEB on all vehicles. This litigation, the group said, should not be interpreted as opposition to AEB, a lack of confidence in the technology, or an objection to AEB’s widest possible deployment across the U.S. vehicle fleet.

Rather, according to the group, it’s about ensuring a rule that maximizes driver and pedestrian safety and is technologically feasible.

EVs Across the Pond

Meanwhile, in Europe, current EU regulations require that manufacturers reduce their fleet-average CO2 emissions by 15% by 2025, relative to a 2021 baseline. This target increases to 55% for cars and 50% for vans by 2030. The non-compliance penalty is €95 ($99) per car and €120 ($125) per van for each g/km CO2 exceeding the target.

The European Automobile Manufacturers’ Association (ACEA) has called on the EU authorities to provide a penalty relief for non-compliance with the mandatory 2025 CO2 emission targets for cars and vans. The ACEA is asking EU policy makers to consider two alternative compliance options with the CO2 emission mandates: a phase-in of 90% for 2025 and 95% phase-in for 2026, or introduction of an average compliance mechanism for the years 2025 through 2029.

Technology to the Rescue?

As growth in battery EV sales has slowed, the automotive industry is weighing new methods to accelerate electrification momentum. One possible answer is to supplement plug-in hybrid electric vehicles (PHEVs) with extended-range electric vehicles (EREVs). EREVs combine a small ICE-powered generator with an electric powertrain to boost electric-only driving range by 100 to 200 miles (versus a PHEV’s range of 20 to 40 miles) and a total range of over 400 miles, meeting most drivers’ daily commuting needs.

Another is continuing work on solid-state batteries. Recently, for instance, Toyota Motor Corp. developed a new type of cathode material for all-solid-state batteries. Most solid-state batteries utilize solid oxides as the conductive material, replacing the liquid electrolyte and separator found in traditional lithium-ion batteries.

Toyota reportedly improved the capacity per volume of the positive cathode in all-solid-state fluoride-ion batteries to about 3X that of lithium-ion batteries. The cathode material for all-solid-state fluoride-ion batteries delivers more than double the 120 to 250 mAh/g typical of lithium-ion cathodes.