Qualcomm Dials Into 5G Networks With New Class of RF Filters

Qualcomm rolled out a new family of RF filters called UltraBAW that target mid- and high-frequency bands used by 5G networks, part of an effort to expand its market share in chips surrounding its cellular modems.

It is trying to persuade major phone makers to purchase its filters and other chips in a pre-integrated RF front-end along with 5G baseband modems, RF transceivers, and millimeter-wave antennas, rather than buying them part by part from different vendors. The RF front-end manages and shapes all the wireless signals used by smartphones and the RF filters inside help dial into different bands. This subsystem is invaluable to getting the best possible performance out of 5G phones and other devices such as PCs.

Radio-frequency (RF) filters isolate and clarify signals from the different frequency bands that phones use to send and receive data and block out unwanted noise and interference. Qualcomm said there are more than 10,000 combinations of frequency bands used by 5G, up from 1,000 used by 4G networks, which is why consumer electronics makers are packing more RF filters primarily in phones but other devices, too.

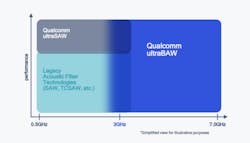

The UltraBAW filters cover a wide frequency range from 2.7 GHz to 7.2 GHz, including the 5 GHz and 6 GHz bands used by Wi-Fi. The chips complement filters based on the UltraSAW technology the company rolled out last year to filter signals in frequency bands from 600 MHz to 2.7 GHz. UltraBAW filters also support ultra-wide channels of up to 300 MHz, according to Qualcomm.

"This is the new industry benchmark for performance in that range," said Qualcomm CEO Christiano Amon on a quarterly conference call with analysts Wednesday.

Qualcomm said the new RF chips are based on thin-film piezoelectric micro-acoustic technology and are designed to deliver faster data transfers as well as improve GPS and other global location technologies. They also bring improvements in heat dissipation to lift power efficiency, prolonging the battery life in 5G phones and other devices. The chips have improved insertion loss, with a Q-factor of up to 1500 at 5 GHz.

The world's largest smartphone chip maker is wrestling to win more market share in RF front-end (RFFE) chips as part of a drive to diversify. Qualcomm said RFFE sales soared 45% year-on-year in its third quarter to $1.2 billion, driven by the "pull-in" of demand ahead of product launches in the fourth quarter. Customers placed orders for RF filters and other chips even if they were unable to buy all the 5G modems they needed.

The San Diego, California-based firm sells a wide range of RF filters, including surface acoustic wave (SAW), temperature-compensated surface acoustic wave (TC-SAW), and bulk acoustic wave (BAW) components to battle Qorvo, Skyworks, and Murata. It is also up against Broadcom, which sells another type of RF filter—an alternative to BAW filters called FBARs—which can sort through signals in higher bands than SAW devices.

While legacy SAW, TC-SAW, BAW, and UltraSAW filters have high performance at sub-3 GHz and 4G bands, Qualcomm said it is trying to raise the bar in the mid- and high-frequency bands used by 5G with UltraBAW. Qualcomm said ultraBAW filters are designed with the high selectivity and lower insertion loss required to clarify signals in crowded mid- and high-band frequencies while keeping noise, power, and heat in check.

It is winning slots with its UltraSAW filters in Samsung's Galaxy, Google's Pixel, and many other premium 5G phones.

Qualcomm said that it is integrating its UltraBAW filters in its power amplifier modules, diversity modules, and Wi-Fi modules, along with other parts in its RF front-end portfolio. Qualcomm said UltraBAW filters are also used in its latest power amplifier module, the QPM6679, enabling high power handling at higher bands. The company said modules with UltraBAW filters inside are already sampling to early potential customers.

Qualcomm said the first products with UltraBAW inside are due out in the second half of 2022.