ASML Warns Against U.S. Push to Block Equipment Sales to China

ASML warned the world’s path out of the ongoing chip shortage will get even more complicated if the U.S. blocks it from selling a wider range of its high-end chip-making equipment to China.

“I think we need to realize that China is an important player in the semiconductor industry, especially in the more mainstream semiconductors,” said CEO Peter Wennink on a conference call with investors Wednesday. “They’re a very significant supplier of the global markets. So, we just have to be careful what we are doing.”

For years now, the U.S. government has been intent on subduing the rise of China's chip sector. Against that backdrop, Washington is reportedly trying to expand existing sanctions on its most advanced EUV tools to China. U.S. officials are in talks with their counterparts in the Netherlands to block ASML from selling its previous generation of tools called DUV to the likes of SMIC and other Chinese chip makers.

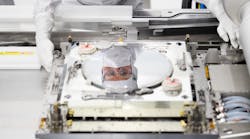

ASML dominates the global market for lithography machines that play a critical role in the modern chip-making process, used to scorch intricate grids of billions of transistors on shimmering wafers of silicon.

The DUV tools are a generation behind the state-of-the-art EUV systems that the likes of Intel, TSMC, and others are buying to build chips using the world’s most advanced process nodes. These range from Apple’s M2 chip for Macs and Qualcomm’s X70 modem for 5G phones to Nvidia’s H100 GPUs for data centers, Marvell’s Octeon 10 DPU, and NXP’s S32 series for cars, which all use TSMC’s EUV-based 5-nm process.

DUV is invaluable for virtually everything else, including chips based on 28-nm or larger nodes that have been in severely short supply for over a year, snagging production of everything from cars to phones and even ASML’s chip-making gear.

Blocking sales of such an indispensable machine would be a big setback to China’s semiconductor goals. The move could also hobble its ability to boost production at a time when the world is still grappling with a chip deficit and disruptions in the supply chain that are raising prices for electronics. “We cannot ignore the fact that China has manufacturing capacity out there on DUV, which the world needs,” Wennink said.

The CEO pointed out that plans to restrict the shipment of its systems have been proposed by the U.S. and other countries from time to time. "We just have to wait [to see] what the politicians come up with," he said.

ASML has become a cornerstone of the $550 billion semiconductor industry because no one else has been able to crack the code on EUV technology. But its dominance has trapped it between the U.S. and China as the countries fight for technological leadership.

The company has already been forced to stop selling the $150 million EUV machines to China. Shipments to China have been blocked since 2019 because the Netherlands is withholding an export license, allegedly under pressure from the U.S.

Now Washington is trying to convince the Netherlands to take the campaign against China to a new level.

If the Netherlands agrees to U.S. demands, it would also throw a wrench into ASML's business. Companies based in China or with operations there accounted for about 15% of its more than $22 billion in 2021 sales.

But any additional restrictions would deal a bigger blow to China’s efforts to become more self-sufficient in chips. An embargo could also cripple its ambitions to make chips that are close to today’s state-of-the-art.

For context, TSMC taps the most advanced type of DUV technology, called "immersion lithography," in its 7-nm node, although the foundry giant has upgraded to EUV equipment in its top-of-the-line 5-nm process.

China has been the largest buyer of semiconductor equipment in the last two years, according to SEMI. The country's spending soared 58% to about $29.6 billion in 2021, outpacing South Korea and even Taiwan.

China's SMIC and Hua Hong Semiconductor would likely bear the brunt of new sanctions, which would curtail their ability to add production capacity. Together, they control about 8% of the foundry business, according to Trendforce, a semiconductor market research firm.

The push to expand export controls on ASML comes as the U.S. pushes to the finish line with the CHIPS Act, which would roll out $50 billion in subsidies to help make the U.S. more competitive against China.