Most Electronic Devices Have a Pulse. You Want to Avoid Skipped Beats.

Almost every electronic device needs to keep track of time to function. Tiny electronic clocks allow the instructions vital to the operation of chips and circuit boards to get where they need to go at the correct moment. These timing devices prevent the device's marching orders from getting to their destination too early or too late.

“But in the electronics world, this is not the flashiest technology,” said Rami Kanama, VP of Microchip’s timing and communications business. Consumers are only ever aware of these components when they malfunction, leading to microwaves that never seem to display the right time and sprinkler systems that never turn on when they are supposed to. But these types of timing glitches could wreak havoc in systems used by corporations and manufacturers.

Without stable timing frequencies, none of the electronics used in data centers, wireless infrastructure, factories and other applications could work reliably. These systems are getting more and more complicated, ratcheting up timing requirements to keep everything running on time. Precise timing is growing in importance as data center networking surpasses 100 Gbps. To support higher data rates, 5G requires 20 times more precision than current LTE networks.

Customers place challenging but straightforward demands on suppliers. Lower jitter and phase noise are critical in preventing losses in high speed data transmission. Timing devices used in smartphones and other consumer electronics need to limit the power they consume. And unless timing devices are protected against temperature changes and vibrations, factories and cars can malfunction. And of course, everyone wants low price-for-performance.

One component has dominated timing applications for decades. The crystal oscillator—more commonly known as the XO—contains a sliver of transparent quartz that vibrates at a certain frequency when run through with electricity. These crystal resonators are artificially grown under high pressure and extreme heat before being sliced into wafers and machined to a specific thickness and size to resonate at a certain frequency, which can be used as a timing reference.

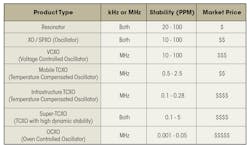

The resonator can be used discretely or packaged with an integrated circuit to create a crystal oscillator, which is typically used in applications that need high stability and low temperature drift. Crystal clocks, which are made mostly in Asia, account for around $2.4 billion of the $4.5 billion timing market, according to researcher Databeans. The market for crystal oscillators is projected to grow around 4 percent versus the total timing segment's 6 percent this year.

In recent years, manufacturers have learned to cut the crystal smaller and ever more precisely to lower power draw without losing accuracy and stability. Major suppliers include Epson, Kyocera, Vectron and IQD Frequency Products. Some companies are shifting more manufacturing to China to reduce costs amid languishing margins. Others are ramping up the integration of programmable circuits to reduce how long it takes to deliver products.

“Crystal clocks are a very mature market and are being replaced more and more by integrated circuit solutions,” said Susie Inouye, an analog semiconductor analyst at Databeans, highlighting their resistance to harsh environments as one advantage. “These are very expensive devices and until they can get to the same performance as crystal oscillators at the same price they will not catch on everywhere, but they are growing quickly,” she explained.

Companies like Silicon Labs and Integrated Device Technology merge crystal resonators with oscillation circuits, clock generators, buffers and other analog devices they design to increase accuracy, reduce jitter and distribute frequencies around electronic devices or SoCs. Greater integration is the trend in the $2.1 billion market for silicon timing devices, which accounted for 1.3 billion shipments last year and is expected to grow around 8 percent this year.

Traditionally, separate devices have been used to support different combinations of frequencies. “But there are many timing domains within an SoC and they all need different frequencies,” said James Wilson, general manager of timing products at Austin, Texas-based Silicon Labs. “From a timing perspective, you need a clock device that can generate a mix of different frequencies with different signal formats and performance levels without external components.”

Wilson added: “It is really an opportunity for timing suppliers to innovate.”

In August, Silicon Labs introduced its latest clock generator with an integrated timing source, which helps customers simplify the layout of their circuit boards. The package also repels interference and other noise that the resonator would normally be exposed to, boosting accuracy. Limiting jitter is increasingly important to communications product designers. Switch chip maker like Broadcom and Marvell are moving to 56G SerDes to support Ethernet above 100 Gbps.

This device is basically a programmable crystal oscillator for data center, communications, video broadcast applications. Silicon Labs also combines all the electronics required to output and distribute networks of clocks signals—also called clock trees—within systems. The product “reduces supply chain complexity since it’s sourced from a single supplier,” Wilson said. The company's clock generators use 55-nanometer CMOS instead of SiGe or BiCMOS.

Other companies are focused on long-term reliability and frequency stability in cars, factories and wireless infrastructure. “Without ultra-precise timing, the benefits and opportunities for next generation systems will not be achieved,” said Jens Fabrowsky, vice president of automotive electronics for Bosch, which produces microelectromechanical systems—more commonly called MEMS—that Silicon Valley-based SiTime uses to build timing devices.

“Our silicon is 1/3000th the mass of a quartz device so vibration energy coupled onto our devices is much lower, making them much more immune to vibration and other environmental conditions,” said Piyush Sevalia, vice president of marketing for SiTime. The company maintains that it holds 90 percent market share in MEMS oscillators, the fastest growing segment in the timing market, even though they are generally more expensive than crystal devices.

The company produces oscillators based on 48 MHz resonators that can be used as reference clocks and 524 kHz resonators for real-time clock applications. These components are smaller than a grain of rice and combined with phase-locked loops (PLLs) to function as MEMS oscillators. These timing devices are replacing crystal oscillators in systems subject to vibration, interference, heat and cold, and other disturbances that can introduce noise to timing signals.

That includes industrial systems that communicate with each other using time-sensitive networking, a new Ethernet standard. Precise timing is required to synchronize the clocks in every node on the factory’s network. This allows smoke alarm and factory automation systems to share the same network used to transfer other information such as equipment diagnostics and video without causing delays—because factory downtime can be costly.

To speed up connectivity, 5G networks requires more precision than current LTE technology. Instead of using today's remote data centers, 5G systems will be mounted on street lamps, traffic lights, and other locations right next to the smartphones and Internet of Things devices they support. To limit service outages and maximize bandwidth, every node in a 5G network needs timing accuracy of 65 nanoseconds versus 1500 nanoseconds with 4G networks.

This level of accuracy is also important to cars. To avoid highway collisions and brake for pedestrians, autonomous cars have to make split second decisions. That increases the timing requirements for cameras and other sensors, which also have to send data without delay to central computers. Precise timing is also required to do things like control the transmission and connect to wireless networks so that it can display traffic maps to the dashboard.

“Our strategy has been to focus on solving difficult timing problems, so we try to avoid pricing competition if we can help it,” Sevalia told Electronic Design. The company expects every new vehicle to have between 30 and 50 timing devices by 2020, almost three times what they have today. That would boost the $215-million automotive timing market to $475 million. Data center servers require around 10 timing devices while smartphones use half that number.

SiTime is definitely onto something. Its unit shipments have been almost doubling every year. Last year, SiTime shipped around 425 million MEMS timing devices, up from 65 million in 2014. The company has sold more than a billion devices into industrial and automotive systems that benefit from their ability to remain accurate over a wide temperature range. SiTime also serves the consumer and Internet of Things spaces that may need lower power or smaller footprints.

Microchip is the only other major MEMS timing company through its Discera deal. Analog Devices targeted the timing market with its Sand 9 acquisition but is still not selling products based on Sand 9’s MEMS resonators. IDT discontinued its MEMS product line after Silicon Labs did the same. Wilson declined to comment on whether it would return to the MEMS market: “We are continuing to invest in new clock and oscillator products and technology."

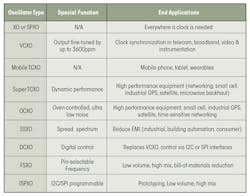

SiTime is targeting customers that typically use temperature-compensated crystal oscillators (TCXO) that can better tolerate heat fluctuations and voltage-controlled crystal oscillators (VXCO) that output different frequencies based on the input voltage. In addition to XO alternatives, the company also offers timing devices that support high dynamic stability (Super-TXCOs). Frequencies can be programmed for customers before shipment, Sevalia said.

“If we can leverage semiconductor infrastructure, we believe we can innovate a lot faster and we believe that we can give customers more capabilities, lower power and—at some point lower price—than crystal,” he said. “We are using silicon-on-insulator wafers and standard semiconductor fabs.” He added that new manufacturing lines often need to be built to produce smaller crystal resonators, increasing upfront costs for quartz suppliers like TXC and NDK.

It remains unclear whether SiTime, which was founded in 2005, can succeed in a smartphone market dominated by low-cost crystal oscillators. But the company has some major customers that could lend a helping hand. This year, SiTime announced that it would supply timing devices for Intel’s 5G multimode wireless modems. The deal also encompasses the company's millimeter wave wireless and global positioning system solutions.

Sevalia declined to comment on whether it also had an agreement with Qualcomm, the largest maker of smartphone chips. SiTime's deal with Intel is focused on wireless infrastructure, but it is worth noting that Apple now uses Intel's wireless chips in every one of its phones. SiTime’s products were used in 2016’s iPhone, said Yole Développement power and wireless division director Claire Troadec. They have also been embedded in the Apple Watch.

“MEMS timing has had success in the commodity and midrange oscillator market, but it has not been adopted wholesale in higher end applications," said Wilson. "Customers in these markets tend to be more conservative and MEMS does not have the longest track record.” Kanama added: “MEMS timing devices should improve in terms of phase noise and jitter over time, taking some market share in [data center] communications.”

Silicon oscillators—also called CMOS oscillators—are also being developed to ease integration with other chips. That would consolidate more timing devices on the circuit board, reducing problems caused by maintaining signal integrity. But these timing devices have had issues with frequency stability and reliability, preventing them from stealing much market share in high speed serial and wireless communications.

Many companies, including Texas Instruments and Maxim Integrated, offer them. "Analog semiconductor companies can just throw them on a manufacturing line," Inouye added.

Crystal oscillator companies are trying to defend themselves from an onslaught of silicon. Epson is increasingly using MEMS manufacturing processes to build smaller and thinner XO components without sacrificing precision, stability and frequency range. Previously, the need for performance limited the production of smaller and smaller crystals. Without these limits, Epson has also started getting more resonators from each wafer, lowering costs.

Kyocera this year introduced a new series of crystal oscillators that have higher frequency tolerance over nearly the same temperature range as MEMS timing devices. The company mounts crystal oscillators to glass substrates that offer different levels of frequency stability—and cost—based on their size. The oscillators are standard blanks, so custom components meant for the automotive market can be churned out faster.

But there are other advantages to MEMS technology. “The robustness of MEMS allows for highly compact, low power and integrated devices,” said Kanama. “The development of MEMS resonator technology also enables the possibility of integrating precise references inside microcontrollers and microprocessors and that will eventually replace traditional on-chip oscillators.” He added: “Since MEMS is a silicon-based element, it allows much easier device integration.

Corrections: Inserted additional information to the 27th paragraph about CMOS oscillators.