US Chip Sector Continues to Grow as Global Sales Rebound in 2020

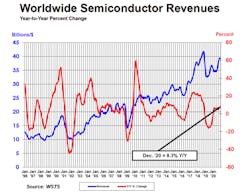

Global sales of semiconductors leaped 6.5% over the last year, lifted by strong demand for chips used in data centers and personal computers despite the economic fallout from the coronavirus pandemic.

Total sales of semiconductors came out to around $439 billion in 2020, up from $412.3 billion in 2019, according to data from the Semiconductor Industry Association, a trade group that represents the top US-based chip makers. Global chip sales recovered in late 2020, canceling out a sharp dip in demand early in the year as concerns around the lethal virus led to lockdowns, upending the global economy.

The report said the rebound in IC demand was largely due to recovering sales of memory chips, which account for around 30% of the semiconductor market and soared by 10% to $117.3 billion, for use in data centers, personal computers, smartphones, and other areas. Sales of logic chips increased at about the same rate to $117.5 billion as the technology industry weathered the worst of the virus.

Google, Microsoft, Amazon and other leading players in the cloud business are upgrading servers, storage, networking and other chip-heavy hardware in data centers as wide swathes of the world's population move to working remotely due to lockdowns and concerns around contracting the virus. Demand for smartphones, personal computers and other consumer devices is also driving growth.

The sales of analog, power management, and other non-memory chips, including microprocessors, rose 5% in 2020, according to Falan Yinug, who leads industry statistics and economic policy at SIA.

Overall sales by US-based companies came to $208 billion in 2020, or around 47% of the market, while chips shipped into the US to be used in electronics production totaled $94.2 billion, up 20% from 2019.

But at the same time, the US semiconductor sector continues to face mounting pressure from other areas. Intel, Qualcomm, Micron, and other US chip-making giants have been dented by the prolonged trade war between the US and China, which has strained the global technology supply chain. The US chip sector has also been lobbying for more federal funds to keep it ahead of China, which remained the leading market for chips in the world, with sales there totaling $151.7 billion, up 5% from 2019.

The trade conflict has transformed into a technology cold war with China, which has been burning through tens of billions of dollars in subsidies to expand its production capacity for chips. It is also trying to decouple its semiconductor supply chain to limit the ability of the US or other rival nations to blacklist Huawei Technologies or other firms from importing chips designed in the US. The spat has also highlighted the heavy dependence of US firms on contract chip manufacturers, such as TSMC.

“While global demand for semiconductors is on the rise, the share of global chip production done in the US has declined," said John Neuffer, SIA president and CEO, in a statement, "and that disparity will only intensify without US government action to level the global playing field. It is imperative the federal government fully fund incentives for more domestic chip production and investments in chip research so the US can benefit from growing demand and product more semiconductors."

While American firms accounted for almost half of semiconductor sales, only around 12% of global production capacity for chips was located in the US last year, compared with 37% three decades ago. Even though Silicon Valley is the cradle of the global chip space and many US firms such as Intel and Globalfoundries continue to churn out homegrown chips, the US share of chip production is shrinking.

US chip makers have been lobbying the US government over the last year to roll out subsidies and other federal incentives to position the US to produce more chips. Congress last month passed the National Defense Authorization Act (NDAA) with provisions that approves the use of tax money for upgrading and building US chip fabs and bolstering R&D to reinforce US leadership in chips.

The provisions could lead to funding for US-based manufacturers including Intel and other firms such as Samsung or TSMC, which are planning to invest billions of dollars in advanced production plants in the US. Other proposals are in the pipeline, including the CHIPS Act and American Foundries Act, both introduced last year, to return more of the semiconductor supply chain to its birthplace in the US.

The US government has still not appropriated funding for the new program, so the final amount is still undecided. Last year, the US semiconductor industry said it needed $20 billion to $50 billion in federal incentives to keep chip manufacturing from fleeing to Taiwan, Southeast Asia, South Korea, and other regions. Failure to deploy enough funding could threaten US dominance of the sector, the SIA warned.

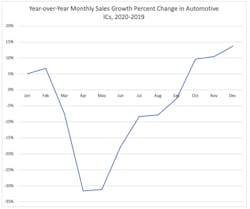

The semiconductor market goes through boom and bust periods every three years or so. Chip sales in 2019 dropped sharply as a result of the US-China trade war and weaker smartphone demand globally.