Electronics and Electrical Engineering Jobs on the Decline—Can They Be Saved?

This article is part of the Professional Advancement Series: Annual Salary Survey

What you’ll learn:

- The state of the engineering job market.

- What current engineers are doing instead of working.

- What may be next for the industry.

The pandemic has done its best to hinder chip production on a global scale. But while the shortage shows signs of subsiding, semiconductor companies are encountering another problem that could set them back: a lack of qualified electronics and electrical engineers.

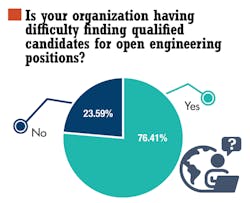

The Electronic Design 2022 Salary & Career Survey paints a clear picture of the experienced engineer shortage. We asked, “Is your organization having difficulty finding qualified candidates for open engineering positions?” A resounding 77% said yes (Fig. 1).

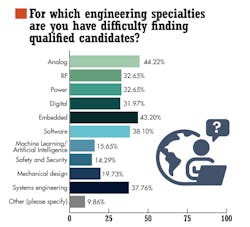

What’s worse, when we asked what specialties are in need of people, and the deficit is almost even across every focus (Fig. 2).

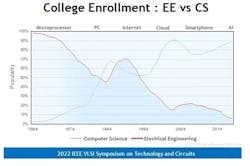

In June of this year (2022), Intel engineer Raja Koduri attended the IEEE Symposium on VLSI Technology & Circuits and raised the issue of engineer scarcity within the U.S., which painted a negative forecast for the near future (to say the least).

CS vs. EE

That concern was highlighted by a graph (Fig. 3) outlining how computer science (CS) majors' college enrollment has overshadowed those majoring in electrical engineering over the last 50 years. That translates to a 90% uptick in the CS field and a 90% drop for those pursuing an EE degree. The situation is worse for electronics engineers, the workforce responsible for building those electronic devices, which is astounding, given the amount of technology the average person has in their homes.

The lack of desire among young people in the U.S. to become electronic engineers can be explained by many factors, including the lack of popularity and a stronger emphasis on programming. Why bother with circuit design when there's so much more money to be had in programming?

Higher salaries in programming also serve as a stronger argument than learning the basics of chip design. Companies such as Microsoft, Apple and Google offer incentives to students and others who pursue a degree in programming, including internships and grants, which puts the dollar sign icing on the software engineering cake.

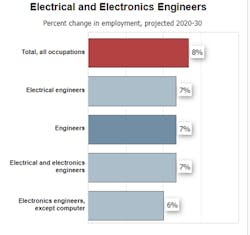

The U.S. Bureau of Labor Statistics (BLS) supports that outlook, as both have all but stalled in growth. The slow rate of advancement in most manufacturing sectors is getting much of the blame for the stall in these occupations. This bleak view of the field directly contrasts with industry claims that the U.S. has a massive shortage of skilled electrical engineers.

Companies in the U.S. claim this isn’t a problem of falling demand, but a reduced investment in American workers, favoring lobbying Congress for low-cost foreign labor. Others claim that the demand for American electrical engineers will increase if the U.S. insists on building the rockets that launch astronauts, satellites, weather, and GPS equipment in this country instead of contracting with other nations.

The BLS predicts (Fig. 4) that most of the opportunities for electrical and electronics engineers will come from engineering services firms as companies look to contracting to save costs. Some companies also are turning to the current engineering pool to help mitigate the chip shortages, which was pointed out in an article from Harvard Business Review.

Dealing with Shortages

Manufacturing experts state they’re adjusting the way companies design their products to mitigate the shortfalls of limited hardware. Among their strategies are to incorporate more software into the components or replace premium components with standard substitutes.

A report released by Avnet, a U.S. component distributor, backs up this claim by stating that 55% of engineers surveyed said they were redesigning hardware due to limited supplies and increased prices. It also points out that those same engineers had to delay the development of new hardware or incorporate standard components into premium designs.

Using those strategies only puts increased pressure on the engineering skills market, which could derail efforts to stay at the forefront of next-gen technology that becomes more complex with every evolution. Some companies, such as AMD, Intel, and NVIDIA, are looking to build their own fabrication and manufacturing plants to reduce costs and increase the production of chips currently being outsourced to countries such as Taiwan and South Korea.

Moreover, the $2.3 trillion U.S. infrastructure plan earmarks $50 billion for semiconductor R&D and production within the U.S. in an effort to increase supply. Intel is doing something similar in the EU by investing $33 billion to secure the European market and create 3,300 high-tech jobs in the process.

The strategies put in place will undoubtedly benefit production. However, building new plants and infrastructure are at minimum two years away, and using design stopgap measures is akin to placing Band-Aids on the cracked façade of a dam bursting at the seams. This will place enormous pressure on companies to hire skilled engineers over a shorter time span, as training new talent will only push operations further into the future.

Era of the Contract Engineer?

The effects of the pandemic also ushered in a new modicum of working from home, and hiring freezes have forced companies to alter their strategies to take advantage of contracting engineers to cover the increase in market needs. This process ensures innovation and growth can continue, although the highly sought-after veterans will usually take a reduction in salary due to the non-negotiation practices that typically accompany contract work.

While it may sound contradicting, freelance engineers working contract gigs often find themselves in a position to take on more prominent roles that will benefit them in the long run. It's not uncommon for engineers in these positions to talk with clients on design aspects, engage manufacturers on production runs, and act as liaisons with software engineers.

Being able to multitask, especially on the engineering level, is a skill worth its weight in platinum. Perhaps that's the route new engineers should consider over a long-term career path. How to get today's youth interested in electronics and electrical engineering isn't something tech companies currently have a stopgap solution for, primarily if the money lies in other fields.