A recent report from Global Marketing Insights brings to light the potential use of waste heat to produce electricity for various industries. More installations of heating units across utility, industrial, and commercial applications, along with growing focus to reduce operation and maintenance expense, will propel the waste-heat-to-power market size. Stringent government regulations to mitigate greenhouse gas (GHG) emissions, coupled with ongoing measures toward energy conservation, will further complement the business outlook.

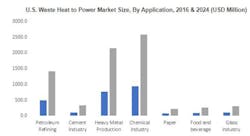

In 2014, the European Union, under 2030 climate and energy framework, has set a target to reduce GHG emissions by 40% from their 1990 level. Figure 1 shows market size in 2016 and the projections for 2024.

1. Shown is the U.S. waste-heat-to-power market size, according to application. The blue represents the year 2016, and the gray is year 2024 projections.

Rapid industrialization and urbanization along with increasing demand for clean fuel energy will push the waste-heat-to-power market, too. And replacement and retrofitting of existing power stations with efficient systems will further augment the product landscape. In March 2017, the government of China announced it will spend US$2.17 trillion on infrastructure and transportation projects during its 13th five-year plan.

Rising electricity demand coupled with volatile fossil-fuel prices will foster the waste-heat-to-power market growth. Increasing demand for waste-heat utilization from commercial and industrial sectors to reduce energy bills will further complement the industry growth. According to the U.S. energy information administration, the commercial and industrial sector consumed around 4,450 trillion BTU of energy in 2016.

A Look at the Technology

An important factor in waste-heat-to-power (WHP) generation is the thermodynamic limitations on power generation at different temperatures. The efficiency of power generation depends on the waste-heat source temperature. Generally, power generation from waste heat has been limited to only medium- to high-temperature waste-heat sources. However, advances in alternate power cycles may increase the feasibility of generation at low temperatures.

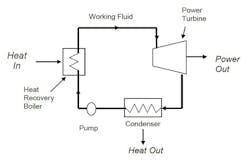

Most of today’s waste-heat power systems employ a liquid working fluid that’s pumped to an elevated pressure before entering a heat-recovery boiler. The pressurized fluid is vaporized using energy captured from waste heat, and then expanded to lower temperature and pressure in a turbine, generating mechanical power that drives an ac alternator. The low-pressure working fluid is then exhausted to a condenser where heat is removed by condensing the vapor back into a liquid. The condensate from the condenser is then returned to the pump and the cycle is repeated.

The working fluid in an Organic Rankine Cycle (ORC) is a hydrocarbon, such as hydrofluorocarbon, or ammonia. This ORC design consists of an evaporator (“boiler”), expander (“turbine”), preheater, condenser, and regenerator (Fig. 2). The regenerator improves efficiency by pre-heating the working fluid with energy that would otherwise be rejected. The working fluid in an ORC machine typically has a lower boiling point than water.

2. This is a basic Organic Rankine Cycle heat-to-power system.

Fluids used in ORCs have thermodynamic properties that enable operation with waste-heat sources that have temperatures near 200°F, or even lower. Operation at such low temperatures, however, is typically only cost-effective when using a liquid waste stream, which allows the use of a liquid-to-liquid heat exchanger. For a hot exhaust from an industrial process, a temperature of at least 500°F is typically required for commercially available technologies.

Global Insights said that the ORC WHP market share is predicted to witness growth over 17% by 2024. Ease of parity with different heat sources, low maintenance, and less space utilization are some of the key features that make its adoption preferable over other alternatives. Increasing demand for low-grade heat recovery and implementation of systems in lower-capacity decentralized power plants will stimulate the product penetration.

Another current WHP process employs the Kalina cycle, which is a variation of the Rankine cycle. It uses a binary fluid pair as the working fluid (typically water and ammonia). In addition to the classic four-stage Rankine cycle components (evaporator, turbine, condenser, compressor), there’s a distillation-condensation subsystem consisting of a series of separators, heat exchangers, and pumps.

The Kalina cycle is specifically designed for converting thermal energy to mechanical power, optimized for use with thermal sources that are at a relatively low temperature compared to the heat-sink (or ambient) temperature. The primary difference between a single fluid Rankine cycle and the Kalina cycle is the temperature profile during boiling and condensation. In the ORC cycles, as heat is transferred to the working fluid, its temperature slowly increases to the boiling temperature, at which point the temperature remains constant until all the fluid has evaporated.

In contrast, a Kalina cycle’s binary mixture of water and ammonia (each of which has a different boiling point) will increase in temperature during evaporation. This process allows for better thermal matching with the waste-heat source, and with the cooling medium in the condenser in counter-flow heat exchangers. Consequently, these systems have relatively good energy-efficiency performance compared with other WHP thermodynamic cycles.

Operating efficiencies for a Kalina cycle WHP system are around 15% with a heat-source temperature of 300°F. Because the phase change from liquid to steam isn’t at a constant temperature, the temperature profiles of the hot and cold fluids in a heat exchanger can be closer, thus increasing the overall efficiency.

Thermoelectric Techniques

Another approach for converting waste heat to power is the use of a thermoelectric module (TEM). TEMs employ a thermoelectric generator, which is a solid-state device that converts temperature differences directly into electrical energy through a phenomenon called the Seebeck effect. The TEM produces a dc output that must be applied to an inverter to obtain an ac output. Producing the appropriate ac output for the load usually requires multiple TEMs.

The TEM creates an output voltage from a temperature difference. It has a hot side (contacting heat source) and a cold side (usually atmosphere). N- and P-type semiconductor materials work together to drive electron flow resulting from the thermal gradient between the cold and hot sides. The thermoelectric couples are arranged thermally in parallel and electrically in series, terminating in a pair of leads. The voltage across the leads depends on the module design. It’s proportional to the Seebeck coefficient (S) and the temperature difference (ΔT), V = S (ΔT)

A thermoelectric module needs a large temperature gradient to generate electricity, something that’s technically challenging to implement. In a power-generation system, the heat for the hot side of this temperature gradient must be supplied efficiently from a heat source.

The cold side must be cooled by air, water, or another suitable medium. To supply this heating and cooling, heat exchangers are used on both the hot and cold sides. A TEM power-generation system can be thought of as two heat exchangers, each of which have to move heat to (or from) the hot (or cold) side of the thermoelectric modules.

Maximizing the efficiency of a thermoelectric power-generation system requires extensive engineering design. Tradeoffs between total heat flow through the thermoelectric modules and maximizing the temperature gradient across them must be balanced.

TEMs have several advantages:

- Solid-state construction features no moving parts, resulting in higher reliability

- Units can be mounted in any orientation

- Devices are environmentally friendly because they use no CFC’s and electrical noise is minimal

- TEMs can be used as energy harvesters, turning waste heat into usable output DC power

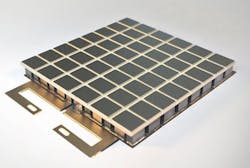

Alphabet Energy (Hayward, Calif.) employs thermoelectric modules to extract waste heat. Alphabet’s PGC “cap” attaches to the top of a combustor, captures the high-temperature exhaust heat (across a range of fuel inputs and combustion temperatures), and passes the heat through Alphabet Energy’s PowerModules, each containing heat exchangers and proprietary thermoelectric material (Fig. 3). The PGC converts the combustor exhaust heat into continuous electrical power while still meeting combustion requirements, all at improved combustion efficiency. Backup batteries and a pipeline assist-gas system ensure power output is continuous.

3. The Alphabet Energy PowerCard-γ is a thermoelectric device that utilizes state-of-the-art thermoelectric materials, namely tetrahedrite and magnesium silicide stannide.

Leveraging nanotechnology research from Lawrence Berkeley National Laboratory and Michigan State University, and with over 60 patents issued and filed, the company’s proprietary PowerBlocks thermoelectric material is the key to converting waste heat into electrical power.

A new generation of thermoelectric materials is attracting a growing interest for waste-heat recovery and autonomous temperature control in Europe. Public research institutes and industrial research teams are involved in the INTEGRAL project that’s studying this new generation of thermoelectric technology. It’s using existing and growing pilot industry lines to address mass markets (transport, process industries) and produce advanced functional materials with customized electrical and thermal conductivities.

Furthermore, the large-scale manufacturing processes to be developed for producing nanostructured materials within the project cut across multiple sectors to find a wide range of applications outside thermoelectrics, i.e., where customization of electrical or thermal properties of sintered or casted materials are needed.

Industrial Applications

These systems are primarily used to generate electricity by capturing discarded heat by an existing process. They’re mostly employed by industries such as petroleum refining industry, chemical, primary metals, nonmetallic minerals, fabricated metals, and paper industries. Growing electricity demand across developing countries along with escalating electricity prices in developed countries will further boost the product penetration.

Cement applications in 2016 accounted for over 22% of the global WHP market share. Growing investments toward infrastructure development, coupled with industry focus to meet the energy demand by utilizing residual heat, will further embellish growth. Adoption of these systems will reduce the overall operational cost, which will boost the product penetration over the forecast timeframe. On an average, electric power accounts for approximately one-fourth of total operating cost of a cement plant, where WHP system can generate around 30% of overall electricity needs.

Petroleum-refining applications are predicted to reach over US$4 billion by 2024. Increasing demand for refined petroleum products along with growing measures toward energy conservation will fuel the WHP market. Escalating electricity prices coupled with enacted regulations to control emissions will further complement the business growth. In January 2017, the U.S. crude oil distillation capacity reached 18.6 million barrels per calendar day, which is 1.6% higher when compared with 2016.

Growing measures toward energy conservation coupled with increasing investment toward clean energy technologies will also fuel the U.S. WHP market size. Greater need for expansion and retrofitting of existing industrial equipment owing to strict government emission standards will further complement business growth. The U.S. Environmental Protection Agency (EPA) introduced national emission standards under the Clean Air Act to limit emissions of hazardous air pollutants like carbon dioxide, mercury and particulate matter.

U.K WHP market size is predicted to reach over 500 MW by 2024. Favorable government policies toward adoption of energy-efficient systems, along with rising concerns to curb carbon emissions, will augment the industry outlook. In Europe, manufacturers are required to be compliant with the Industrial Emission Directive (Directive 2010/75/EU) adopted on November 24, 2010, with an aim to regulate pollutant emissions from industrial installations.

Growing investments across the chemical industry coupled with a positive outlook toward heavy metal and cement manufacturing will likely stimulate the China WHP market size. The country holds a dominant position in the chemical industry across the globe, which is likely to boost product demand. Escalating energy prices along with growing measures toward reducing carbon footprints will further enhance the industry outlook.

The Saudi Arabia WHP market is predicted to witness a growth over 14% by 2024. More investment into water desalination industries along with rising electricity demand should augment the business landscape. In January 2016, Saudi Saline Water Conversion Corporation (SWCC) had announced it will invest around US$80 billion toward desalinated water production by 2025.

Market Share

Notable players in the WHP market include Siemens, Thermax, ABB, Mitsubishi, Ormat, Amec Foster Wheeler, ElectraTherm, Kalina Power, Cyplan, AQYLON, Enogia SAS, Triogen, and Echogen.

Advances in technologies to recover low-grade heat along with highly customized products for several industrial applications have resulted in a competitive industrial scenario. Effective technical and after sales support coupled with quicker lead time will further enhance the business outlook.