NXP Bets on 5G Networks With Radio-Frequency Chip Plant in US

NXP Semiconductors plans to start manufacturing power amplifiers and other radio frequency chips at its latest US production plant in late 2020 to meet booming demand for 5G telecom equipment.

The Netherlands-based company formally opened the factory in the city of Chandler south of Phoenix, Arizona, where it will manufacture chips based on gallium nitride (GaN) that are a major contender for use in 5G base stations. The chips can handle the high frequency bands or millimeter waves used by 5G networks while sapping much less power and occupying less space than silicon transistors.

“Today marks a critical milestone for NXP," chief executive officer Kurt Sievers said at a virtual opening ceremony for the fab, which was attended by Arizona Senators Kirsten Sinema and Martha McSally, US Representative Greg Stanton, and Arizona Governor Doug Duchy. Sievers added that "we are able to bring focus to GaN technology as part of driving the next generation of 5G base station infrastructure.”

The announcement comes at a time when the semiconductor industry is lobbying for billions of dollars of subsidies to lure more chip production to the United States. The US has seen its share of the global production capacity for chips decline sharply to little more than 10% in recent decades as China and other countries invested billions of dollars of incentives to persuade companies to build chip fabs.

The move follows the US government's courting of TSMC, the world’s top contract chip manufacturer, which plans to build its latest production plant in the US at an overall cost of $12 billion over a decade.

GaN is far more energy-efficient than its silicon counterparts, including LDMOS technology at the heart of radio amplifiers used in 4G networks today. GaN is a wide bandgap semiconductor, which means that chips based on it can handle far higher voltages in a smaller footprint than silicon while currents can run through the device faster. NXP said that GaN has become the "gold standard" for use in 5G base stations, bringing huge leaps in performance in both power density and efficiency. NXP is trying to bolster its supply of the advanced chips as the rollout of 5G networks continues all around the world. RF chips based on GaN are also used in radar, aerospace, and defense systems.

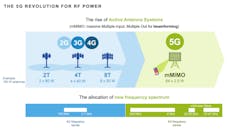

The 5G standard delivers far faster data rates than 4G LTE networks in part by broadcasting over millimeter waves—and in part by adding arrays with many more antennas at the base station. The latest 5G hardware can have from 32 to 64 antennas, giving it more lanes to communicate with a user's smartphone or other device. But the use of so many more antennas in 5G networking gear also means more RF power amplifiers are needed to boost the cellular signal, according to NXP.

These antenna arrays are needed to take advantage of another technology: massive MIMO. With it, 5G radios can broadcast to many more users at once, increasing the overall capacity of networks.

NXP said that its customers are facing challenges in power management and heat as more and more RF parts are packed into a single box of 5G telecom-equipment While 5G base stations pump out 50% more power than 4G equipment, maintaining the box's size and reducing power are mandatory. To fit more power into the same footprint, more power-efficient radio amplifiers are needed. NXP said its GaN devices are ideal for handling higher power density in a smaller area without overheating.

The 5G standard is used to upgrade 4G networks with other types of hardware, including clusters of small cells and other short-range networking gear with rigorous thermal and power requirements to add throughput and deliver faster data rates than 4G LTE technology. More than 10 million 5G base stations could be deployed globally by 2024, according to market research firm Strategy Analytics.

NXP is competing against Qorvo, Skyworks Solutions, Analog Devices, and others to supply power amplifiers and other frequency chips based on GaN to telecom-equipment vendors. Global sales of GaN RF components are on pace to increase from $740 million to more than $2 billion by 2025, due to rising demand in 5G networks and military radar, according to market researcher Yole Developpment.

One of its leading customers is Ericsson, the world's second-largest telecom equipment maker. NXP also sells 5G SoCs that can be installed in the baseband unit of the radio access network (RAN).

Paul Hart, executive vice president and general manager of the radio frequency power business unit at NXP, said it was the most advanced GaN fab in the US rolling out RF power amplifiers for 5G networks. It is also bringing GaN research and development inside the fab so that engineers can coordinate more closely, reducing the time it takes to bring products to market and roll out future generations of GaN.

NXP, which also sells radio frequency chips based on LDMOS, SiGe, and GaAs for cellular networking gear, said that it plans to start volume production at the 150-millimeter GaN fab by the end of the year.