What Can the Solar Revolution Tell Us About the EV’s Future?

Members can download this article in PDF format.

What you'll learn:

- Will EV adoption follow the traditional hockey stick curve?

- Parallels between solar energy and EV technology challenges and adoption rates.

- Key "step functions" for EV batteries.

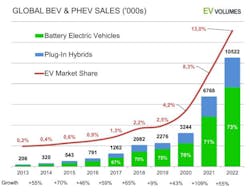

Although electric-vehicle (EV) technologies are receiving lots of attention these days, some industry skeptics are still unsure if they will ever replace internal combustion engines (ICE) in most automotive applications. And if they do, will the transition be measured in years or decades (Fig. 1)?

While the rate of this transition depends on a complex mix of economic, social, and political factors that are nearly impossible to quantify, it may be possible to make an educated guess about when EVs will go mainstream. This is based on what we know about how solar electric power went from being a fringe technology to a major force in the global energy market.

Follow the Hockey Stick

A decade's worth of sales data shows that EVs appear to be following the classic "hockey stick" adoption curve experienced by most modern technologies, including personal computers, cell phones, and solar-electric systems. This is characterized by years of small but steady increases followed by an inflection point where sales begin to accelerate in a near-exponential manner.

But after nearly a decade, global EV sales remain a tiny fraction of the market, and an even smaller fraction of U.S. sales (3.55% in 2021). So where will this inflection point occur for EVs—or has it already happened (Fig. 2)?

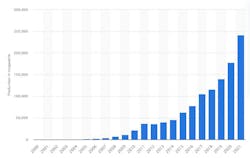

Perhaps the history of the solar industry's emergence into the mainstream economy can provide us with enough information to make an educated guess. As Figure 3 shows, this inflection point occurred for solar panels around 2009. We'll look at why this happened shortly.

EVs face several hurdles that are slowing their rate of adoption, including the need for a better public charging infrastructure and multiple supply-chain shortages. However, arguably the biggest challenge confronting EV manufacturers is delivering products that cost roughly the same as an equivalent ICE-powered vehicle.

According to a recent study conducted by findmyelectric.com, most estimates put the average price of a new EV somewhere around $64,000.1 For comparison, the average price in 2023 of a new car of any kind in the U.S. is around $48,000. Part of this price gap will close due to economies of scale that occur as production volumes grow. Still, a large part of the difference won't go away until batteries, which accounted for 30% to 40% of the cost of an EV in 2022,2 become significantly less expensive.

Since the solar module industry faced a similar problem in the early 2000s, the factors that affected the industry's success can provide us with some excellent clues about how the EV battery market will unfold over the next few years.

Solar Inflection

Back before 2008, the solar-module industry faced a similar problem. In 2007, the average cost of a photovoltaic (PV) panel was roughly $4 per watt, making it impractical for most applications. Nevertheless, there was enough demand to help drive the cost down to under $3/W by 2008, which made them cost-effective for many more applications.

By 2009, the increased demand had helped drive the cost of PV modules to just above $2, a point where they could compete with fossil-generated electricity in some parts of the country. At this juncture, utilities and homeowners who could now afford to adopt solar helped push the cost below $1/W within a couple of years, leading to even more cost-effective applications.

Figure 4 shows the steadily falling cost of PV panels, which eventually drove the market to an inflection point around 2009. But also note that the price decline flattens out slightly between 2010 and 2011, which can be correlated to an even more dramatic flattening in Figure 3's demand curve between 2011 and 2012.

Far from a drop in demand, the data reflects the point where demand for solar panels rose so quickly that it outstripped the supply of silicon wafers being used to make both the solar panels and computer IC chips. The sharp rise in demand for solar cells was so sudden that the companies making raw silicon wafers could not expand their production facilities fast enough, resulting in shortages and rationing.

In the long run, though, the "great silicon shortage" turned out to be a blessing in disguise because it forced the solar industry to get very clever about the materials it used, and how it used them. First, they found ways to produce much thinner solar cells, enabling them to produce two to four times the number of cells from the same kilogram of silicon than they had before.

They also retooled their manufacturing processes to use a slightly less pure grade of silicon called "metallurgy-grade," which was easier to produce and significantly less expensive. These changes, along with new processes that dramatically improved the efficiency of solar cells, eventually helped drive the cost of a panel down to 27 cents per watt by 2021.

A Tipping Point for EV Batteries?

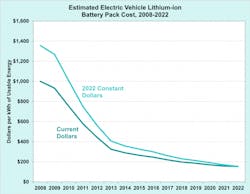

EV batteries have been undergoing a journey that is eerily similar to what solar modules went through over a decade before. It's difficult to say if the EV battery industry has reached an inflection point similar to the one that the solar industry experienced in 2010 yet. However, many signs indicate that, barring economic disaster, the anticipated sharp upturn is likely to be a year or two away.

Much like the solar industry’s silicon shortage, EV battery prices are being kept artificially high due to political tensions in a region where much of the lithium, nickel, and other critical materials are currently sourced from (Fig. 5). This problem should be relatively short-lived as several large lithium deposits have been discovered in North America, India, and other “friendly” countries, and work is already underway to develop them. There are also similar efforts to develop new sources for other critical battery materials.

In addition, two technology step functions in the pipeline are expected reduce the battery's contribution to the balance of vehicle cost to 28% by 2024 and 22% in 2028. But things may happen even faster.

The first step function will happen over the next two to three years as lithium-ion battery manufacturers adopt new processes that can be used to retrofit their existing battery plants to produce cells with much higher energy densities (i.e., less lithium, less weight per kWh). These technologies use most of the existing manufacturing process, but they replace the equipment and materials used to form the cell's carbon-based anode with silicon-based structures that enables much higher energy densities and, in most cases, more charge/discharge cycles.

In addition to reducing the amount of lithium required to store a kWh of energy, some of these new chemistries reduce or eliminate the need for nickel, cobalt, and other "strategic" minerals required to produce today's batteries. It's expected that batteries based on technologies from companies like Enovix and NanoGraf will begin volume production in 2024.

The next step function will occur a few years later as novel battery architectures that use even less lithium—or none at all—begin to enter the market. Some companies, such as Amprius will employ novel silicon-anode structures to deliver even higher energy densities, but they need to be manufactured on a completely new production line.

Many other such batteries use radically different chemistries based on abundant, inexpensive materials like aluminum, salt, and sulfur. For example, Drexel’s College of Engineering recently announced promising news about a sulfur-based battery architecture that may offer 3X the capacity of Li-ion batteries and last more than 4,000 recharges—far more than the 500-1,000 cycles typical of most Li-ion cells.4

While Drexel's promising technology will probably take five to 10 years to commercialize, several sulfur-based technologies are much closer to entering the market. For example, a solid-state lithium-sulfur battery architecture developed by Theion is expected to enter limited production this year.

Theion's novel chemistry combines sulfur’s crystal material properties with carbon nanotubes and a proprietary solid electrolyte. The company says its batteries will offer low cost per kWh of storage and fast-charging characteristics. And, according to Theion, they will eventually be able to deliver 2,000 W/kg and maintain near-full capacity for 1,000+ charge cycles across its −20 to 60°C operational temperature range.

So, how soon?

It's difficult to say for sure precisely where EV batteries are on the adoption/price curve, but even the most conservative estimates put the market roughly two years away from a steep, steady rise in demand. Hopefully, this will give battery manufacturers and their vendors enough time to find more reliable sources for lithium and other enterprise-critical materials or, as their counterparts in the solar industry did, adopt lower-cost alternatives.

Meanwhile, today's supply-chain bottlenecks will work their magic to incentivize development of storage technologies. Such tech will play an important role in bringing the cost of EVs to their own inflection point, allowing them to compete effectively with ICE vehicles in nearly all markets.

References

1. “Electric Car Prices: Average Electric Car Cost in 2023,” January 2023, Findmyelectric.com.

2. “Electric Vehicle Battery Costs Soar,” Institute for Energy Research, April, 2022.

3. “EV Batteries Almost 90% Cheaper Today Versus 2008, DOE Estimates,” Andrei Nedelea, Inside EVs, January 2023.

4. “Breakthrough in Cathode Chemistry Clears Path for Lithium-Sulfur Batteries’ Commercial Viability,” Drexel News, Feb 22, 2022.

5. “Advanced Battery Technologies Will Help Transform Our Energy Economy,” Lee Goldberg, Electronic Design, November, 2022.