Intel Corp. and Altera Corp. announced a definitive agreement under which Intel would acquire Altera for $54 per share in an all-cash transaction valued at approximately $16.7 billion.

The acquisition will couple Intel’s leading-edge products and manufacturing process with Altera’s leading field-programmable gate array (FPGA) technology. The combination is expected to enable new classes of products that meet customer needs in the data center and Internet of Things (IoT) market segments. Intel plans to offer Altera’s FPGA products with Intel Xeon processors as highly customized, integrated products. The companies also expect to enhance Altera’s products through design and manufacturing improvements resulting from Intel’s integrated device manufacturing model.

“Intel’s growth strategy is to expand our core assets into profitable, complementary market segments,” said Brian Krzanich, CEO of Intel. “With this acquisition, we will harness the power of Moore’s Law to make the next generation of solutions not just better, but able to do more. Whether to enable new growth in the network, large cloud data centers, or IoT segments, our customers expect better performance at lower costs. This is the promise of Moore’s Law and it’s the innovation enabled by Intel and Altera joining forces. We look forward to working with the talented team at Altera to deliver this value to our customers and stockholders.”

“Given our close partnership, we’ve seen firsthand the many benefits of our relationship with Intel, the world’s largest semiconductor company and a proven technology leader, and look forward to the many opportunities we will have together,” said John Daane, president, CEO, and chairman of Altera. “We believe that as part of Intel we will be able to develop innovative FPGAs and system-on-chips for our customers in all market segments. Together, we expect to drive meaningful value for our customers, partners, and employees around the world. This is an exciting transaction that provides immediate and significant value to our stockholders. We look forward to working closely with the Intel team to ensure a smooth transition and complete the transaction as quickly as possible.”

Altera will become an Intel business unit to facilitate continuity of existing and new customer sales and support. Intel plans to continue support and development for Altera’s ARM-based and power-management product lines.

The transaction is expected to be accretive to Intel’s non-GAAP EPS and free cash flow in the first year after close. Intel intends to fund the acquisition, which is expected to close within six to nine months, with a combination of cash from the balance sheet and debt.

The transaction has been unanimously approved by the Intel and Altera boards of directors and is subject to certain regulatory approvals and customary closing conditions, including the approval of Altera’s stockholders.

What It Means

According to Tom Hackenberg, principal analyst, embedded processing for IHS, Intel’s largest purchase comes on the heels of a long series of semiconductor mergers and acquisitions–including last week’s announcement that Avago had agreed to purchase Broadcom Corp. for $37 billion.

Prior competitor mergers also include NXP and Freescale, Cypress Semiconductor and Spansion, Lattice Semiconductor and Silicon Image, Qualcomm and CSR, Infineon and International Rectifier, and several more. While none of these companies directly competes with Intel for its largest market—PC central processing units (CPUs)—each of these mergers has had an influence on various embedded markets where Intel has a stake.

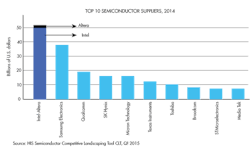

Intel is the largest supplier of microprocessors (MPUs) in the world, with overall semiconductor revenues nearing $50 billion in 2014 and MPUs comprising 80 percent of that revenue. While not as large as Intel, with $2 billion in 2014 revenues, Altera is the second-largest supplier of programmable logic devices (PLDs) and system-on-chip (SoC) FPGAs.

The largest markets for Intel’s MPU solutions are CPUs for portable PCs and tablets, desktop PCs, notebooks, servers, and high-performance computing (HPC) platforms. In the last several years, demand has flattened for desktop PCs and the forecast for portable PCs has begun to slow. Much of this market sluggishness has been related to the introduction of more portable computing platforms, such as smartphones and tablets. IHS predicts that the tablet market is entering a saturation phase, with larger sizes also entering a slowing growth. More relevant to the Altera purchase, Intel supplies a host of integrated chip solutions to many markets beyond computers, and it is in many of these markets that Intel has the most potential for continued growth.

Communications infrastructure and data-center equipment comprise some of the largest synergetic markets for Intel and Altera. Intel is already the leading supplier of high-performance wired and wireless telecommunications infrastructure processor solutions and—with an increasing market for IoT connected devices—these markets provide even greater opportunity for the right solutions. Altera’s position as a strong supplier of broadband, networking, and telecommunications solutions was likely a crucial consideration for Intel when the company decided to purchase Altera.

On the whole, Intel’s x86 microprocessors and applications processors would be highly complementary to Altera’s broad base of programmable logic, especially for networking solutions. Intel microprocessors are optimized for high-performance control, and Altera PLDs and FPGAs are flexible and can be easily configured to process huge parallel streams of packet data as a co-processor to the MPU, which could be a key strength of the acquisition. There are a few small overlaps to consider, such as the Altera SoC FPGA with embedded ARM Cortex A processors. Whether Intel will continue to develop ARM core-based solutions, a strategy it tried and abandoned with the XScale technologies, will be the type of strategic choice IHS will continue to follow after the acquisition.

There are many applications and markets where a high-performance MPU and configurable logic are designed to work side by side: industrial applications for military and aerospace; manufacturing and process control; automotive applications; security and surveillance; broadcast; and many more. Even in HPC, FPGAs will perform co-processing functions. Whether it is offering complementary solutions, or combining intellectual property, in order to create new unique SoCs, the combined potential of Intel and Altera should be well poised to target a growing telecommunications market and IoT applications.

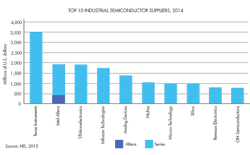

Robbie Galoso, principal analyst, industrial semiconductors, for IHS, says the Intel-Altera merger would have generated almost $2 billion in industrial semiconductor revenues in 2014, which equates to roughly 5% of the overall global industrial semiconductor market. The merged Intel-Altera would rank second, behind Texas Instruments, which is a leap from Intel’s previous rank of fourth and Altera’s previous rank of 29th.

The combined company would achieve impressive industrial electronics worldwide market-share gains, especially in the following categories: manufacturing and process automation (ranked second); military and civil aerospace (ranked second); and test and measurement (ranked fourth).

The Intel-Altera merger is complementary, given that essentially each company manufactures different types of semiconductors. The Intel-Altera merger would combine Intel’s leading position in industrial MPUs with Altera’s second-ranked position in industrial PLDs.