Inverters fight for traction

When it comes to electric vehicles (EVs), battery technology makes most of the headlines. Automakers are on a well-chronicled quest to boost energy density and lighten up batteries that will power the next generation of EVs. But though it doesn't attract the fanfare, inverter technology is on the same do-more-with-less trajectory.

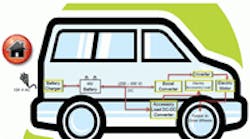

All EVs or hybrid electric vehicles (HEV) use solid-state inverters to convert the direct current from the batteries or generators to three-phase alternating currents that drives the propulsion motors. The critical power-handling semiconductor components in the inverter are insulated gate bipolar transistors (IGBTs), diodes, and a dc bus capacitor that suppresses voltage ripple and provides temporary energy storage.

When the vehicle accelerates, the inverter can get frying-pan hot. It typically must dissipate around 250 W of heat per power device at a heat flux reaching 300 W/cm2 while keeping the chips below 125°C.

Heat removal technologies in this kind of environment are critical. But the first generation of thermal management hardware in EV inverters is relatively simple and unsophisticated. There is little attempt to save weight and space. The typical approach is to use passive heat spreaders and thermal grease between the power device and a heat sink. Problem is, this setup presents a high thermal resistance. As a result, current HEV electric power inverters circulate water-ethylene glycol coolant over the heat sinks at about 70°C. But this sort of dedicated cooling loop is complicated, heavy, bulky, and expensive.

That's important because inverters are in the “cannot fail, zero-tolerance” category of EV components. Another reason for concern about the cost of inverter electronics is that the inverter is lumped together with the EV battery when figuring the cost of the overall electric drive system. That may seem like a trivial point, but there is some thought in the industry that future government rebates and incentives could hinge on overall electric drive efficiency.

An indication of the trend is the latest Electrical and Electronics Technical Team Roadmap from the U.S. Dept. of Energy (DoE). It sets a high bar for manufacturers of EV components and vehicles. These requirements include getting the cost of the electric drive system to under $12/kW by 2015 and to $8/kW by 2020. Among other things, the roadmap also wants manufacturers to develop better coolants for handling higher temperatures, along with more efficient replacements for bulky electrolytic bus capacitors at the front end of the car's dc/dc converter and (dc/ac) inverter blocks.

Inverters are using advanced components and semiconductor technology to hit these goals. Some prototypes reportedly sport power modules fitted with silicon-carbide (SiC) and gallium-nitride (GaN) power semiconductor devices that have a high thermal conductance and thus can reduce system size to one-quarter of that today, but these aren't yet practical. The cost of the exotic power devices is still through the roof.

Silicon savvy

One way of reaching EV inverter roadmap targets is through novel topologies that reduce the power-handling demands on key components. An example is a Z-source inverter under investigation at Oak Ridge National Labs (ORNL). The “Z” moniker arises because the circuit uses what might be called an impedance-matching L-C network between the dc source and the switching devices. The L-C devices provide temporary energy storage. The components themselves can be physically smaller than the single capacitor storing energy in conventional V-source inverters. Elimination of this capacitor is important because it can account for over 20% of the cost and weight of an ordinary inverter, and about 30% of its volume, ORNL researchers say.

The Z-source inverter also is advantageous in that it can supply ac voltages exceeding the level of the dc source. The buck-boost action that makes this possible comes about through use of a “shoot-through” mode in the switching circuits, wherein both legs in one phase of the inverter bridge are on simultaneously. Conventional inverter designs guard against this condition because it can destroy the IGBTs in the bridge, and because it causes EMI. But the Z-source inverter manages the condition and uses it to realize the buck-boost operation.

The Z-source design at ORNL also eliminates any need for reverse-blocking diodes across the switching IGBTs, and it tolerates open circuits in the phase legs as well. Researchers say this could halve the footprint of the power modules used in the inverter.

Page 2 of 4

ORNL researchers say they have produced a prototype dual-motor inverter that weighs half that of equivalent conventional designs and occupies about half the volume as well, coming in at 16.6 kW/L and 4.89 kW/kgm. Next year they plan to begin work on a 55 kW prototype.

ORNL's Z-source inverter is an exotic device. For most commercial inverter makers, however, the route to lower costs and smaller footprints involves using more advanced components and better heat sinking rather than trying to devise rocket-science inverter topologies. “The number-one driver from customers is to take the cost down,” confirms Monty Hayes, manager of Advanced Power Electronics at Delphi Corp. (Kokomo, Ind.) “Performance is a given. But customers expect us to continue to take the cost down. Reducing costs usually involves reducing the size and using smaller components. But that energy-dense strategy also demands better cooling facilities and devices that have lower losses. We need thermal stackers to take away the heat, and we can't create much heat to begin with. So this energy-dense strategy means new semiconductors, better system coolants, and new technologies for capacitors.”

There are some basic packaging issues associated with integrating the new materials into power circuits. “At one end, we need to reduce the thermal resistance of a MOSFET package,” explains Alessandro Campailla, product marketing staff engineer, Power and Discrete Devices, at STMicroelectronics (Lavonia, Mich.). “At the other end, we need to lower the on-resistance of the IGBT.”

But apart from the traditional arguments concerning trench-versus-planar IGBTs and MOSFETs, even the best silicon devices today are by most accounts nearing their power-handling limit. In response, some vendors are investigating silicon-carbide (SiC) devices on silicon substrates, as well as gallium-nitride (GaN) on silicon. Both technologies are extremely expensive now. But experts think the parts that will evolve in these areas just a few years hence may well become competitive. That prediction is a sign of progress. Just a year or two ago the industry figured we wouldn't see such devices much before 2020.

“SiC is already in production in a line of diodes for battery chargers,” says Campailla. “We also have some SiC transistors. They are extremely expensive.” Actually, Nissan in 2008 claimed to have the first inverter for vehicles that used SiC-with-silicon diodes. The semiconductor devices have a so-called heterojunction diode structure (named for the interface that is between two layers of dissimilar crystalline semiconductors). The inverter went into one of Nissan's fuel-cell vehicles. Nissan claimed the SiC diode is 70% smaller than silicon devices having the same power rating. Overall efficiency of the SiC devices is 20% better than that of equivalent silicon diodes. The inverter touted both size and weight improvements of 15 to 20%, owing to less of a demand on the cooling system.

GaN power semiconductors will take the form of MOSFETs in power supply circuits. Device manufacturers figure the time-line for GaN high-volume production will look something like that of SiC. “In 10 years, the technology will evolve to the point where silicon-carbide devices will cost ten times less than what we have today,” says Campailla. But even a few years will make a difference. “In two or three years, price-wise it will be only slightly higher, maybe by 10%, than standard silicon. The trick is to use a silicon substrate.”

It may be tough to predict how improved SiC devices and GaN will affect inverter costs. But many designers expect a reduction of at least 30%. That will be a significant improvement because by many accounts, inverter systems now cost as much as the rest of the electronics in the auto.

“Traction controllers on the average have about 18 of these diodes and IGBTs,” explains Joe Bolsenga, marketing director for the Automotive Business Unit, North America Region at STMicroelectronics. The impact of less expensive power semiconductors could be significant because power inverters so many of them. Because GaN and SiC power devices are more efficient, manufacturers are also shooting to halve the size of the inverter through, among other things, use of smaller heat sinks.

Page 3 of 4

“Traction controllers on the average have about 18 of these diodes and IGBTs,” explains Joe Bolsenga, marketing director for the Automotive Business Unit, North America Region at STMicroelectronics. The impact of less expensive power semiconductors could be significant because power inverters so many of them. Because GaN and SiC power devices are more efficient, manufacturers are also shooting to halve the size of the inverter through, among other things, use of smaller heat sinks.

Tip of the iceberg

No question that today's hybrid engine compartment is a harsh environment. And automakers can't make much headway squeezing costs out of the inverter without better thermal performance in the electronics. This goal force system integrators to buy bare die and build their own cooling-optimized packages around them.

Of course, there are various cooling techniques for chip packages. For instance, International Rectifier's double-sided cooling scheme mounts the silicon source and gate directly to the PCB. A protective metal lid covers the drain and acts as contact to the PCB. This minimizes package stray resistance. There is an efficient dissipation of heat because the drain attachment is through the lid and there is no mold compound to act as a thermal barrier as with other packages.

But manufacturers say it will take more than just cleverly heat-sinked chip packaging to deliver the performance expected of next-generation EV inverters. “It's one thing to enable the technology; it's another thing to implement it effectively on the system side,” summarizes Michael Wittmann, director of market development in the Automotive Products Business Unit of International Rectifier (El Segundo, Calif.). He explains that just because SiC and GaN devices are more efficient, “A given technology doesn't automatically qualify it for better thermal performance in an automotive inverter. You have to design the system around it. Customers have different mechanical designs, and the process is not straightforward.”

Indeed, system integrators recognize an automotive inverter design is a lot more than the sum of its parts. “Automotive design methods and targets don't work that way,” says Wittmann. “The integration of power electronics comprises a lot more than simply putting some components in a box.”

One problem: There are conflicting requirements. The design should be reliable if it meets overall thermal requirements. But fans, radiators, and other means of cooling electronics can be expensive. To get costs down, designers need to optimize standard cooling methods and make them more efficient.

Better packaging is one agent for balancing cost, size, and overall integration issues. The typical inverter for EV/HEV applications operates somewhere in the 10 to 25 kHz range; typical efficiency today is 90% (94% is the target set for 2015). If history is a guide, efficiency improves perhaps 1% with each new device family introduction. These efficiencies typically come from better die junction thermal ratings and specific IGBT switching points optimized for a switching frequency. Also, high-voltage IC (HVIC) drivers for driving the gate of IGBTs are looked upon as every bit as critical as IGBTs when it comes to improving efficiency and overall performance. These devices, too, have room to improve. A few companies like STM are working on high-voltage IC (HVIC) drivers that they imply are game-changers, but they will not talk about them; they say it's too soon. Indications are such devices are a year or two away.

But there have been incremental improvements in power stage devices. Recent developments in this area include new IGBT devices from International Rectifier, called Gen 6.5 parts, optimized for 10 kHz applications.

The biggest key to better performance seems to be in increased integration that will cut costs. “A lot of those changes will be happening at the system level, beyond the electronics,” explains Joe Bolsenga. “For instance, you won't likely need a dedicated cooling system, so you'll save significant costs there.” As for the savings to expect, it's still too early to say.

Page 4 of 4

Various power-module couplings may offer a degree of pricing relief. Some designers, for example, see a higher level of integration for such key component parts as the motor and the inverter in the same unit, a natural match, they say, because of the intimate nature of the energy-exchange cycle. (One example: Toshiba's recent deal to supply Ford with inverters and motors.)

Ultimate end-system cost to the buyer is another thorny issue. Even with all the media coverage given these vehicles, the typical consumer would be hard pressed to correctly tag the price for a specific EV/HEV at $25,000 or $40,000. In short, it's beyond most anyone's guess as to how the pricing structure will pan out for electric-based vehicles. Pricing roadmaps for the individual subsystems may be even more difficult to track. “It's tough to talk about the inverter in terms of the overall price of the vehicle,” says Gary Cameron, director of Power Electronics Engineering at Delphi Corp. “But they say the hybridization cost is $3k to $5k for the conventional power train. Well, what we can say now is that it's headed towards $3k and less towards $5k. Maybe half of that is the battery system, the other half is split between motor and inverter.”

RESOURCES

Aqwest LLC, http://www.aqwest.com/

Delphi Corp., http://delphi.com

International Rectifier, www.irf.com

Nissan Motor Co., www.nissan-global.com

STMicroelectronics, www.st.com

U.S. Dept. of Energy, www.eere.energy.gov

Z-source inverter explained, http://saturn.ece.ndsu.nodak.edu/ecewiki/images/a/a7/IEEE_-_Z_Source_Inverter.pdf

Want More?

http://eetweb.com/power-supplies/keeping-inverters-safe-0511/

Cost-conscious inverter makers focus on capacitors

Temperature specifications for EV power electronics are growing increasingly stringent and this trend means big changes in store for one of the least-thought-of components in the converter/inverter power chain: the dc input capacitor, which accounts for much of the power chain's weight and volume.

“These are 500 to 3,000 µF devices, says Delphi Corp.'s Gary Cameron. “We'll need improved dielectric constants, and that leads to better thin-films to make the capacitor smaller. The required ambient temps are going to 125 to 150°C, so we'll have to find materials appropriate for those temperatures. Standard polypropylene won't be able to handle it.”

Electrolytics can also be candidates, but they don't usually approach the performance of polymer film types when it comes to equivalent series resistance, ripple levels, temperature stability, reliability, and size. Alternatively, capacitor makers are also trying to develop suitable ceramic capacitors, which ideally compete with or exceed the capabilities of polymer in almost every way (The DoE roadmap calls for halving their cost, volume, and weight/microfarad by 2015).

Two areas remain questionable: how ceramics will fail if they do, and their cost. Designers are also looking at the related area of glass capacitors for their temperature stability and heat-handling qualities. The costs of these devices reportedly is low, but beyond that it's not clear whether large-scale devices would be suitable for EV inverters.

Inverter infrastructure

The typical inverter for vehicular applications drives the main motors and often doubles as diode rectifier to recharge the car battery during regenerative braking. But inverters for vehicular applications must work reliably in harsh environments - ambient temperatures hit at least 125°C, and system coolants typically work to 105°C. Industrial environments are frequently 20°C cooler.

“Typically six half-bridges provide a three- phase dc/ac output,” says Delphi Corp.'s Monty Hayes. “There's often a front-end stage to boost battery voltage (input from high-voltage battery packs might be in the range of 200 to 450 V).” The inverter bus might run anywhere from 400 up to 1,200 V for certain hybrids. The inverter must deliver somewhere in the range of 300 to 450 A RMS for light-duty vehicles, with fully electric vehicles generally drawing more current and having substantially different peak-to-average requirements than hybrid vehicles. And today's typical inverter spec calls for a minimum lifetime of about 17 years, about the same as that for batteries in hybrids such as the Prius and the Chevy Volt EV.