Modular Market Drives a Disruptive Change

Modular instrumentation has seen steady development, outgrowing the traditional box instrumentation over the past decade and the test and measurement market as a whole. Nevertheless, the traditional instrument market remains about 10 times the size of the open-system modular market, largely defined by PXI, VXI, and the emerging AXIe standard.

This is about to change dramatically, due to a number of factors. Powerful forces are igniting a disruptive change in the marketplace where open modular systems will become the dominant architecture for automated test solutions.

Nash Equilibrium

John Forbes Nash Jr. and two others won the Nobel Prize in Economics in 1994 for his breakthrough work in the mathematics of game theory. Portrayed in the film A Beautiful Mind by Russell Crowe, one of Nash’s contributions was the concept of the Nash equilibrium. Essentially, it describes a competitive equilibrium in a multiplayer game where each player keeps to a stable strategy because it is the optimal strategy given the strategies of the other players. Nash showed that there can be several equilibrium points, but a significant change must occur to move the game from one equilibrium to another.

Nash’s work is directly applicable to competitive markets including the test and measurement industry. For years, the automated test segment has been governed by a competitive equilibrium defined by powerful boxes. Based on the EIA 19-inch rack standard, GPIB interface, and most recently the LAN-based protocols of LXI, these traditional instruments have been the workhorses of the automated test industry.

In spite of this, open modular solutions have shown strong growth, taking market share in the core of many automated applications. Due to a variety of factors, there is growing evidence suggesting that the industry is transitioning to a new equilibrium: a disruptive shift where open-system modular architectures become the mainstream choice for automated test.

Enter Porter’s Five Forces

While Nash proved the existence of equilibriums, to understand why a shift to another equilibrium is occurring, it is necessary to look deeper at the particular forces involved. Enter Porter’s Five Forces. Conceived by Michael E. Porter, a leading authority on competitive strategy and a professor at Harvard Business School, the Porter Five-Force model is a useful framework to understand the dynamics of an industry (Figure 1). It consists of examining five key forces present in any industry:

- Substitute Products

- Competitors

- New Entrants

- Suppliers

- Customers

While the traditional use is to examine the competitive intensity in an industry, itself one of the five forces, it also can illuminate other industry dynamics. In the Porter Five-Forces model, modular products are an alternative to traditional instrumentation. When considering the potential of substitute products (in this case modular instrumentation), these five forces comprise a useful framework to explain the shift that is occurring in the test and measurement industry.

Force 1: The Potential of the Substitute Product

In many applications, a user has a choice between deploying modular instruments or traditional instruments or a combination of the two. In this context, modular instruments are largely a substitution for traditional instrumentation. For a shift to occur, the new architecture must have a compelling value proposition. When users are asked why they chose modular solutions, the four most common answers have been cost, size, speed, and flexibility.

The flexibility advantage is clear. Modularity brings scalability—the capability to add more channels or more functionality without purchasing an entire new instrument. Some product categories are naturally modular, such as switches and logic analyzers.

The industry is seeing a shift in these naturally modular product categories from proprietary architectures to open architectures. Vendors started this trend in the 1990s with VXIbus offerings of switches and data acquisition systems and then expanded these offerings into PXI in the 2000s. Recently, AXIe has enabled high-performance logic and protocol analyzers to be deployed in an open modular format as well. In summary, there are two trends occurring: the shift from boxes to modular and the shift from proprietary modular to open-system modular.

The speed advantages of modular solutions also are driving the shift. The high-speed serial fabric of PCIe allows the new standards of PXIe and AXIe to deliver solutions that are faster, smaller, and more flexible than their traditional counterparts. The speed comes from two aspects of PCIe: its total bandwidth and its short latency times. A four-lane PCIe connection can deliver 1 GB/s of bandwidth at Gen 1 speeds, equivalent to 10GbE. Double that for Gen 2 and double again for an eight-lane connection. This is a critical throughput advantage for many streaming applications or applications where large blocks of data are transferred.

Even more compelling is the interactive speed of PCIe-based instruments. Many automated test applications are based on stimulus-response testing where the aggregate bandwidth is not overwhelming but high interactive speed is essential. Here, the memory-mapped nature of PCIe has a clear advantage over a typical GPIB or LAN-based instrument. The memory-mapped architecture of PCIe avoids altogether any ASCII command interpretation or execution of the TCP-IP protocol stack needed to send even a single character.

Tests have shown that products as simple as a digital multimeter can realize orders of magnitude speed improvements by adopting register-based programming techniques enabled by PCIe. In high-speed production testing, the interactive speed often becomes the primary bottleneck.

Size is another advantage of modular instruments. With traditional front panels and keyboards eliminated, modular instruments can be packed into less rack space. This brings other advantages as well. The smaller the rack space needed, the shorter the cables and fixturing to the device under test. As device speeds increase, the cables become an increasingly critical part of a test system. Making these as short as possible helps ensure the measurement integrity needed.

Cost often is quoted as the principal advantage of modular instruments. However, when prices are compared to traditional instruments, the results are mixed. The theoretical advantage of eliminating the displays and keyboards often is neutralized by the cost of the chassis and the extra cost per module of supporting the backplane interface. Vendors will promote their own favorite comparisons between boxes and modules, but suffice it to say that the prices are more similar than different.

Then, why do so many users quote cost as the reason that they moved to modular instruments? The answer lies in the difference between cost and price. Many users are looking at the total cost of test, not just instrument price.

The advantages of modular allowed them to reduce their total costs, sometimes substantially. One good example of this is speed. If an electronic manufacturer increases test speed by a factor of three, this allows the company to reduce the number of testers on the production floor by that same factor to achieve the same volume. This not only reduces capital costs by a factor of three, but it also decreases operating and maintenance costs by that same factor. The flexibility to quickly reconfigure test stations to match changing product mix is another cost advantage. Finally, the smaller factory footprint delivers real savings.

All these factors explain why modular instrumentation is on the rise. But the disruptive element—where the industry flips to adopt modular as the dominant automated test architecture—actually is driven by internals within the industry.

Force 2 and 3: Competitors and New Entrants

There must be critical mass in any one application segment for customers to adopt modular instruments. Simple as that seems, this is the basis of understanding the inflection point the industry is now approaching. Back to the Nash Equilibrium, if no vendor provides modules for a particular application, why would any vendor be the first and only to offer a partial solution? The answer is it wouldn’t. That’s the equilibrium.

Data acquisition has clearly passed through this equilibrium point. With the rich set of modules available today, these applications are dominated by modular solutions, typically open modular systems in PXI, VXI, or PCIe.

If nobody is willing to make the first investment, how does it occur? In a new segment, there are two ways to reach critical mass. One is by leveraging modules from adjacent segments.

Let’s take automotive electronic testing as an example. Many modules from physical data acquisition (digitizers, digital I/O, switching) are directly applicable to automotive electronic testing. Since they already exist, the marginal investment to address the complete application is reduced. A vendor can add a CAN-bus interface to control a module or a video card to look at a dashboard and enable an entire new application. This has been the history of modular instrumentation: marching from one application to the next, all the while creating a growing set of capabilities that sets it up to address the next segment.

The initial investment also can be made by a vendor choosing to make a large strategic investment in a new segment to take market share. In the modular instrument domain, National Instruments has clearly taken this strategy for some segments. It is not alone. Aeroflex and Agilent Technologies also have brought new capabilities to the modular segment, and there is a long list of specialized vendors enabling new applications by delivering modular solutions in their product category. Users are guaranteed an increasing number of innovative products, many only available in the modular format.

The industry has reached a critical inflection point. As more modules become available, even more applications are enabled, encouraging vendors to deliver even more products. The greater number of products enables even more applications. This positive feedback is creating a disruptive shift in the industry toward modular instruments. Modular instruments now are addressing applications from medical electronics to high-energy physics and from structural integrity of buildings to RF semiconductors. The Nash equilibrium point is being shifted by these powerful forces.

Force 4: Suppliers

The supply chain for modular instruments is similar to that for traditional products; however, there are some subtle differences. Since modular instrument standards typically are extensions of an industrial computer standard such as VME, cPCI, or AdvancedTCA, there is an overlap of components and supply chains with these industrial product lines. In some cases, this has enabled new entrants to offer products to the test and measurement industry or allowed current test and measurement vendors to leverage from the industrial marketplace. While an advantage, it is not a driving force of the disruptive change.

Force 5: Customers

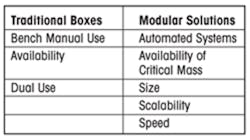

No analysis can be complete without the customers: the people and organizations that purchase and integrate automated test systems. A user will make a decision based on a number of factors driven by the needs of particular applications. Some applications are better addressed by either traditional instrumentation or modular solutions. Table 1 shows the factors that may weight an application in one direction or the other.

In general, manual use on a workbench favors traditional instrumentation while modular instruments are focused at automated systems. Bench instruments have been highly optimized for manual use with their integrated keyboards and displays. Modular instruments, being faceless, are always controlled by an embedded or external computer. For this reason, modular instrumentation is almost exclusively focused on automated test. Since either format can be deployed in automated systems, other factors come into play.

The next factor is availability and is present in both the traditional box and modular approaches. This is where box products have had a decided advantage due to their breadth of offering—but where modular products are closing the gap. Whether modular solutions are acceptable for any given application often is determined by whether there is a critical mass of products to enable that application.

Once it is established that either a box or modular system can solve the application, the decision criteria move to other factors. If it is desirable for a given piece of equipment to have dual use, both automated and manual, then the decision maker may lean more toward a traditional solution. If small size, scalability, or speed is a key factor, then the decision maker may lean more toward modular solutions.

One industry segment that continues to transition to modular solutions is aerospace/defense. This often is driven by the requirement for small size. Defense systems may have to be deployed in crowded repair depots, airplane hangars, or aboard ships where space is at a premium. Many large programs specify modular systems wherever possible. The growing offering of RF and microwave products in modular form factors will accelerate this trend.

High-volume manufacturing is another industry segment transitioning to modular. From automotive test to wireless component manufacturing, modular systems are being deployed due to their speed advantages. The mathematics of cost/device is clear: Higher speeds result in lower cost of test per device.

Wither Boxes?

With all these advantages, are box instruments going away? Not at all. While modular products may become the dominant architecture for automated test, this still excludes two very large segments: bench and handheld instruments. Manufacturers will continue to supply world-class products in these categories, nearly all with LAN or USB interfaces to allow automation as well.

In some cases, the boundary between traditional instruments and modular instruments may become blurred. Aeroflex recently introduced a bench RF signal analyzer and generator composed of PXI modules internally. Teradyne offers an adapter that allows PXI modules to be integrated into its in-circuit tester. And, Agilent’s latest logic analyzer family actually is a set of AXIe modules controlled by software on an external PC. As the breadth of modular products grows, there will be more opportunities to combine modular and traditional products in creative ways.

The industry is going through a disruptive change and forming a new equilibrium with modular instruments at the core of automated test. This change represents challenges and opportunities for all segments of the industry from equipment vendors to system integrators and users themselves. A new ecosystem is being formed through this transition. It is a very exciting time to be in the test and measurement industry because these changes will encourage innovation at all levels and enable new creative solutions.

About the Author

Larry Desjardin is president of Modular Methods. He joined Hewlett-Packard, now Agilent Technologies, in 1977 as an R&D engineer, and during his 34-year career with the company held various management roles in R&D, marketing, finance, strategic planning, and general management. Before founding Modular Methods in November 2011, Desjardin managed Agilent’s modular product operation, helped create the AXIe standard, and served two years as chair of the board of the AXIe Consortium. [email protected]