Accelerating Adoption of Ethernet, Wireless DAQ Systems

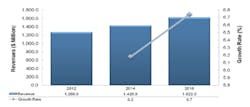

Following a year in which the total world data acquisition (DAQ) hardware and software market was estimated to reach $1,269.6 million in revenue, Frost & Sullivan foresees moderate single-digit growth for the market with a compound annual growth rate (CAGR) estimated at 6.4% from 2012 to 2018. From a product-type perspective, Ethernet held the largest share of the total market revenues while the VXI market is declining with relatively flat growth estimated during the forecast period. In the long run, it is expected that at least half of the DAQ market will be based on Ethernet.

Competitive Landscape

National Instruments continues to hold the largest market share followed by Agilent Technologies and Keithley Instruments. National Instruments is moving toward wireless DAQ systems that users can associate with sensors, signal conditioning hardware and software, recently introduced technology, and a software dashboard for LabVIEW. Agilent’s key differentiators are its capability to reduce the number of software development projects and provide extensive DAQ channel counts. The company’s products are providing DAQ up to 50 GHz. Keithley Instruments continues supporting very economical integrated and multifunctional applications for PCI-based and USB modular DAQ.

Total Data Acquisition Hardware and Software Market—Revenue Forecast

Courtesy of Frost & Sullivan

VTI Instruments is expected to maintain its strong market position by focusing on providing integrated DAQ and signal conditioning in a common solution. The company plans to enter the growing PXI marketplace in 2013 with PXIe products.

Market Trends

From an end-user perspective, the aerospace and defense segment held the largest market share of the total revenues. However, the majority of new leads and sales are coming from the energy sector. The smart-grid sector, including both renewable and conventional energy, is showing an increasing interest in DAQ. Standalone or Ethernet-based DAQ will be critical to monitor what is happening in the grid. Wireless technology is being used to implement DAQ units directly into the smart grid.

Frost & Sullivan foresees a major change in the DAQ market moving forward—that is, the increasing adoption of wireless DAQ systems. Wireless capability will allow companies to differentiate themselves in the market and enable the continuous monitoring of DAQ systems remotely for the control of electrical, mechanical, and acoustical signals. Mobile computing devices are game changers for wireless DAQ systems.

National Instruments has been working with LabVIEW software compatible with the iPhone, iPad, and Android for DAQ and embedded monitoring systems. Agilent has created an application for smartphones for wireless DAQ as well.

Despite its benefits, wireless technology is not widely used; however, it will mature over time, catching the interest of more leading vendors and driving growth in the market. There remain issues and challenges with the adoption of wireless technology in DAQ, mainly related to security due to critical information that requires dedicated networks for Ethernet and wireless.

Cloud also is an area of interest for the future. Cloud-based DAQ is the future direction of the market. “Working seamlessly with the cloud provides DAQ companies the opportunity to differentiate themselves from the competition and gives the user the ability to access their data from anywhere. End users also are expecting DAQ systems to interface well with mobile tools for remote visualization,” said Todd Dobberstein, National Instruments’ manager of data acquisition technologies.

Many current customers still are using existing technology that is a decade old. This adoption void has complicated the process of retrofitting solutions and migrating to newer specifications. Leading companies have addressed this challenge by embracing the hybrid concept—introducing, for instance, a hybrid PXIe chassis. The hybrid platform for a total solution accommodates a variety of modules, such as PCI, PXI, and PXIe. By adopting a hybrid approach, end users leverage their previous investments while upgrading the solution to accommodate new technology feature sets.

For More Information

Frost & Sullivan