Cambridge, UK. As competition heats up, can e-textiles take the next step towards the mass market?

Over the past 20 years, e-textiles have progressed from an academic curiosity to an important technology platform generating revenue for companies globally. In particular, the industry saw strong growth for several years up to 2015, with successful launches of many new products from a series of players. IDTechEx Research’s recent report “E-Textiles 2017-2027: Technologies, Markets, Players” found that the market has grown to around $100 million in annual wholesale revenue from e-textile products today.

Most of these products can be found across several key application areas. The report lists a total of 31 product types, arranged in 13 areas across 6 vertical market sectors. Perhaps the most prominent products are types of compression apparel, where e-textile features are used to introduce sensing (including heart rate, respiration, motion, ECG, and EMG), to provide heating or cooling, to apply current to muscles (TENS/EMS), and potentially several more interesting new functions. However, the application landscape is diverse, both in apparel for other sectors (workwear, military, fashion apparel, etc.) and beyond apparel for a variety of sectors including medical, industrial, and home textiles.

Today, many of the most prominent e-textile brands remain relatively young, driven either by recent start-ups, spin-outs from larger companies lower in the value chain, or generally companies outside of the mass-market consumer sector in either textiles or electronics. This is the most significant factor that is poised to change in the coming years. The early hype following the early commercial success may be starting to fade, but behind the scenes growing manufacturing know-how and efficiency means that a mass-market order for e-textiles will soon be possible.

The report details a series of case studies showing how giants from the sports apparel and consumer electronics industries are adopting different strategies to investigate and eventually adopt e-textile products. This information is compiled from a series of primary interviews conducted by the report’s authors, including 28 full company profiles, reports from major industry events globally, and activities from over 110 companies mentioned throughout the report. With each passing iteration of the development cycle, e-textile products are increasing in maturity, meaning that the risk and overheads required for a large product launch are gradually being eroded.

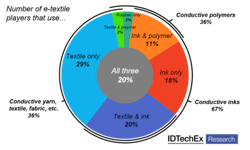

The industry has been diverging rapidly in the last two years, with more options and competition at the material and component level. IDTechEx found that the diversity of material experience and use is spreading, with a particular increase in the number of conductive inks on and being used in the market. Today, two thirds of e-textile players on the market used or have previous experience using conductive inks, whether as a supplier, using them in components or using them in prototypes or products.

All of this research is concluded in a series of market forecasts, outlining a scenario for the growth of e-textiles over the coming decade. From the modest $100 million global market today, the report concludes that e-textiles to grow from its relative infancy into a market that approaches $5 billion by 2027. However, it is not a case of simple exponential growth, as relationships between key industry players, development of supporting infrastructure, and mixed end user interest across several sectors continue to shift. The dedicated program of primary research accessible through this report offers unique insights from key decision makers, enabling the reader to learn from previous mistakes in the industry and develop an optimized strategy in this diverse space.