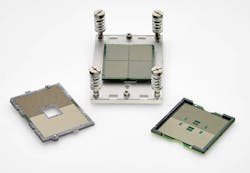

Serving the role of connecting a device and its tester, test sockets—also known as package probes—play a crucial interconnect role in integrated circuits (IC), and therefore the greater field of semiconductor testing.

Depending on the purpose of the test, IC sockets are categorized into two either 1) test sockets for measuring electrical characteristics, or 2) burn-in sockets for testing reliability. Both types are generally referred to as IC sockets, although their required performance varies depending on the difference in use. IC sockets’ applications include the aforementioned burn-in test, failure analysis, engineering test, production test, and more. Most IC sockets are compression-mounted and can be designed to fit an existing printed circuit board footprint.

Designs of test and burn-in sockets are robust, cutting edge, and are often produced in small quantities but at very high costs. They are typically tested in excess of 100,000 touchdowns before socket rebuild.

Market outlook

According to a report released in June 2019 by Mordor Intelligence, a few of the key factors impacting the IC test socket market include1:

- The increasing popularity of enterprise technologies like Big Data, and cloud-based services and the dependency on servers and CPUs with high computing power has been increasing significantly over the past few years, further leading to the growth of this market. Companies like Intel and AMD are using new processors. These new processor platforms require socket designs to meet the design requirements and offer higher performance and better system scaling.

- With the advent of the Internet of Things, coupled with an increasing focus on automation in the automotive and manufacturing industries, the IC socket market is expected to grow during the forecast period.

- The trend of miniaturization has been a challenge for the IC sockets market, as they tend to occupy additional space and add an extra electrical signal path to the IC device.

That same report forecasts that the IC socket market is expected to see a CAGR of 9.11% between 2019 to 2024, adding that their consumption has witnessed rapid growth over recent years in correlation to the increasing demand for performance and efficiency.

Some of the leading companies in the test socket market include TE Connectivity, Ironwood Electronics, Smiths Interconnect, Mill/Max Manufacturing,

In April of this year, VLSIresearch released a report that detailed 2018’s top five suppliers of test and burn-in sockets in the semiconductor industry, by revenue.2 Those five, in descending order, were Yamaichi Electronics, Cohu, Enplas Corp., ISC, and LEENO. The report noted those five companies accounted for 42% of the total test and burn-in socket market in 2018, up from 39% in 2017. Yamaichi had 2018 sales of $124 million, closely followed by Cohu, which climbed to second place following its acquisition of Xcerra.

VLSIresearch’s report noted that after the exceptional growth in the test and burn-in socket market in 2017, 2018 was a year of digestion, with market growth of only 2.3%.

“The rollout of 5G over the next few years is going to present multiple technical and cost challenges for suppliers of test and burn-in sockets,” commented VLSIresearch Europe managing director John West. “This may favor the larger suppliers with the resources to overcome these problems, but I wouldn’t rule out the possibility of some smaller companies playing a major role”.

Here's a look at a few recent product introductions in test sockets.

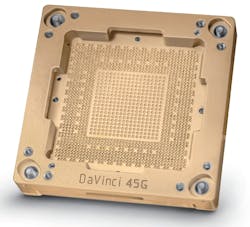

75GHz BGA Socket for NXP's BGA388