Download this article in .PDF format.

Influx of electronics redefines 'automotive'

The fields of automotive design and test have taken on an incredible burden amid the rise of electronics in today’s vehicles. Not only are those engineers tasked with creating a car that can get from point A to point B, as always, but now they must do it while getting that car’s electronics to account for a seemingly endless amount of factors—whether they are for convenience or absolute necessity for drivers and passengers. This is alongside the need to keep today’s technology-heavy vehicles at an attractive price point.

“Automakers are facing the same challenges that other industries have to take on, but escalated exponentially,” said Sepp de Maeyer and Daniel F. Wyatt, Western Europe sales director and VP of Eastern U.S. and Canada sales, respectively, for Averna Technologies. “Cars offer a lifestyle, and they need to stay ahead of the curve while remaining affordable. Automakers juggle to keep components in or on the vehicle current, flexible, and future proof, while delivering quickly. Speed is key in such a competitive market. Both of these factors make maintaining a budget very difficult, as they both contribute to higher costs. Car manufacturers are also more dependent on electronic device manufacturers. This is a challenge that won’t disappear.”

The Averna duo recently explained to Evaluation Engineering that a trend they are seeing increasingly more of is the effort to reduce the use of “development mules” and moving testing into the lab as much as possible with hardware-in-the-loop (HIL) simulation.

“Test mules cost OEMs millions of dollars and impose scheduling restraints on the different groups needing to test their products,” Maeyer and Wyatt said. “By being able to test in the lab, they can test more effectively for a lot less money while expediting the process. Averna’s AST-1000 is an excellent example of an infotainment tester that can be done 100% in the lab, and with the record and playback feature, it’s possible to bring real-world impairments back in from the field for repeatability.”

The transition from mechanical vehicle to electromechanical vehicle will become increasingly evident as automakers compete to outdo each other when it comes to autonomous vehicles (AV). Widespread fully autonomous vehicles may still be a decade away, but until then, more and more individual vehicle driving functions will become autonomous, and this requires designers to innovate with several new-age technologies simultaneously.

“Another newer trend for automotive design is factoring in the necessities for complete connectivity,” Maeyer and Wyatt told EE. “We are seeing the demands for the development of radar, LiDAR, ADAS, and above all, autonomous driving. More and more cars are now heading in that direction to remain competitive, which is what makes camera assembly and installation so vital to the field. With so much skepticism in the technology, it needs to be executed flawlessly. Active alignment is playing a much greater role than it has in the past.”

To take a deep dive into the topic of automotive test and design, EE gathered commentary from more than a dozen vendors of automotive test solutions, asking for their input on technology trends, challenges, demands, and what new products are on the market. Read on to see what they told us.

What’s trending?

Sandeep Sovani, global automotive industry director at ANSYS: “We can comfortably say we’re in a great mobile evolution. The automotive industry has existed for about 125 years, and in just the next few years, it’s going to totally transform into a mobile industry. Vehicles are becoming electric, driven by batteries or fuel cells. Along with those trends, the deeper underlying trends include functional safety and the rise of electronics and software. The amount of lines of code inside a car are mind-bogglingly high compared to, say, an aircraft.”

Greg Kregoski, North America automotive business development manager at Rohde & Schwarz: “In order to increase the level of autonomy in automotive driving, the number and complexity of sensors in a car have steadily increased. In the case of the automotive radar, the physical placement of these sensors is critical to ensuring the vehicle is getting an accurate picture of the outside world. If the radar transceiver is not mounted correctly, this can impair the ability of the sensor to determine accurately a target’s location.”

Bob Stasonis, technical product specialist at Pickering Interfaces: “The biggest trend we see is ‘more data.’ Whether it is input from cameras, sensors, strain gauges, or LIDAR, or your child downloading the latest video from the internet, more and more data is handled within the confines of your vehicle. And as much of the above data is critical to the safety of the vehicle’s occupants, the networks in the vehicle must be reliable and function in a real-time environment. So, testing of a network’s robustness can be as complex as testing all of the added protocols for automobiles layered on the IEEE 802 Ethernet standard or simply testing the path protection scheme by injecting faults into one or more physical connections.”

Adnan Khan, senior business development manager at Anritsu: “The most impactful trend in the last year has been 5G. Many automakers are testing 5G now to learn about the technology and get ahead of the curve since it takes years to bring an automobile to market. Compare this to mobile devices that are introduced every 6-12 months and you can understand the need to take such a proactive approach to understanding 5G. With 5G, it is the first time that standards are developed based on use cases, a few of which are well suited for automotive. Enhanced mobile broadband has benefits in infotainment applications, such as the ability to more easily and quickly download movies and gaming apps into cars, as well as maps and firmware updates. Another use case will be low-latency mission critical communications, such as C-V2X.”

Kotaro Hasegawa, ARTeam Japan Lab Senior Director at Advantest Corporation: "1) The need for higher voltage testing is an emerging trend. Devices running on 48-volt battery power are prevalent in today’s market. These devices must undergo stress condition testing at higher voltages (e.g., 200 V to 300 V) and require extended testing coverage in this range. Hybrid, SiP (system-in-a-package) packaging is being used for most automotive devices, especially MCUs with high-voltage drivers that enable higher torque and efficiency. These embedded devices require higher-voltage isolation testing. 2) As the number of the semiconductors/ECUs per vehicle grows, the variety of ECUs also increases. Test solutions must accommodate both massively parallel manufacturing volumes and a high mix of different products. Testing systems need the versatility to address both of these trends with higher efficiency in production and engineering environments."

Jeff Phillips, head of automotive marketing at National Instruments: “The most significant trend that I’ve seen is the bifurcation of ADAS and autonomy, which has led to the hardening of those now separate platforms across the industry. Even given this, the market is still incredibly challenged with rapidly changing test requirements, driven by the evolution of the underlying technologies.”

Lee Harrison, automotive test solutions manager at Mentor Graphics: “Speaking from the perspective of the design and testing of automotive semiconductors, the two big challenges are (1) achieving zero DPM for manufacturing test, and (2) addressing the requirements for functional safety as driven by the ISO 26262 standard. Many of our customers are looking to achieve zero DPM or even zero DPB, using the latest process technology nodes and smallest geometries available for the manufacture of advanced semiconductors.”

Sudipto Bose, general manager of automotive and time domain solutions at Tektronix: “The biggest trend impacting automotive design is the convergence of connectivity, autonomous, safety, and electric technologies. These technologies are forming the building blocks for next-generation vehicle development, bringing new testing challenges and more rigorous testing requirements to ensure reliable and safe operation of the vehicle. The test challenges include increasing complexity, longer testing cycles, traceability, and communication infrastructure reliability and robustness.”

Fred Weiller, automotive & energy solutions marketing manager at Keysight Technologies: “The demand for technology acceleration and integration pushes established automakers and their challengers to operate more like an agile development software startup than a traditional slow-moving heavy metal company. To streamline development and contract the concept to market availability timeframe, the industry needs to adopt the DevOps (development and operations) practices of the software market by connecting testing in R&D with the manufacturing operations through an integrated TestOps software platform such as Keysight PathWave.”

Eric Turner, general manager at E-A Elektro-Automatik: “The latest on-board battery charger/motor drive systems are operating at high power levels that are requiring higher voltage (900V) to reduce current levels and manage wire harness weight. These higher voltages, the increased demands on fast response (high slew rate), and the bidirectional nature of the test environment (charge/discharge) place a burden on the power sources and electronic loads.”

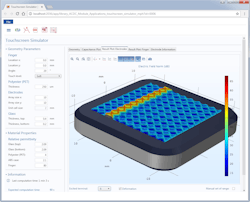

Bjorn Sjodin, VP of product management at COMSOL: “Automotive companies have a greater need to simulate electrical engine components; new types of power systems, including wireless power transfer, batteries, and battery thermal management; as well as new wireless technologies that are internal and external to the vehicle. New challenges arise when lighter materials are chosen for the design, including corrosion at junctions of different metals and composite material strengths. Autonomous vehicles come with a need for simulating new types of optical and RF systems, such as lidar.”

Jim Beneke, VP of products and emerging technologies at Avnet: “To meet environmental protection requirements and energy saving goals, there are a number of new engine types coming into the market, such as start/stop engines, HEV, EV, fuel cell and others. Aside from newer engine and motor designs, there are several other applications that have also been introduced.”

David Vondran, Sr., product marketing manager at Astronics Test Systems: "We see a lot of interest in advanced driver assistance systems (ADAS) as it pertains to the automotive radar building blocks that enable those systems and the associated test systems for design and production purposes. Key electrical requirements include, at a high-level, the use of mm-wave signals with capabilities to generate and measure a variety of challenging waveforms (e.g., FMCW with a 4 GHz chirp). These waveforms represent a challenge not only for the automotive radar subsystem in vehicles, but also for the test system that can identify defects during design and before shipment."

Tools

Maeyer and Wyatt, Averna: “With the number of components built into one vehicle, the requirements for test are practically limitless. Over time, Averna has developed hundreds of customized test and assembly stations covering everything from top to tires. We have a dedicated vision lab and we have designed solutions for everything from dashboard to transmission valve inspection to camera module assembly using active alignment—a huge contributor to ADAS and radar. The active alignment process for optical device assembly is a very deliberate and thorough process and must be done flawlessly considering the potential consequences.”

Sovani, ANSYS: “From an electronics and hardware perspective, the hardware can be thought of as comprised at three levels—chip, package, and system. Chip is really the semiconductors, which, at automotive grade, means they have specialized qualities. We offer tools for management of the chips and power optimization of semiconductor chips. At the package level, there are things like the reliability of the board. We offer specific solutions for various aspects like signal interference of the board and EMI/EMC of these components and how to mitigate those. We do calculations like structural reliability of the board or connectors to see if there will be any structural failures.”

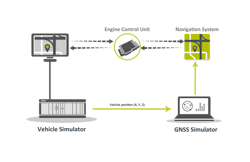

Kregoski, Rohde & Schwarz: “For C-V2X testing, we offer a complete end-to-end test solution portfolio with the main focus on the R&S CMW500 PC5 emulator, the R&S SMBV100B satellite constellation simulator, the R&S CMW100 PC5 physical layer generator, and Vector’s CANoe comprehensive software tool. For radar testing, we offer a complementary set of instruments, including the R&S AREG100A radar target simulator, the R&S ATS1500A automotive radar anechoic chamber with the CATR (compact antenna test range) reflector for indirect far field measurements, and various spectrum analyzers and signal generators for antenna pattern and interference measurements.”

Phillips, National Instruments: “Testing electronics content is a core competency of our platform. The modular formfactor of PXI provides an inherent advantage for parallelizing tests, and our automotive test systems build on top of PXI with application-specific software packages that meet the needs of the various types of ECUs throughout the vehicle.”

Khan, Anristu: “For infotainment, Anritsu offers the Signaling Tester MD8475B all-in-one base station simulator to test 2G, 3G, and 4G cellular designs; the Bluetooth Test Set MT8852B for systems utilizing Bluetooth; and the Wireless Connectivity Test Set MT8862A supports Wi-Fi. Our Universal Wireless Test Set MT8870A has been specifically designed for the high-volume manufacturing testing of devices and systems using all major wireless technologies. Anritsu is also currently integrating the MD8475B with the MT8000A for expanded 5G testing. For testing automotive radar, we have the Spectrum Master MS2760A Ultraportable Spectrum Analyzer that weighs less than 1 pound and covers 9 KHz to 110 GHz.”

Harrison, Mentor: “We provide a broad range of automotive targeted software tools to carry out analysis, and then implement the test on many of these complex systems now found in today’s vehicles. Mentor’s Tessent tools suite is a comprehensive set of software tools, designed to provide extremely high-quality semiconductor test solutions. At a high level, Mentor’s semiconductor test portfolio includes best-in-class tools for logic test, memory test, AMS &I/O test, SoC integration, silicon bring-up, and yield analysis. In addition, Mentor’s Austemper tools suite provides comprehensive functional safety solutions for the analysis, implementation and verification for automotive semiconductors, where functional safety standards are quite stringent.”

Chambers, Teradyne: “Teradyne tracks trends across all automotive systems and develop production test equipment for the integrated circuits that are the building blocks of these systems. For example, our customers use the Teradyne UltraFLEX system with the UVS64 device power supply to test AI processors at the core of ADAS systems. The Teradyne ETS-88 and ETS-88TH systems are deployed to test high- power discrete SiC and GaN devices and modules used in electric vehicles. All of these growing market areas require power management. The ETS (ETS-800, ETS-364 and ETS-88) systems are used extensively to test a variety of ASSP and general purpose power management devices found in all automotive systems.”

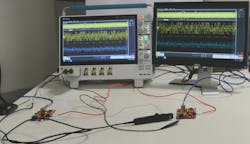

Bose, Tektronix: “For automotive testing, Tektronix and Keithley offer a full complement of test solutions. These include oscilloscopes, spectrum analyzers, source meter units, arbitrary waveform and function generators, digital multimeters, probes, and application-optimized software for testing. These products support everything from semiconductor characterization to radar module testing, in-vehicle and V2X network testing, switching power electronics, and EMI/EMC pre-compliance testing.”

Sjodin, COMSOL: “The COMSOL Multiphysics product suite contains tools to address these needs. For infotainment, especially touchscreen design, the AC/DC Module can be used for electrostatics analysis. The AC/DC Module can also be used to analyze wireless power transfer. The Batteries & Fuel Cells Module can be used to optimize battery technology, while the RF Module, Wave Optics Module, and Ray Optics Module can be combined to analyze ADAS, lidar, and related RF and optical systems.”

Software

What tools are available to support embedded software design for automotive applications, and what challenges do these tools help customers address?

Sovani, ANSYS: “The amount of automotive software used is rising significantly, along with the responsibility put upon it. ANSYS starts with the functional safety analysis, which checks if requirements are correct from a safety perspective and provides feedback. At the requirements level, we do a cybersecurity analysis. Companies need to make sure they have plugged the holes in their software that could be attacked. ANSYS provides a 3D analysis where we see if there are areas that are susceptible to attacks and raise a red flag. At the actual offering of the software, we provide tools for model-based design. We can test the software at the model level and ensure the models are behaving correctly. From there, we have a solution that gives automatic photo generation.”

Stasonis, Pickering: “Our family of fault insertion modules are helping embedded designers to verify how ECUs will react in bad conditions. As mentioned earlier, increasing complexity requires more stringent testing in order to avoid embarrassing and even deadly failures in the field. We also offer software to port test data from MATLAB Simulink application to further ease integration.”

Hasegawa, Advantest: "Up until now, a typical automotive ECU testing strategy was to combine HIL simulation with actual vehicle testing. But today’s ECUs have so much embedded functionality that some defects are hard to detect using only HIL, and actual vehicle testing can be costly and time-consuming. So, having a hardware evaluation base test cell and test process has become critical before devices go to full actual vehicle testing. A hardware evaluation test cell can evaluate mechanical operations including DC motor behavior and execute full ECU testing at the hardware level. Key aspects of hardware evaluation include ensuring the high accuracy of timing control as well as synchronizing and correlating operation between multiple interfaces on the ECU."

Phillips, National Instruments: “Our platform is best used to validate the behavior of the software, done through an HIL workflow. The same PXI platform is at the core of this design, along with dedicated signal condition and load management products. We provide a reference design for HIL applications, providing a common starting point across the various needs of software validation.”

Bose, Tektronix: “Embedded software design engineers often test their software on the hardware technologies to validate if their software works as specified. Being software engineers, it’s often difficult to decode and debug issues that might arise due to the interface of hardware with software. Tektronix— with its vast offering of communication protocols and decodes—makes it easy for software engineers to debug and fix issues in real-world testing situations.”

Weiller, Keysight: “A major emerging challenge to automotive embedded and computing systems is the accessibility through the many wired and wireless communications interfaces now available in modern connected vehicles. Keysight provides penetration testing and ongoing identification of security vulnerabilities from the expertise acquired through its acquisition of network performance and security testing provider Ixia.”

Beneke, Avnet: “In the automotive sector, there is an understandable need for very high safety standards, and it can be a challenge to marry concept and practicality to meet those standards. We are actively strengthening our role in offering support for embedded software design for automotive applications. For some customers’ projects, we engage a third party to participate in our R&D in order to optimize system development.”

Mark Elo, U.S. national sales manager at Tabor Electronics: "With Tabor’s new Proteus line of PXIe-based, wide-bandwidth arbitrary waveform transceivers, we provide key tools for simulating multiple targets, with varying range, velocities, and cross sections for both long-range radar and short-range-radar (SRR) algorithm validation. This is key in target vs. clutter identification, as well as target intent. As the PXIe format can support multiple AWG’s, thus multiple targets, high-density, real-live target environments are easily created."

Autonomous design & simulation

What are the design and simulation consequences of various levels of autonomous vehicles, and what solutions do vendors offer for autonomous-vehicle applications?

Maeyer and Wyatt, Averna: “Autonomous vehicles require multiple integrated cameras/sensors to be installed throughout the automobile to provide situational awareness. To be accurate, effective, and safe, these cameras require a greater image quality and resolution than average. Averna’s Active Alignment for camera module vision systems is built to provide precise assembly to the sub-micron with reliable repeatability. These systems can be fully or semi-automated from the initial preparation, including inspection, cleaning, and treatment up to final validation—delivering results within a matter of seconds.”

Sovani, ANSYS: “Simulation has a crucial role to play in development of AV systems. It’s been estimated that to validate an autonomous system, it will take many billions of dollars to physically test. AV test manufacturers have simply found that they cannot get AV cars out on the road without simulation. Unless your autonomy software drives virtual cars inside of virtual worlds and the software doesn’t know it is virtual, the software will think it is real-world driving and will make different decisions. You can have pedestrians coming out of nowhere, weather fluctuations, etc., and put them all together. You can rigorously test if the software will make the right decisions. Our software allows you to put those sensors on a virtual car, driving in a virtual world, driven by real-world software.”

Phillips, National Instruments: “We target the validation of both the perception algorithm on the main compute platform and the hardware platform that houses the algorithm. There’s a distinct difference in the approach to testing ADAS from autonomous applications, particularly because of the difference in test cases between the two.”

Stasonis, Pickering: “Each level of autonomous vehicles defines the need for ‘more data.’ With each level comes more and more sensors and cameras to help determine how the vehicle is to respond to its environment. With more data to parse, the more testing is required. As this data moves at higher and higher data rates, protocol testing now involves RF and microwave-level switching.”

Khan, Anritsu: “Our MD8475B can be used for autonomous vehicles because it can efficiently simulate how the vehicles will connect to cellular networks in the lab, saving time and money. It can also be used for cyber security testing, which will be an important element for autonomous vehicles so their commands cannot be overridden. The Keycom LiDAR target simulators Anritsu represents can test autonomous vehicles under all conditions. The LiDAR simulators create corner cases in the lab that rarely occur in the real world.”

Hellsrud, DTS: “Safety testing of autonomous vehicles is potentially even more critical because of the changing role of the human factor. Both active safety features, like automatic braking, as well as passive safety devices, like seat restraints and airbags, are critical for passenger and pedestrian safety. DTS miniature data acquisition systems are being used in autonomous vehicles and unmanned aerial systems to measure impact, acceleration and location.”

Harrison, Mentor: “With the new challenges of autonomous vehicles and new automotive standards, the landscape has changed for both the traditional automotive suppliers and the many new companies coming into this new and exciting market. Manufacturing test quality is no longer enough. Products now have to be safely and regularly tested during day-to-day operation. The consequence of this is that in-system testing of automotive silicon has become a requirement, and this has driven both the use of existing DFT technologies—for example LogicBIST for logic gate testing—as well as new technologies such as MissionMode for functional safety control, to become used as standard in today’s automotive designs.”

Weiller, Keysight: “Considering that a modern vehicle has now evolved from a single radar sensor to a dozen, two challenges have emerged. The first is to rapidly design arrays of signal emitting elements, where each contributes to the overall coverage without disturbing its neighbors. Keysight's SystemVue Radar Library provides highly-parameterized simulation models and higher-level reference design workspaces that allow designers to create radar system operation scenarios, including radar signal generation, processing, and environmental effects. The second challenge is to ensure that manufacturing properly implements what R&D designed. This requires consistent testing solutions spanning testing at the module level and at the system level throughout the entire process.”

Elo, Tabor: "Between Astronics Test Systems and Tabor, we have a combined long history of supporting many military radar/sensor systems. This unique experience allows us the capability to create test systems that fully exercise an automotive system, from typical level 3 driver assists (ADAS) systems employed in most new vehicles today, to future generations of level 4, and ultimately level 5 autonomy."

Multiphysics

Can automotive electronics design take place in isolation, or must multiple domains (electronics, mechanical, etc.) be considered simultaneously in a multiphysics environment?

Maeyer and Wyatt, Averna: “Automotive design can begin in isolation, but only as a starting point. There are too many outside factors that need to be considered when designing any piece on a vehicle, because of the way a car is used. There is so much wear-and-tear on a vehicle, whether it be road conditions, environmental conditions, or the way consumers treat the car. As an example, humidity & temperature vary greatly, due to the location a car will be sold, seasons changing, different altitudes they will travel, etc. These conditions all have an effect on electronics. Another example would be windows. Automatic windows are controlled by a PCB. The PCB can be developed in a lab and can control the window, but the mechanics of the door need to be considered, such as the effects of what will happen if a person decides to close it too quickly.”

Sovani, ANSYS: “We have more and more complicated systems working simultaneously. And increasingly more often, they are made of a large number of components of very different types—gears and shafts, electronics, and software. All of them have to work together. Nowadays, a rigorous and methodical approach is used in development. It’s a well-known adage that optimized components do not create an optimized system. You have to optimize the system and the components with respect to the system. It’s not just multiphysical—it’s multidomain. We have to test the software and the hardware together to see if the system is performing correctly.”

Kregoski, Rohde & Schwarz: “It is clear that various subsystems within a vehicle can be developed separately from the complete multiple domain environment. However, testing of the system as a whole is critical before a vehicle is released to the public. There are a few testing requirements that are essential to ensuring the multidomain ecosystem works correctly. One of these areas is communication between modules through the testing of the Ethernet interfaces and harnesses. Another critical area of testing is EMC coexistence and OTA radiated emissions, and Rohde & Schwarz offers comprehensive lab-quality measurement solutions, including test equipment, chambers, and specialized services that can help.”

Stasonis, Pickering: “Of course, there can be some ECU functions that can be defined and tested in a stand-alone environment. However, in the case of any electronics involved with navigation and safety, and the level of automation defined, the majority of the systems involved complement or rely on each other. And because of possible liability that can come from a failure, HILS testing has an increasing role in the design and testing of the newest automobiles. The mechanics are married to electronic systems more often in system development and final assembly of the vehicle rather than in ECU manufacturing.”

Phillips, National Instruments: “Automotive electronics design can start in pure electrical design/circuit simulation tools, but designers pretty early on must consider multiple domain impacts because they are fundamental to the design, especially for high power EV powertrain systems. For instance, traction inverter overall design and critical parameters like weight and size and switching frequency are governed by power transfer efficiency and losses, where the “lost energy” is primarily converted to heat. Thus, a design environment that integrates modeling and simulation for heating and provides for testing of heat transfer and management solution is essential.”

Harrison, Mentor: “Many automotive electronics systems are designed and developed independently without the full understanding of the system they will be used in. This out-of-context development now becomes a challenge for the designers to understand the applications and environment in which their products could be used in, as this will define the quality level and functional safety qualification they need to achieve. If you aim too high, you will have a very high-quality product that is not cost competitive. If you aim too low, you could end up missing out on potential customers if your product does not achieve the required rating.”

Bose, Tektronix: “Automotive electronic systems require rigorous testing that approaches and sometimes even exceeds military-grade levels. The interdependencies and the integration of the many systems in today’s and tomorrow’s automobiles and the need to function in extreme climate conditions requires electronic design not be done in isolation. This means having a systematic approach to testing across multiple domains is needed to test vehicle systems and architecture across the entire automotive life cycle from design to post-production maintenance.”

Weiller, Keysight: “With electronics permeating every corner of the automotive platform, it is imperative to take a system-level approach to ensure that elements positively tested independently do not throw the validation team in a never-ending troubleshooting loop once connected together. A good example of such challenge is the new automotive Ethernet network technology. Most test technology vendors provide solutions to test the transmit (Tx) interface and functions. But what good is that if you don’t test the transport cable (link segment) and the receive (Rx) interface and functions? Only a comprehensive solution validates the physical layer of automotive Ethernet as a complete end-to-end system to ensure that the entire design will operate as one, not as a patchwork.”

Beneke, Avnet: “It is very difficult to create automotive electronics design in an isolated system. The central processor serves as the main control system for the vehicle, with responsibility for engine control, steering, and braking. Of course, the preference is to create simpler modules to reduce the chance of any design or system issues. However, there are now sensor units that range from a few sensors to the hundreds, and they all need to work together in order to handle all of the many different driving environments and road conditions.”

Elo, Tabor: "Radar is key as it adds the depth dimension to other sensors systems within the vehicle. As we add more radars to the vehicle, it’s critical to understand the characteristics of car paneling and how that may not only attenuate the range, but how it will distort the cross section of the target. This, in turn, adds risk to target identification and its derived intent."

For more information

Averna Technologies 1

Averna Technologies 2

ANSYS

Rohde & Schwarz

Pickering Interfaces

Anritsu

Advantest

Diversified Technical Systems

Mentor Graphics

Teradyne

Tektronix

Keysight Technologies

E-A Elektro-Automatik

COMSOL

Astronics/Tabor