Keysight Moves to Software Focus, But it Should Own the IoT

If our test-and-measurement companies are smart, and they are for the most part, they should step up and own the IoT. At the recent Mobile World Congress, Keysight Technologies gave me hope that it might actually be on the path to doing just that.

As I pen this, startups springing up left and right are offering software or hardware-agnostic solutions to help CEOs, CTOs, and COOs make sense of the terabytes of raw data streaming in from new IoT deployments across cities, farms, and factories. Of course, IBM, Microsoft, and the other heavyweights we know and love are doing this, too: The purpose is to apply the data to improve processes and outcomes, improve products, monitor workers (to make everyone safer, of course), and even strike up new, recurring revenue streams.

What’s odd here is two of the three major premises of IoT—sensing and analyzing—are already the founding strengths of T&M companies. The third premise—connectivity—is something these firms don’t specifically perform, but they have been analyzing connectivity interfaces and protocols and maintain the intellectual property (IP) and know-how to enable it.

At a high level, the IoT is one big system generating data that needs to be analyzed. Companies like Optimal+ already get this, and are applying their semiconductor and wafer analysis expertise to systems to enhance system design and reliability, as well as lower life-cycle cost.

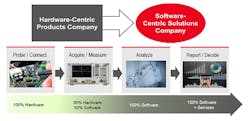

1. At MWC 2017, Keysight made clear its plan to become software-solutions-focused. (Source: Keysight Technologies)

For their part, T&M companies have also taken the software route: Many of the new announcements and product updates comprise software updates to core hardware platforms, from ‘scopes to spectrum analyzers to ATE equipment. At MWC 2017, Keysight explicitly called this out as a company direction, which is more than just a reaction to better meet designers’ needs as efficiently as possible. No, Keysight is formally moving from being a “hardware-centric products company to being a software-centric solutions company.” That’s about as explicit as it gets (Fig. 1).

The explicitness actually surprised me, and I quickly asked how this would affect Keysight’s renowned Santa Rosa-based expertise in front-end design for high-sensitivity, high-speed measurements. Gautam Awasthi, marcom manager for EMEAI, assured me that the group would not be affected by the shift in emphasis. He may be right, for now, but a shift that big usually means more changes are likely coming.

5G, IoT, and Automotive Joined at the Hip

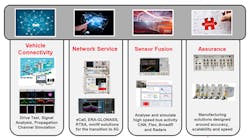

Meanwhile, at MWC, Keysight made some significant announcements in the area of the connected car, 5G, and IoT. For the connected car, the company announced it had joined the 5G Automotive Association to bring its “rich expertise in 5G design and test” to that group’s collection of automakers and network providers. In truth, 5G, IoT, and automotive connectivity are now becoming joined at the hip (Fig. 2).

According to Hervé Oudin, market industry manager, WDO (wireless devices and operators) for Keysight Technologies (France), the company will bring its 5G libraries as well as its flexible enabling solutions for experimentation and simulation to accelerate proof of concepts. For automotive, fast handoffs are particularly important, given the amount of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications that will take place. With that in mind, Oudin emphasized the desire for zero-second handoffs within the 5G specification as it takes shape—and Keysight’s ability to help prototype and simulate for those handoffs.

Also at MWC, Keysight demonstrated a NarrowBand-IoT (NB-IoT) test rig using an Intel XMM 7115 NB-IoT modem (Fig. 3), a 5G MIMO beamforming simulation and analysis setup (Fig. 4).

Along with a slew of 5G partnerships, Keysight also used MWC to talk about its recently announced purchase of Ixia for $1.6 billion. Ixia provides visibility, test, and security across physical and virtual networks, which plays into Keysight’s goal to move toward a software focus.

4. Massive MIMO, a fundamental feature of 5G to optimize spectrum usage, is already being tested and deployed in stages. Keysight provided a demo at MWC 2017. (Source: ClariTek)

The Ixia purchase also underscores the massive IP for IoT that Keysight now owns—from sensors, to networks, to data gathering, mining, and analysis. The company and other T&M vendors are already doing what developers of industrial IoT (IIoT) and smart-city solutions are demanding: “Please, help me! I have multiple networks, multiple systems, and multiple geographies, and I need someone to help me gather and make sense of my data!”

Keysight and its peers can step up and assume the role with its massive front-end sensing, connectivity, data analysis, software, and soon, cloud expertise. Or, it can sit back and help others do it instead. The startups aren’t sitting back waiting, though. The prize goes to the nimble and the brave in a world where hardware dependence is an artifact of a bygone era.