In tabulating our Fiscal 2015 line score rankings (Fiscal 2015 vs. Fiscal 2014 data) that formed the basis for Electronic Design's Top 50 Employers, we used a total pool of 89 public companies:

1-Data was gathered for both 2015 and 2014, mainly from company 10-K reports filed with the SEC, reflecting a company’s 2015 fiscal year. In many cases, this did not mirror the calendar year of January to December 2015.

Changes in the company pool this year were as follows:

Deleted:

International Game Technology: Acquired by Gtech S.p.A. and Lottomatica S.p.A; the name was changed back to IGT. The company is headquartered in London and controlled with a 51.5% stake by the De Agostini group.

SanDisk: Acquired by Western Digital

Added:

SPX Flow: SPX Corp. spin-off of its Flow Technology reportable segment, its Hydraulic Technologies business, and certain segments of its corporate subsidiaries.

Changed:

Broadcom: Avago Technologies Ltd. agreed to buy Broadcom Corp. The new Singapore-based combined company is called Broadcom Limited

SPX Corp.: Reflects the spin-off of SPX Flow.

All $ financial data is shown in millions.

2-Employee data was mostly gathered from 10-K reports. In the few instances where it could not be found, annual reports or company websites were used. In most cases, the 2014 data had to be gathered from the 2014 10-K report, as the previous year’s employee count is not included on the 2015 10-K for most companies. Employee count is typically reflected as of the last day of the fiscal calendar year being reported.

When employees were broken out separately by U.S. and International, both numbers were added together as long as a comparable breakout was available for the prior comparison year.

In the case of acquisitions or divestitures, our best guess was used, so as not to severely credit or penalize a company based on year-over-year changes. Employee data pertaining to the unit acquired or divested is typically not separated out for the timeframes required, if available at all.

In cases where a reasonable assumption could not be made, the line score was adjusted, again in the spirit of not severely penalizing or crediting a company.

3-Sales or total revenues was gathered from 2015 10-K reports.

4-Pretax income was gathered from 2015 10-K reports. The emphasis was on comparing the profit/loss generated solely by the operations of the company, but to also include interest expense, which is a result of business strategy or the nature of the business. We also wanted to be as consistent as possible across companies.

5-Pretax income margin is simply pretax income divided by sales.

6-Long-term debt and stockholder’s equity data was taken from the 2015 balance sheets, reasonably trying to include all debt of a non-current nature. However, at times, it is not specifically labeled “long-term debt” on the balance sheet.

With respect to stockholder’s equity, the previous year’s balance (2014) is always taken from the current year’s (2015) 10-K. Prior year restatements can be made that affect the balance, unless any differences are minor.

7-Long-term debt to shareholder’s equity ratio is simply the former divided by the latter. In cases where a company has a negative stockholder’s equity position as of the balance-sheet date, the resulting negative number does not have much meaning, other than a negative equity position is never a good situation.

8-2015 total patents issued data was taken from a report sorted by company that’s generated by the U.S. PATENT AND TRADEMARK OFFICE.

9-High and closing stock prices for 2015 were taken from Yahoo Finance for all companies. Stock data was gathered on a calendar-year basis, so the timeframe may differ from that of the financial data, for those companies who don’t report on a calendar-year basis, but at least it’s a consistent approach for all companies.

10-Research and development expenses came mainly from a separate note contained within the 10-K or in some cases, a line on the Income Statement. Most companies do not put R&D as a separate line on the Income Statement.

For Comcast and Verizon only, capital expenditures were used for the comparison instead of R&D, as they are more relevant for these companies.

11-Our final rankings are determined by what we call our total line score. Our line-score methodology is as follows:

a-Each of the following nine categories is ranked for each company:

Employee growth % (2015 v. 2014)

Sales growth % (2015 v. 2014)

Pretax income growth % (2015 v. 2014)

Pretax margin improvement Pts. (2015 v. 2014)

LT debt to S/H equity ratio improvement pts. (2015 v. 2014)

2015 total # of patents issued

Change in total # of patents issued (2015 v. 2014)

2015 stock price closing as a % of 2015 stock price high

R&D expense change % (2015 v. 2014)

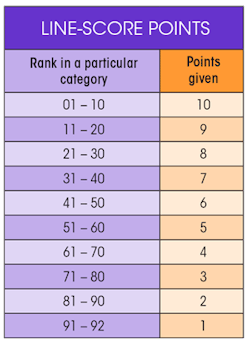

Line-score points are then given to each category ranking as follows:

Bonus 10th Category: A maximum of 10 bonus points are given based on company responses to five key questions on the Electronic Design 2016 Reader Survey. Points are accumulated based on individual employee responses to each question and then averaged by the total number of respondents for a particular company.

B5. How satisfied are you in your current position?

a Extremely satisfied

b Very satisfied

c Satisfied

d Not very satisfied

e Not at all satisfied

B7. Do you feel that you are being challenged intellectually with the engineering projects you work on at your present job?

a Sufficiently challenged

b Somewhat challenged

c Not challenged enough

C1. To the best of your knowledge, what is the engineering employment outlook at your company in the coming year?

a My company plans to increase the number of engineering jobs

b My company plans to maintain the current level of engineering jobs

c My company plans to scale back engineering staff

C4. Do you feel that your organization is more focused on employee retention this year as compared to a year ago?

a Yes

b No

C11. How concerned are you with the prospect of losing your job to outsourcing?

a Very concerned

b Somewhat concerned

c Not very concerned

d Not at all concerned

http://survey.techsurveys.com/ed_reader_2016/results/

Maximum total line-score points possible are 100. Nine categories have a maximum of 10 points each, plus a bonus 10th category with a maximum 10 bonus points.

Highest actual total equaling our #1, 2016 (based on fiscal 2015 data) ranking, was the 78 points awarded to Broadcom Limited. Last year’s #1 ranked company was Micron Technology with 84 points. The previous year’s #1 ranked company was SanDisk with 86 points.