What’s the Difference Between Silicon Carbide and Silicon?

Members can download this article in PDF format.

What you’ll learn:

- What unique characteristic does SiC bring to power electronics in comparison to silicon?

- How to evaluate whether SiC or legacy silicon solutions are better suited for an application.

- What are some of the key challenges to consider while planning for long-term SiC investments?

For more than 65 years, silicon has undoubtedly been the poster child of the semiconductor industry’s revolution. From making pocket electronic calculators a reality to powering the digital age that we know today, the rate of progress has fueled remarkable technological innovation across industries. But with the plateauing of Moore’s Law, rising focus on clean energy technologies, and a global chip shortage, the industry’s demands for smarter and more energy-efficient solutions are at an all-time high.

A rising star has started to make a material difference in the world of power electronics. SiC, a close cousin of silicon, has gained a stronghold for its distinguishing performance and impressive energy efficiency. Discovered first in 1891 by the American inventor Edward G. Acheson—in an attempt to produce artificial diamonds—the crystalline compound of silicon (Si) and carbon (C) has gone through a noteworthy evolution.

Today, in terms of material and process sophistication, SiC is where silicon was approximately 30 years ago. Still, the use of SiC-based devices promises a significant increase in system efficiency and far higher switching frequencies than what today’s Si-based devices can offer.

While the compound’s expanded use in semiconductors has been relatively recent, there’s growing demand for SiC devices. According to MarketsandMarkets, the SiC market is projected to grow from USD $899M in 2021 to $2,113M in 2026, at a compound annual growth rate of 18.7%. This ramp up is predominantly driven by the increased market demand for power electronics and advanced electric vehicles (EVs), plug-in hybrids, and full hybrids.

Let’s take a closer look at some of the primary differences, key benefits and tradeoffs, and different parameters to consider when choosing between SiC- and Si-based solutions.

Material Properties

As a wide-bandgap (WBG) semiconductor material, SiC’s wider energy difference allows it to have higher thermal and electronic properties compared to traditional silicon (Fig. 1). This characteristic enables power devices to operate at higher temperatures, frequencies, and voltages.

SiC’s efficacy in EV applications and other power electronics is largely credited to the material itself. Compared to silicon, SiC offers:

- 10X higher dielectric breakdown field strength

- 2X higher electron saturation velocity

- 3X higher energy bandgap

- 3X higher thermal conductivity

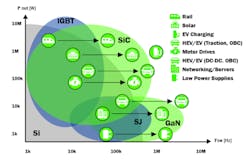

With the benefits mentioned above, SiC’s advantage increases in parallel with rising operating voltage. Relative to silicon, 1200-V SiC switches have added value compared to 600-V switches (Fig. 2). These properties have driven a radical transformation in SiC power switching devices, substantially improving system efficiency in EVs and EV charging as well as energy infrastructure—making SiC an ideal choice for OEMs and Tier-1 automakers worldwide.

The cost-to-performance benefit of SiC is rather flat for lower-voltage operation below 300 V. This is where the adoption of another WBG semiconductor, gallium nitride, is expected to expand.

Performance Characteristics: Range and Efficiency

A key differentiator of SiC over silicon is its higher system-level efficiency, owing to the greater power density, lower power loss, higher operating frequency, and increased temperature operation. This translates into a higher driving range on a single charge, smaller battery sizes for traction inverters, and faster charging time for on-board chargers (OBCs).

In the world of EVs, one of the biggest opportunities for automotive content lies in its gasoline engine replacement—the electric drivetrain’s traction inverter. When direct current (dc) flows into an inverter, the converted alternating current (ac) helps run the car’s motor to provide power to the wheels and other electronic components.

Replacing existing silicon switching technologies with advanced SiC chips reduces the amount of energy loss in the inverter, enabling the car to deliver extra range. In cooperation with a leading carmaker, we validated onsemi’s VE-Trac Direct SiC power module to boost the inverter system efficiency by 40%, resulting in a net driving range increase between 4% and 8%. With the battery pack being the most expensive component of an EV, this translates into an attractive system-level value-add for SIC.

Thus, SiC MOSFETs (metal-oxide-semiconductor field-effect transistors) become a compelling commercial factor when features such as form factor, size of the inverter or dc-dc block, efficiency, and reliability are key considerations. Design engineers are now equipped with smaller, lighter, and more energy-efficient power solutions to meet already challenging design goals for a wide variety of end applications.

Take the example of Tesla. While the company’s first few generations of EVs used silicon-based IGBTs (insulated-gate bipolar transistors), the uptake in the standard sedan market led them to use SiC MOSFETs in the Tesla Model 3, resulting in a first-of-its-kind performance in the industry.

Power: The Name of The Game

SiC's material characteristics make it a go-to choice for high-power applications that have high temperatures, current, and thermal conductivity. Since SiC devices can operate at higher power density, it enables the form factor of EV power electronics systems to shrink. According to Goldman Sachs, SiC’s hero efficiency can reduce EV manufacturing cost and cost of ownership by nearly $2,000 per vehicle.

One case in point is the main traction inverter of leading electric car models such as Nissan Leaf and Tesla Model 3. With battery size already reaching nearly 100 kWh and plans to increase that size to allow for a much longer driving range, we envision future generations heavily depending on SiC’s added efficiency and ability to handle higher power. On the other hand, for lower-power vehicles such as a two-door entry-level EV, plug-in hybrid, or light EV that use battery sizes of 20 kWh or less, Si IGBTs become a more cost-effective solution.

In the effort to minimize carbon emissions caused by power inefficiencies at higher voltages, we’re witnessing a greater push within the industry to prioritize SiC over other materials. Many EV customers have already been able to swap out incumbent silicon solutions with new SiC switches, quickly demonstrating the system-level value-add of SiC technology.

The Cost Factor

Today, a common rule of thumb in the market is that SiC components are about 3X the cost of a silicon predecessor for the same rating. One of the main reasons for that relates to the supply of SiC, which is still very modest in comparison to silicon.

A few years ago, key SiC suppliers would spend hours convincing customers why the additional cost was worth the long-term ROI (return on investment). Today, the market has matured, and OEMs are more aware of the benefits of SiC modules and how they will help them reach their desired level of power capability. SiC and silicon have its own payback merits depending on the intended application.

For example, if a Tier-1 supplier develops a drive system, a SiC-based traction inverter will be more expensive than a silicon-based IGBT inverter. Thus, there’s no payback. But if you take it a step further with an automaker or OEM that integrates the entire solution, then a SiC solution gives them the option to have an extra 4% to 8% vehicle range or reduce the battery-cell count (one of the most expensive components in an EV). Therefore, some of the additional cost paid is regained.

Moving SiC MOSFETs from a 6- to 8-inch wafers is a pivotal step toward beefing up SiC supply. It allows for better process capabilities, which leads to higher current densities, smaller chip sizes, more chips per wafer, and up to 30% lower chip costs. As most commercially available wafer fab equipment today is 8-inch-capable, investment into an 8-inch SiC can boost the theoretical capital efficiency by more than 50%.

However, given the numerous technical challenges concerning the maturity of current SiC technology, it will require fundamental engineering development. A premature investment in 8-inch can exponentially increase technology complexity and hinder progress toward resolution. In other words, there’s still a lot of cost and yield benefit to gain from improving the existing 6-inch SiC technology.

Market Opportunity

The automotive market is seeing growing popularity in all-wheel drive systems, in which the driver can choose between using two separate axles to drive, depending on the road conditions (be it snowy, icy, wet, or dry). The larger axle is typically on the rear end of the vehicle and is turned on most of the time because of its efficiency. In this case, SiC-based solutions are often used.

On the flip side, the front axle, which is the secondary axle of the vehicle, is known for its extra acceleration boost. Here, Si-based IGBT solutions are typically used. This drivetrain configuration provides an optimum cost and efficiency tradeoff at system level.

The second biggest market opportunity for SiC in power electronics lies in the OBC, which converts ac power of the charging station into dc power to recharge the car’s battery. With SiC technology maturing in the last few years, the adoption of SiC in OBCs has become much more widespread, displacing legacy silicon-based superjunction MOSFETs. The incumbent technology is being replaced with SiC switches in future OBCs, which allow for smaller form factors and shorter charging durations.

SiC delivers lower drain-source on-resistance and lower switching losses, enabling higher efficiency across the entire operating range. This reduces the energy waste; more power gets delivered to the battery; and at the same time power density increases, resulting in more compact systems—creating a more efficient system at lower system cost for the end user.

Challenges to Consider

With more industry players looking to expand their SiC foothold, the biggest challenge will lie in their supply chains. Currently, most equipment suppliers are sold out for 2022, and with only a handful of slots left in 2023, the lead times are stretched. The question then becomes how bold customers will be to make long-terms agreements with SiC suppliers worldwide to book future capacity.

On an atomic level, the fundamental infusion of silicon and carbide atoms to form SiC produces an elevated level of defect density, resulting in lower production yields compared to silicon. It’s an engineering obstacle that requires brilliant minds to resolve. Another crucial enabler for volume ramp up of SiC-based power electronic solutions will be to provide sufficient capacity of SiC crystals to improve crystal quality and prepare the full supply chain to 200 mm.

Looking Ahead: Vehicle Electrification Will Play a Driving Force

With President Biden’s recent executive order aimed at making half of all new vehicles sold in 2030 electric, SiC has immense opportunity for continued growth. In addition, the drastic increase in the number of EVs will require a network of rapid and efficient charging infrastructure to be rolled out to meet the needs of drivers and allow them to complete their journeys quickly and without “range anxiety.”

Industry players such as Tesla have already displayed a successful ramp up of SiC and the market’s need for higher range, making many OEMs much more aware of the technological benefits of SiC and the implementation of SiC electric drivetrains.

As we plan for a net-zero emission economy and witness more countries and companies committing to phasing out fossil-fuel vehicles by 2040 or earlier, advances in SiC-based solutions will be critical to creating game-changing innovations that can support a responsible and sustainable ecosystem.