How AMD Made It in the World of Workstation Graphics

AMD is one of the leading players in the world of graphics processing units (GPUs). But its $5.6 billion deal for ATI Technologies in 2006 also pushed it into the upper crust of the market for PC graphics cards.

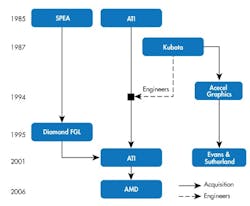

Over a decade before the deal, in 1994, ATI decided to expand out of the consumer PC graphics chips and add-in board (AIB) business. To enter the PC workstation market, it hired a group of engineers from the long-struggling Kubota Graphics. Starting out in the late 1980s as the graphics division of Kubota Pacific Computers, Kubota developed high-performance 3D graphics workstations primarily targeting professionals in computer-aided design (CAD) and scientific visualization.

Kubota’s systems were based on DEC’s Alpha processors and featured advanced 3D rendering capabilities. Despite its technological advances, Kubota Graphics struggled to stand out in a crowded field of competitors and secure a significant market share. In 1994, engineers from Kubota's Boston office joined ATI, and Kubota sold its PC workstation business to startup AccelGraphics, later acquired by Evans & Sutherland in 2001.

Consolidation of the AIB Industry

In 1985, on the other side of the world, Ulrich Seng founded Germany-based SPEA, a pioneering high-end CAD AIB supplier and one of the first independent graphics-board companies focused on PC-based workstations. However, even the high-end market could not sustain the company’s ambitions, leading SPEA to acquire Video 7, a leading mainstream AIB supplier, in 1992. SPEA then collaborated with Siemens in 1994 to develop the SGA3000, a 3D chip.

In 1995, SPEA went through a significant restructuring process, selling its chip design division to Philips and its AIB business to Diamond Multimedia, a pioneering force in the AIB industry.

By mid-1998, Diamond's professional graphics division was also facing substantial challenges, and its prospects appeared bleak. Then, in June 1999, S3 acquired Diamond, inheriting its Professional Graphics division as part of the deal. This strategic move bolstered S3's presence in the market.

The industry consolidation continued in December 1999 when Number Nine, another pioneering AIB supplier, announced its closure. Taking advantage of the situation, S3 acquired Number Nine's assets, ensuring the continued supply of S3-based AIBs to IBM, a key client.

S3, which was trying to reshape itself into a consumer electronics company, changed its name to Sonicblue after the success of its Fire GL product line, based on the IBM chips. S3 offloaded its graphics controller chip business to VIA Technologies and renamed its professional graphics unit, the Fire GL (FGL) division. While it was separate from its consumer-electronics ambitions, the business was making money, so S3 decided to hold onto it.

Here’s where ATI comes back into the picture. In early 2001, ATI moved into the workstation market by buying Sonicblue's FGL Graphics division for a mere $2.7 million. The deal marked a significant expansion of ATI's product portfolio, including the Radeon 8500 AIB, which I covered for Electronic Design as part of my history of the graphics chip industry.

At first, ATI intended to develop its own entry-level workstation graphics solutions. However, the acquisition of Fire GL products immediately gave it a complete top-to-bottom product offering, enabling ATI to cater to a broader range of customers and applications. The rest, as they say, is history.

About the Author

Jon Peddie

President

Dr. Jon Peddie heads up Tiburon, Calif.-based Jon Peddie Research. Peddie lectures at numerous conferences on topics pertaining to graphics technology and the emerging trends in digital media technology. He is the former president of Siggraph Pioneers, and is also the author of several books. Peddie was recently honored by the CAD Society with a lifetime achievement award. Peddie is a senior and lifetime member of IEEE (joined in 1963), and a former chair of the IEEE Super Computer Committee. Contact him at [email protected].