Flexible Electronics: Heterogeneous integration boosts sensor systems

Flexible electronics technologies are showing promise in applications ranging from home healthcare to aerospace. To realize the benefits, organizations including SEMI FlexTech and NextFlex are supporting the funding of and education in the technologies. And companies such as GE and Lockheed Martin are looking to exploit flexible hybrid technologies.

Indicating the significance of the topic, it was the subject of two full-day workshops at SEMICON West as well as two hours of presentations and a panel discussion on the exhibit floor.

Speaking at SEMICON West, Dr. Melissa Grupen-Shemansky, CTO of SEMI FlexTech, said a new era of electronics is emerging, enabled by flexible hybrid electronics (FHE). Scaling in silicon is reaching its limit, with efforts now focusing on 2.5D and 3D technologies to extend Moore’s Law. At the same time, she said, “The IoT is affecting all of us as well as connecting us to each other and to our data.” Personal electronics are becoming wearables—in the form of biomonitoring devices or even e-textiles. Flexible displays have been with us for a while, she added, but new products are appearing that will let us wear our smartphones on our wrist. Flexible displays are driving a great deal of innovation. Human-skin-like materials are incorporating a host of sensors. All are driving demands for innovation in flexible hybrid electronics.

To assist in the adoption of the technology, she said MatWeb and FlexTech are developing a materials and equipment registry (flextech.matweb.com) for the flexible- and printed-electronics industries. The registry is a work in progress with more improvements to come, she said.

DoD initiative

Jason Marsh, director of technology at NextFlex, explained that his organization, set up in August 2015, is an institute of the National Network for Manufacturing Innovation —a DoD initiative focused on coordinating public and private investment in emerging advanced manufacturing technologies.

Marsh described FHEs as flexible, stretchable, and conformable integrations of heterogeneous technologies. They also benefit from being lightweight, transparent, and low cost. Heterogeneity has its limits, however: An effective FHE cannot incorporate standard gull-wing silicon devices. A suitable silicon device for effective FHE integration will have a thickness of less than 50 μm. Unfortunately, you can’t readily order such devices off the shelf.

Interconnect also poses challenges, Marsh said. He noted that NextFlex is not pedantic about interconnect—thin-film, thick-film, foil-lamination, plating, and conductive-polymer techniques may all have a role to play, depending on the application. He cited other fabrication challenges, noting that an FHE assembly typically won’t withstand a lead-free solder reflow process.

Helmet-integrated sensor

Laura Rea, a program manager at the Air Force Research Laboratory, outlined the Air Force’s interest in FHE. In 1996, she said, a fatigued ground crew failed to refuel an airplane, resulting in several deaths. And today, fatigued operators of unmanned aerial vehicles could cause civilian casualties.

The Air Force, she said, is looking to monitor a variety of biomarkers and investigating innovations such as a helmet-integrated neural spinal hydration sensor. Batteries are a huge problem, she continued. Airmen already carry backpacks weighing 75 lb so adding weight is not an option. By 2020, Rea concluded, the Air Force will have the smallest force structure in its history, making human performance optimization a critical requirement.

Qualcomm is a commercial company interested in flexible electronics. Urmi Ray, principal engineer, said that packaging and integration are keys to putting the world at our fingertips. She noted that the human body is not rectangular or cubic. Consequently, Qualcomm is interested in ways to integrate sensors, processors, RF front ends, and antennas on conformal, flexible substrates. Such an approach, she said, could augment applications like remote patient monitoring services.

Lockheed Martin also is interested in FHE. Jeff Stuart, a researcher at Lockheed Martin Advanced Technology Laboratories, told SEMICON West attendees that each F-35 includes a big shielded box of printed circuit boards, and a lighter weight integrated solution would be advantageous. What’s required is ruggedization and survivability in extreme environments—as well as effective test strategies.

He said FHE is not the solution for all applications, but the company wants to understand where FHE might be effective. Potential applications include asset monitoring, soldier-wearable biosensors, body-wearable antennas, energy harvesting and storage, flexible computing, stealth wear, medical and health monitoring, and asset structural health monitoring with a transition from schedule-based maintenance to condition-based maintenance.

“Sense, process, and communicate”

Nancy Stoffel, senior engineer for electronics packaging at GE Global Research, said GE makes big systems that “… build, cure, move, and power the world.” Such systems require electronics assemblies that “sense, process, and communicate,” she added.

The company does have an interest in healthcare, but in a hospital environment rather than in the home or the gym. One goal of GE, she said, is to get wires out of the hospital environment with wireless approaches to vital-sign monitoring. FHEs offer the promise of new ways of looking at patients with new sensors, she said. What’s required are comfortable, stretchable, soft substrates with good body-attachment methods and—for disposable applications—very low cost.

In addition to making hospital patient-monitoring products, GE makes a lot of equipment that’s “hot and spinning,” Stoffel said, adding that for condition-based monitoring, the company wants to move the sensors close to the active part—such as a turbine blade. The sensors and their accompanying processing and communications functions will need to withstand high temperatures, be low profile, and offer a robust attachment mechanism. Bare-die chip-scale parts will be required—not COTS semiconductors. In addition, volumes will be relatively low, so keeping costs low will present a challenge.

FHE manufacturing

One company contending with FHE manufacturing challenges is Uniqarta. Ronn Kliger, CEO and cofounder, pointed out that standard ICs are too thick to bend. He put the threshold of flexibility at 50-μm thickness and said Uniqarta works with 25-μm devices. Challenges related to thinning, dicing, pickup, throughput, and interconnection require a holistic approach to the assembly process. “We start with the wafer-fab output and end up with thin, placed, connected chips,” he said.

Kliger added that it’s beneficial to be compatible with standard semiconductor wafers, avoiding the need for custom processes while leveraging existing tooling. For placement accuracy, the company makes liberal use of “handles,” which cause a thinned chip to look like a standard chip to pick-and-place equipment. The handles are subsequently removed through thermal-adhesion processes.

Completed projects

In the run-up to SEMICON West, FlexTech announced the formal completion of three FHE R&D projects under a U.S. Army Research Laboratory (ARL) technology investment agreement. The completed projects are with ENrG for a flexible ceramic substrate, nScrypt and NovaCentrix for a next-generation 3D printing tool for creating complex and functional objects, and PARC, a Xerox Co., for a flexible sensor platform. Projects ranged from 12 to 18 months and were managed by members of the FlexTech Technical Council—a team of experts in flexible, hybrid, and printed electronics technologies.

ENrG, located in Buffalo, NY, completed a 15-month project to develop a high-yield process to create a 20-μm-thick, flexible ceramic substrate that retains its integrity when drilled, cut, rolled, and processed at high temperatures. ENrG developed processes to print thin-film lithium batteries and circuits as well as to apply copper cladding and other metallization.

The project, valued at $570,000 total, was 56% cost-shared by the company.

nScrypt, based in Orlando, FL, in partnership with NovaCentrix of Austin, TX, developed a 3D printer for rapid prototyping of electronic devices. The $1,291,000 award was cost-shared by nScrpyt, NovaCentrix, and FlexTech and completed over a 16-month period. The tool additively builds integrated hybrid circuits on 3D surfaces as well as flexible, low-temperature, rigid planar substrates. The first tool has been installed at ARL, and commercial tools are available from nScrypt.

PARC, headquartered in Palo Alto, CA, developed a passively powered, digitally fabricated, communication-enabled, flexible sensor platform that is customizable to multiple sensor types. The project addressed the availability of an end-to-end system design that can be manufactured in large quantities with digital printing for smart-tag or wearable applications. The total cost was $409,000 and shared equally between PARC and FlexTech.

“Each of these projects, chosen and supported by the Technical Council, moves the needle on learning how to fabricate electronics on flexible substrates,” stated Michael Ciesinski, president of FlexTech, in a press release. “Especially impressive is the teaming on the projects, which helps build out the FHE supply chain.”

IDTechEx cites flexible-electronics automotive opportunities

According to IDTechEx, printed and flexible electronics are beginning to proliferate in the automotive sector. Early this year, the research firm said the market is expected to grow to greater than $5.5 billion dollars in the next decade, spearheaded by the projected growth of in-mold electronics (IME) and organic LED (OLED) technologies.1

Source: IDTechEx, “Printed and Flexible Electronics in Automotive Applications 2016-2026.”

The company said OLED displays represent the biggest success of organic electronics, having found use in consumer products such as smartphones, tablets, televisions, and wearables. For automotive applications, OLEDs offer light weight, robustness, and design versatility. In the future, the auto industry may adopt transparent displays to transform the windows of vehicles into screens that show heads-up information such as speed, navigation instructions, and location-based information. In addition, the rear windshield could communicate safety warnings and other notifications to fellow motorists.

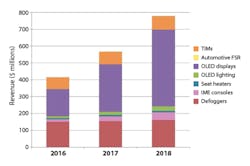

IDTechEx also offered predictions for IME, forecasting that the market of a few tens of millions of dollars in 2016 could reach almost a billion dollars by 2026. The graph accompanying this article shows forecasts for IME—as well as OLEDs, force sensing resistors, thermal interface materials, seat heaters, and defoggers—through 2018. The company said that standard manufacturing processes can implement car overhead consoles and center stacks using IME, reducing weight as well as the size and complexity of the PCBs integrated into vehicles.

The firm said the technology is already in production, with Canatu’s CNB Touch Sensors incorporated into a new automotive model for a yet unnamed North American customer. Production and deliveries started in 2015.

In related news, Canatu in May introduced an ultrathin 12-µm version of its CNB Flex film. The CNB supports extreme bending and folding, making it particularly well-suited for wearable, foldable, and rollable devices. The company’s transparent conductive film portfolio consists of CNB Hi-Contrast Film, optimized for flat projected capacitive touch devices; CNB Flex Film, optimized for wearable, flexible, and foldable touch-enabled electronics devices; and CNB In-Mold Film, optimized for 3D formable capacitive touch surfaces.

In addition, Canatu said in July that the European Investment Bank is supporting Canatu with a EUR 12 million loan for the development and capacity increase of its Carbon NanoBud-based conductive-film and touch-sensor production in Finland. The company said the investment will speed up the commercialization of the company’s products and allow Canatu to better serve the consumer electronics and automotive segments.

Reference

- “IDTechEx: Printed and flexible electronics in vehicles offer $5.5 billion opportunity by 2026,” EE-Evaluation Engineering Online, Jan. 31, 2016.

About the Author

Rick Nelson

Contributing Editor

Rick is currently Contributing Technical Editor. He was Executive Editor for EE in 2011-2018. Previously he served on several publications, including EDN and Vision Systems Design, and has received awards for signed editorials from the American Society of Business Publication Editors. He began as a design engineer at General Electric and Litton Industries and earned a BSEE degree from Penn State.